Affimed looks to reverse a share price collapse

Five years after Affimed switched to NK cell engagers investors will see the fruits of a potentially registrational trial.

Five years after Affimed switched to NK cell engagers investors will see the fruits of a potentially registrational trial.

Affimed’s Luminice-203 study will yield its first data in the first half of this year, and the results should show whether the group’s lead project, the CD30-directed NK cell engager acimtamig, has a shot at its first approval in Hodgkin’s lymphoma.

There is already strong backing for acimtamig in this setting, from a single-centre trial run by MD Anderson, but important caveats have to be considered given design differences. Against this stands the fact that Affimed is trading near its cash balance, having seen its share price fall 94% in under three years.

Perhaps dwindling cash reserves and the shares’ collapse explain why acimtamig development has progressed rather slowly. It’s been over two years since MD Anderson demonstrated the value of combining acimtamig with NK cells, but Luminice-203, the first Affimed-sponsored trial of this approach, only began last October.

Luminice-203 will recruit 70-110 Hodgkin’s lymphoma patients who have failed Adcetris as well as PD-(L)1 blockade, and the first-half data concern 24 subjects from an initial cohort. The trial also includes an exploratory cohort of CD30-positive peripheral T-cell lymphoma patients, but only Hodgkin’s is designed to back accelerated approval.

Benchmarks

The trial is effectively uncontrolled, but Affimed says late-line Hodgkin’s patients would be expected to see CR rates of 5-34% with established therapies, while Keytruda plus Lag-3 inhibition has shown 9% in a post-Adcetris/checkpoint clinical setting.

