J&J ramps up its bladder cancer battle

The first approval for TAR-200 is on the horizon, setting up a challenge to Keytruda.

The first approval for TAR-200 is on the horizon, setting up a challenge to Keytruda.

Bladder cancer is becoming increasingly crowded, particularly non-muscle invasive disease, but Johnson & Johnson believes that it can set itself apart with its drug-eluting intravesical systems TAR-200 and TAR-210.

The company gained the projects through its 2019 acquisition of Taris Biomedical for an undisclosed fee, a presumably small deal that now looks smart. Data presented at the recent ESMO meeting added weight to J&J’s goal of broadly covering the bladder cancer market, but the company’s sales target looks punchy; it has said the Taris assets could bring in $5bn at peak.

First approval of the lead project, the gemcitabine-eluting TAR-200, could come next year. J&J plans an accelerated filing in the first quarter of 2025 in NMIBC, based on the Sunrise-1 trial in BCG-unresponsive patients, data from which featured at ESMO.

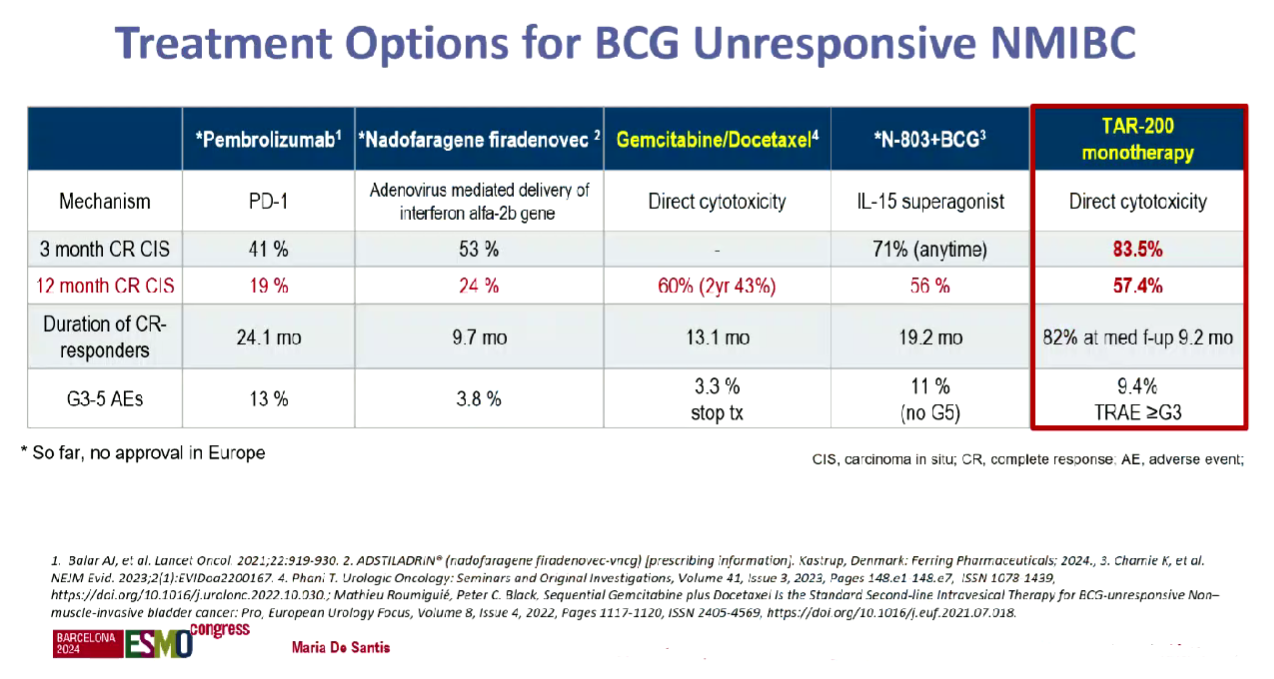

The discussant, Dr Maria De Santis of the University of Warwick, UK, dubbed an 84% complete response rate at any time with TAR-200 monotherapy “spectacular”. However, at 12 months the CR rate dropped to 57%, and she conceded that durability needed to be confirmed.

Still, De Santis noted that TAR-200 compared favourably to existing NMIBC therapies on a cross-trial basis: Keytruda is approved in BCG-unresponsive disease based on a 41% CR rate in the Keynote-057 trial.

