Claudin18.2 expression clouds Elevation's big reveal

Western data on EO-3021 fail to live up to the billing of a Chinese trial.

Western data on EO-3021 fail to live up to the billing of a Chinese trial.

Elevation Oncology’s key 2024 catalyst, data from a US-focused trial of the anti-Claudin18.2 ADC EO-3021, have reminded investors that expression of the target protein matters. They might also caution against putting too much reliance on earlier results generated in China.

That’s because Chinese data, revealed at ASCO 2023, served to justify Elevation’s licensing of this asset from CSPC Pharmaceutical for $27m up front a year earlier. Those results amounted to a 47% ORR among Claudin18.2-expressing gastric cancer patients, but now the Western study has yielded an ORR of just 20%, and Elevation stock opened down 53% this morning.

However, there is important nuance to a cross-trial comparison of this sort. For instance, the latest dataset is tiny, comprising just 15 subjects; and, as data from Astellas’s anti-Claudin18.2 MAb Vyloy showed, ORR is an unreliable metric in these patients. Crucially, the two EO-3021 trials used different baseline criteria for recruitment.

The earlier CSPC trial mandated Claudin18.2 expression of >1%. But, perhaps because the ORR figure among all 17 gastric cancer patients was so impressive, in Elevation’s study the Claudin18.2 expression requirement was skipped entirely, recruiting all-comers on the basis that gastric cancer is “likely to express Claudin18.2”, as the clinicaltrials.gov entry states.

20% ORR in all-comers

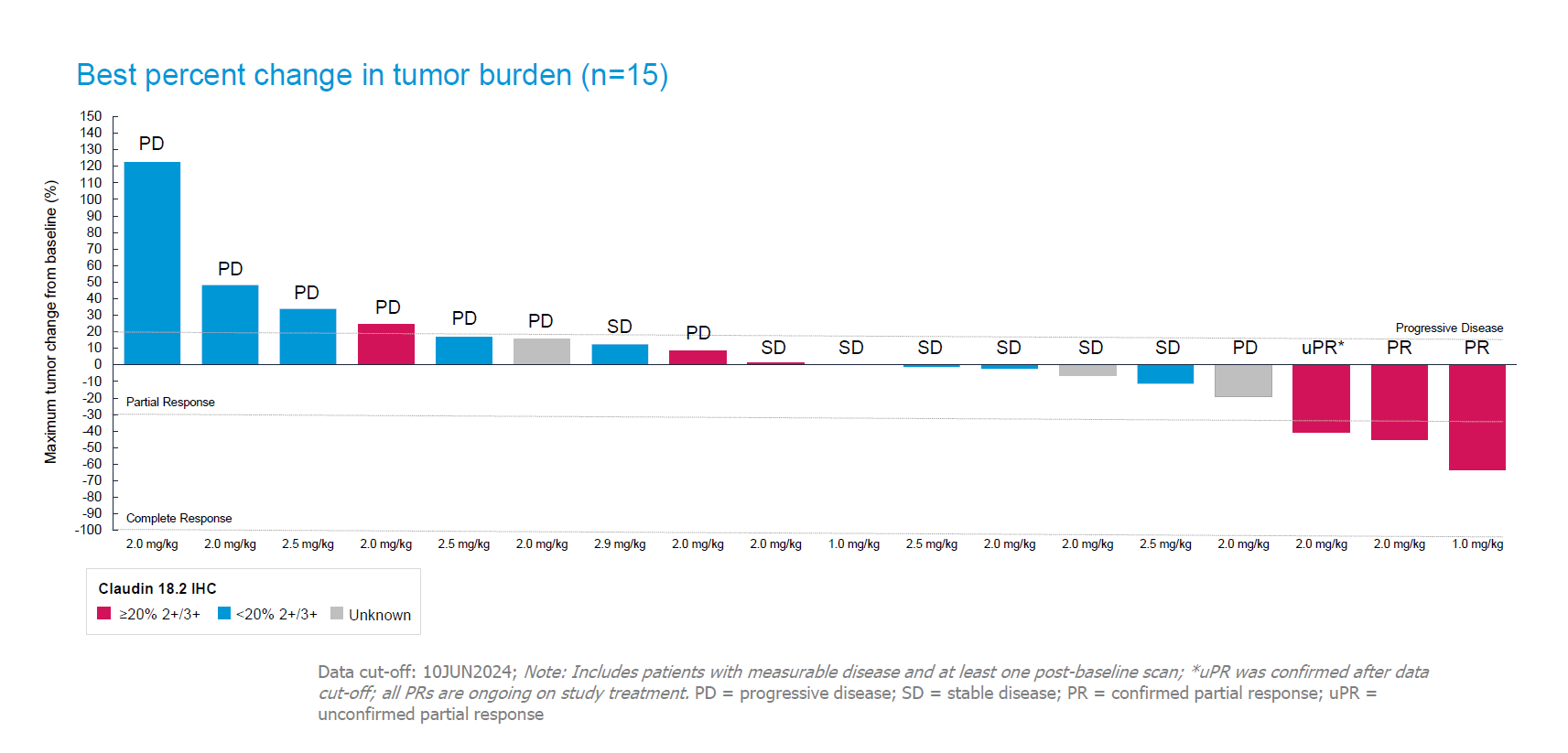

It’s this move that has now come back to haunt Elevation, which today revealed a confirmed ORR of just 20% among all 15 gastric cancer patients.

Accordingly, the group moved to highlight a 43% ORR among seven subjects deemed retrospectively to be Claudin18.2 positive. However, there is more nuance here: these patients had to be Claudin18.2-high (meaning ≥20% at IHC 2+/3+) because EO-3021 yielded no responses at all in those expressing Claudin 18.2 at under 20%, which included some low expressers.

Such considerations are key to determining EO-3021’s potential market, and limiting a drug to Claudin18.2-high patients wipes out the promise of activity in much lower expressers. Elevation says it will proceed with dose expansion, but will also work further to assess how Claudin18.2 expression is linked to response; “a biomarker patient selection strategy will be an important component of future clinical development”, it states.

EO-3021 in efficacy-evaluable gastric/GEJ cancer

Elevation gained ex-China rights to EO-3021 in a July 2022 deal with CSPC, which is developing it under the code SYSA1801.

The ADC uses a monomethyl auristatin E payload, so there might be some hope that one with a topoisomerase 1 inhibitor might yield better efficacy. One such anti-Claudin18.2 ADC is Innovent’s IBI343, which is in a phase 3 study in Claudin18.2-positive gastric cancer, and which in phase 1 showed 37-47% ORR (depending on the dose) in ≥75% expressers.

Also in focus is Keymed’s AstraZeneca-partnered CMG901/AZD0901, which like EO-3021 uses an MMAE payload, and which last year showed ORRs of 29-61% in ≥20% expressers. However, the Keymed dataset included unconfirmed responses – today Elevation said all three of its responses were confirmed on second scan – and there was no dose response, with patients on the lowest CMG901 dose apparently doing best.

Given the small patient numbers in Elevation’s study, and the fact the company was yesterday worth just $116m, perhaps today’s share price fall is an overreaction. But Claudin18.2 is an extremely crowded space, and only the best data will cut it.

2491