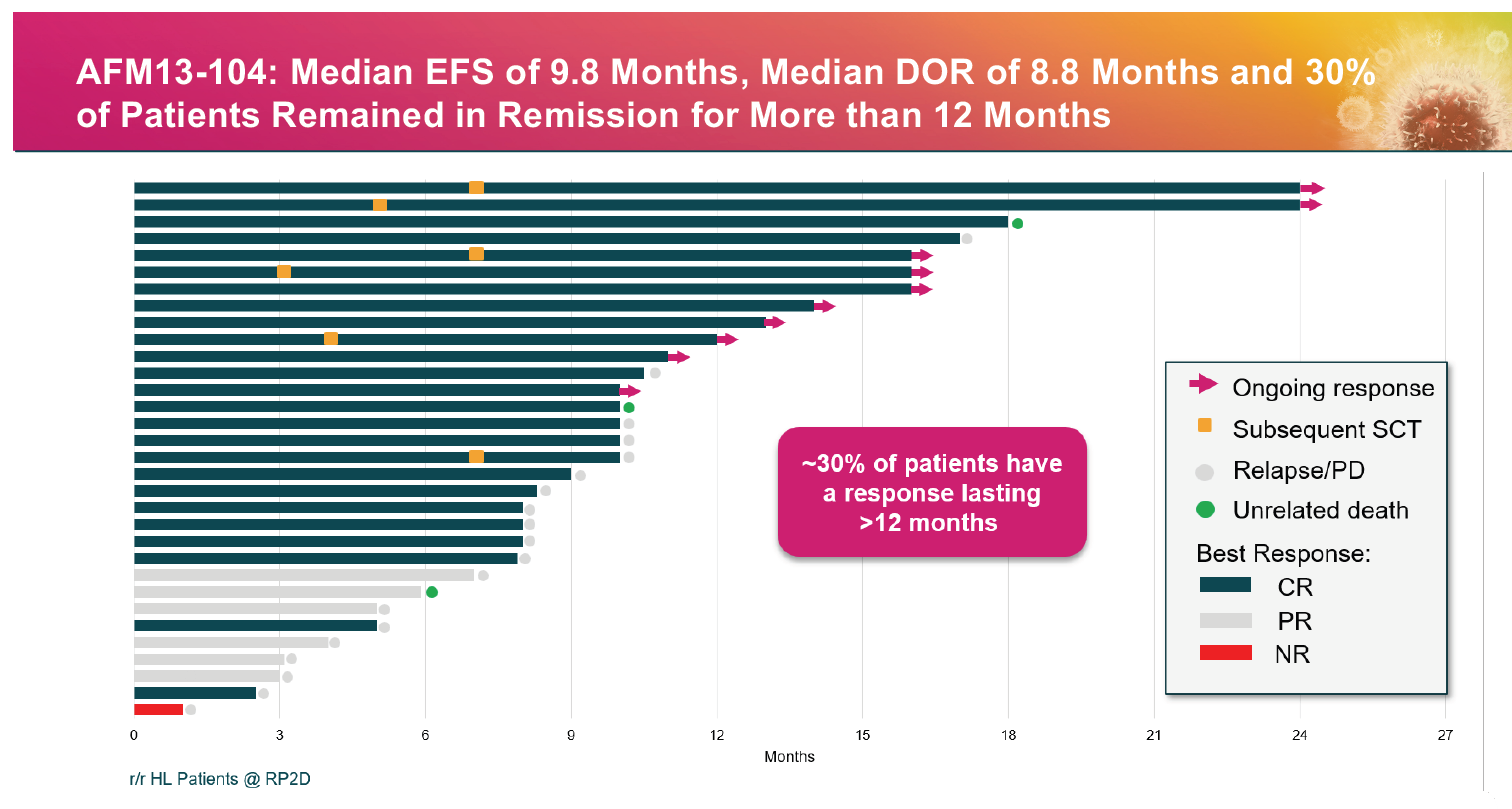

If these numbers set a minimum for Luminice-203 then the omens are good. The latest cut of the MD Anderson trial with the target acimtamig dose given to 32 patients showed a complete response rate of 78%, and 97% ORR.

Speaking to ApexOnco at last year’s ASH conference, Affimed’s chief medical officer, Andreas Harstrick, said the MD Anderson trial involved patients refractory to Adcetris who had exhausted available options – indeed the response rate to their most recent treatment was 0%.

He was especially enthused at the CR rate, since “complete disappearance of the tumour is a precondition of of long-term survival and benefit”, and noted that about 30% of patients now have responses lasting over 12 months, stating: “Once you make it beyond 12 months your response really seems durable.”

The latest acimtamig data from MD Anderson

So what are the caveats? Clearly a single-site, academic-sponsored trial likely lacks the objective rigour of a multicentre, company-backed study. The early trial also preselected lymphomas expressing CD30 – acimtamig’s target antigen – whereas the Hodgkin’s cohort of Luminice-203 enrols all-comers.

MD Anderson used fresh NK cells pre-complexed with acimtamig, but Affimed is using allogeneic NK cells (a product coded AB-101) developed by the partner company Artiva; these cells have been frozen, as would be the case in a real-world setting. There is no pre-complexing in Luminice-203, which also co-administers IL-2.

The supposition is that such changes won’t result in a meaningful difference in efficacy. “We are expecting to see exactly the same data,” Harstrick said.

Interestingly, the FDA also asked that Luminice-203 include 12 patients given just AB-101 allo-NK cells and IL-2. This is to illustrate the contribution of the individual components, that “the combination is doing the trick”, according to Harstrick. Both this and the MD Anderson trial use cy/flu preconditioning, though at levels lower than for T-cell therapies.

Change of focus

Affimed had once worked on T-cell engagers, but in 2019 it abandoned work on such CD3-anchored therapeutics and went all-in on innate immunity, meaning bispecifics that hit an antigen of choice as well as CD16A, which is expressed on NK cells and macrophages.

However, the development path of acimtamig, the most advanced such bispecific, hasn’t been smooth. Affimed’s initial approach, to use the MAb as monotherapy, came up short and ended up being discontinued, and it was MD Anderson’s NK cell combo that provided the game-changer.

Affimed’s current cash, just €97.5m at the end of September 2023, is projected to last into 2025 – clearly not enough to see the group to full data and an acimtamig filing. Investors should probably expect a cash call if the first 24 Luminice-203 patients show strong responses this year.

1788