Ferring’s gene therapy Adstiladrin (nadofaragene firadenovec) and ImmunityBio’s IL-15 receptor agonist Anktiva also have a green light in the same setting, and the latter, which is used alongside BCG, looks like TAR-200’s closest rival in terms of efficacy.

However, BCG – which is a standard therapy for NMIBC – has issues: it contains live bacteria, so has strict conditions for use, and is also linked with a recurrence rate of around 40%. And this is before taking into account recent BCG shortages.

Other rivals are looking to enter NMIBC, including CG Oncology, with its oncolytic virus candidate cretostimogene grenadenorepvec. The uncontrolled Bond-003 trial in BCG-unresponsive patients, presented at the American Urological Association (AUA) meeting in May, found a 75% CR rate at any time, while the 12-month CR rate was 43% – making cretostimogene look slightly worse, on a cross-trial basis, than TAR-200.

More data from on cretostimogene are due this year. AstraZeneca also has bladder cancer ambitions, and data are due in the first half of 2025 from the Potomac trial in BCG-naive NIMBC patients, testing Imfinzi plus BCG versus BCG alone.

TAR-200 vs BCG

J&J, though, hopes eventually to replace BCG. To this end, the company’s confirmatory trial, Sunrise-3, tests TAR-200, with or without the PD-1 inhibitor cetrelimab, versus BCG, in BCG-naive patients. The aim is to confirm TAR-200’s initial approval and expand its use.

Sunrise-3 is “almost fully enrolled”, Craig Tendler, J&J’s vice-president of oncology clinical development, told ApexOnco during ESMO. Data from this event-driven study could emerge in the next 12-18 months, he added.

NMIBC accounts for around 75% of bladder cancers, and around a third of patients have high-risk disease, the population J&J is targeting with TAR-200.

But the group has another project, the erdafitinib-releasing TAR-210 that, it believes, could be used in intermediate-risk NMIBC, which accounts for another third of the population. Most intermediate-risk patients are FGFR positive, according to J&J, so could respond to an FGFR inhibitor like erdafitinib. The company started the Moonrise-1 trial here earlier this year.

J&J also has ambitions in the smaller niche of muscle-invasive bladder cancer, where it’s testing TAR-200 in both the first line and as neoadjuvant therapy. The company will need all of these studies to come through if it’s to meet its ambitious revenue goal.

Mid-to-late-stage trials with TAR-200 & TAR-210

| Project | Trial | Setting | Regimen | Primary endpoint | Note |

|---|---|---|---|---|---|

| TAR-200 (gemcitabine eluting) | Ph2 Sunrise-1 | 2nd-line high-risk NMIBC, BCG unresponsive | +/- cetrelimab vs cetrelimab | CR | Data at ESMO 2024: CR 84% with TAR-200 mono vs 46% with cetrelimab; final data & regulatory filings due Q1 2025 |

| Ph3 Sunrise-2 | 1st-line MIBC not receiving cystectomy | + cetrelimab vs chemoradiotherapy | BI-EFS | Primary completion Dec 2026 | |

| Ph3 Sunrise-3 | 1st-line high-risk NMIBC | +/- cetrelimab vs BCG | EFS | Confirmatory trial, “almost fully enrolled”, data possible in next 12-18mth | |

| Ph2 Sunrise-4 | Neoadjuvant MIBC pts undergoing cystectomy | + cetrelimab vs cetrelimab | pCR | Data at ESMO 2024: pCR 42% with TAR-200 + cetrelimab vs 23% with cetrelimab | |

| Ph3 Sunrise-5 | 2nd-line high-risk NMIBC, BCG experienced | Monotherapy vs intravesical chemotherapy | DFS | Primary completion Nov 2030 | |

| TAR-210 (erdafitinib eluting) | Ph3 Moonrise-1 | 1st-line intermediate-risk NMIBC with FGFR alterations | Monotherapy vs intravesical chemotherapy | DFS | Primary completion Jun 2028 |

Note: BI-EFS=bladder-intact event-free survival; MIBC=muscle-invasive bladder cancer; NMIBC=non-muscle invasive bladder cancer. Source: OncologyPipeline.

Following publication of this story, J&J discontinued the Sunrise-2 trial on futility.

1747