ASCO 2023 – China’s Dizal claims broad coverage with a super-Tagrisso

Having impressed two years ago, Dizal returns with even more comprehensive targeted therapy data.

Having impressed two years ago, Dizal returns with even more comprehensive targeted therapy data.

Since presenting apparently industry-leading data in a targeted lung cancer niche at ASCO 2021 China’s Dizal, an offshoot of Astrazeneca, has returned with what look like even more impressive data on its lead project, sunvozertinib.

In a pivotal Chinese trial sunvozertinib has shown higher efficacy than in its earlier studies at ASCO 2021, and it has also made inroads into first-line use, as well as into a separate setting dominated by Astra’s Tagrisso. Dizal, which nearly floated on Nasdaq some time ago, will now be hoping to extract maximum value in a licensing deal covering sunvozertinib.

Indeed, it might come as a surprise that sunvozertinib has yet to find a partner. The initial NSCLC setting in question, EGFR exon 20 insertions, has seen the approval of Johnson & Johnson’s MAb Rybrevant and Takeda’s small molecule Exkivity, and ther has been licensing interest: Otsuka paid $275m for Cullinan’s CLN-081, and Blueprint gave Lengo $275m for BLU-451.

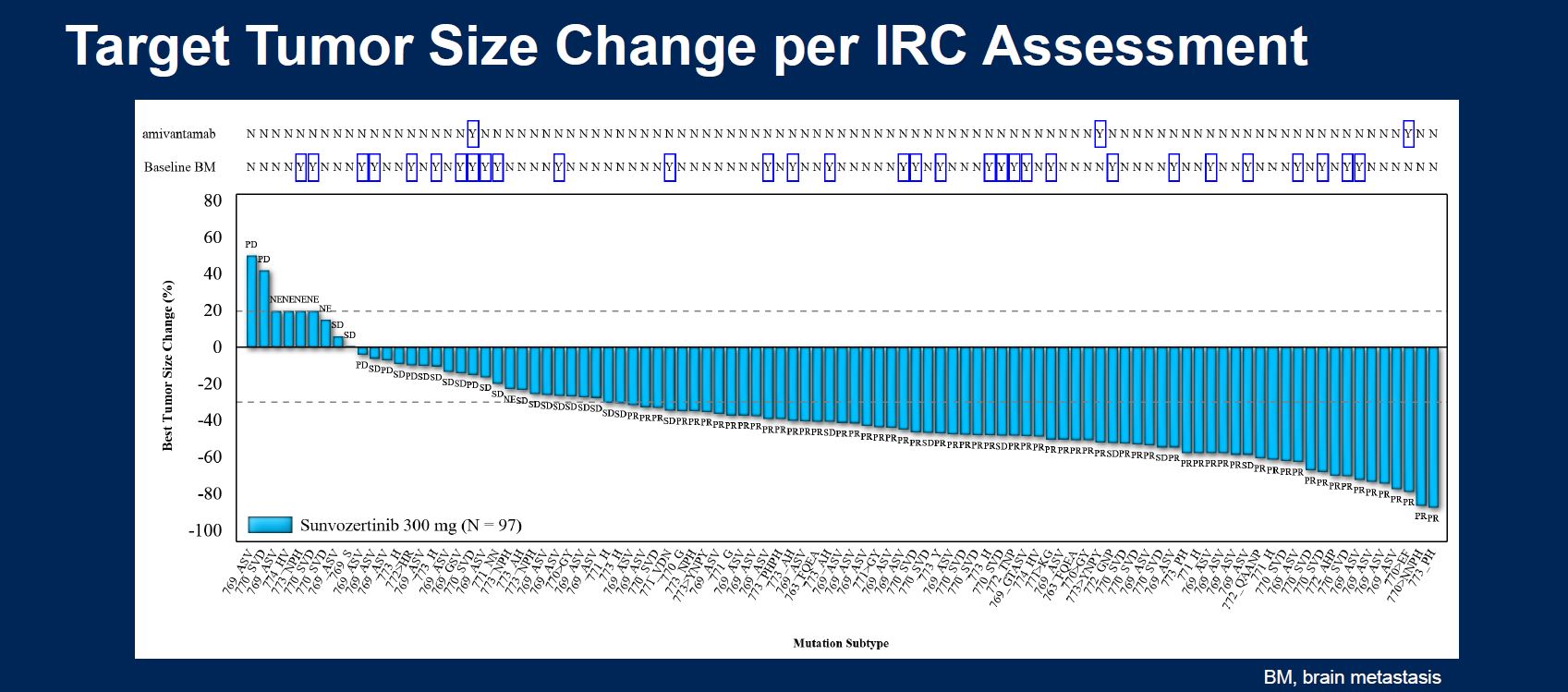

At ASCO 2021, on a cross-trial basis, sunvozertinib looked as good as Rybrevant, and better than Exkivity. Now Asco has seen data from the Chinese Wu-Kong6 trial showing an even better 61% remission rate, including in two of three post-Rybrevant subjects; the results backed a filing in China, where sunvozertinib could be approved within months.

Clever

Dizal’s chief executive, Xiaolin Zhang, says success has come thanks to clever chemistry and his 20 years’ experience at Astra. At the time he helped set up Astra’s Shanghai-based Asian R&D centre, and then founded Dizal in 2017 as a spin-out of this.

Dizal floated on the Shanghai stock exchange in late 2021, with Astra retaining a 25% equity stake, and other investors including Lilly Asia Ventures, Sequoia Capital and STIC Ventures. Zhang says he even appointed Goldman Sachs to run a Nasdaq IPO, but was then put off by the US’s cooling stance on China.

In fact, exon 20 insertions was never the key focus behind sunvozertinib, and rather this was seen as “low-hanging fruit” at a time before that genetically defined niche really matured. The ultimate aim was to design “a super-Tagrisso” with broad activity across EGFR mutations, Zhang says.

Importantly, Tagrisso, and Astra’s earlier iteration Iressa, both work on EGFR activating mutations, which have not been actionable with a molecule that also hits exon 20 – until now, apparently. A separate ASCO poster, in NSCLC patients with EGFR activating mutations, reveals a 27% remission rate.

Chang claims that one of the early design criteria for sunvozertinib was that it had to be equally potent against all insertion mutations, and in addition to EGFR activating mutation activity the molecule shows “almost equal potency across around 30 types of exon 20 insertions”. And then there is front-line use in exon 20 insertions, where ORR stands at 71%.

Amazingly, Dizal and sunvozertinib are not the only offshoot of Astra’s EGFR-targeted lung cancer work. Years ago Astra was working on a better Tagrisso with CNS penetration, and designed a molecule coded AZD3759 – of which coincidentally Zhang is one of the inventors.

Though Zhang says AZD3759 won prestigious design awards Astra did not take it forward, and instead sold it to a private Chinese group called Alpha Biopharma. The compound now has the generic name zorifertinib, and is awaiting China approval; Asco data show numerically better front-line activity than Iressa, but that comparator seems obsolete given that Tagrisso is now firmly established here.

Cross-trial comparisons in EGFR-mutated NSCLC

| Project | Company | Mutation/setting | Trial | Asco data |

|---|---|---|---|---|

| BLU-451 | Blueprint (ex Lengo) | EGFR exon 20 ins, ~4L NSCLC | NCT04862780 | 1 PR cited in exon20, none in "atypical EGFRm" |

| Sunvozertinib | Dizal | EGFR exon 20 insertions, 2-4L NSCLC | Wu-Kong6 | ORR 61% (59/97), including in 2/3 patients who failed Rybrevant |

| EGFR exon 20 insertions, 1L NSCLC | Wu-Kong1 & 15 | ORR 71% (20/28), including in 8/9 patients with brain mets | ||

| EGFR activating muts, NSCLC post EGFR inhibitor | Wu-Kong1, 2 & 15 | ORR 27% (10/37), including in 5/25 patients who failed 3rd-gen TKI like Tagrisso | ||

| BLU-945 | Blueprint | EGFR activating muts, NSCLC post Tagrisso | Symphony | ORR 4% (2/44), 22% gr≥3 ALT elevation |

| BLU-945 (Tagrisso combo) | EGFR activating muts, NSCLC refractory to Tagrisso | ORR 10% (4/41) | ||

| AZD3759 (zorifertinib) | Alpha Biopharma (ex Astrazeneca) | EGFR activating muts, 1L NSCLC | Everest | ORR 69%, versus 58% for Iressa/ Tarceva |

Source: Asco.

Blueprint’s early-stage assets also featured at ASCO over the weekend, though there was nothing major to suggest a threat to Astra or Dizal. Perhaps most intriguing will be BLU-945’s combination with Tagrisso in patients who have progressed on the Astra drug, though perhaps such a combo is necessitated by BLU-945’s incomplete coverage of EGFR activating mutations, and a 22% rate of severe liver enzyme elevations could be disastrous.

While Wu-Kong6 is a Chinese study, part B of a phase 1/2 trial called Wu-Kong1 is international, and should yield data later this year. This could back sunvozertinib’s US and Europe filings, with Dizal then leaving commercialisation to a partner.

It would be unusual for interest not to have already emerged for sunvozertinib, but interestingly Astra does not have first-refusal rights. Moreover, the chief exec says there is no special advantage to seeking a deal with his former employer.

395