Celcuity goes early with its Pfizer cast-off

The company is to start a first-line phase 3 breast cancer trial of gedatolisib, as second-line data approach.

The company is to start a first-line phase 3 breast cancer trial of gedatolisib, as second-line data approach.

PI3K inhibition is getting more selective, but Celcuity is pushing ahead with gedatolisib, a broadly acting PI3K/mTOR inhibitor it picked up from Pfizer in 2021. A recent clinicaltrials.gov listing details a phase 3 study, Viktoria-2, in first-line breast cancer, slated to start in mid-2025 – as the group awaits data from its second-line trial, Viktoria-1.

Still, Pfizer offloaded gedatolisib for just $5m up front, and Celcuity stock is sitting at a one-year low, suggesting that investor hopes for the project aren’t high.

Toxicity has held back previous attempts to develop pan-PI3K/mTOR inhibitors, with the likes of Lilly’s samotolisib (LY3023414) falling by the wayside. Meanwhile, two selective PI3Kα inhibitors are marketed, Novartis's Piqray and Roche's Itovebi, though both hit wild-type as well as mutant forms of the protein, and come with warnings on their US labels.

This has led some companies to develop wild-type sparing PI3Kα inhibitors. Meanwhile, Celcuity reckons that gedatolisib is more specific than other pan-PI3K/mTOR projects, a feature that could make it safer. This will be put to the test in the Viktoria trials.

Gedatolisib phase 3 trials in ER-positive, HER2-negative breast cancer

| Trial | Setting | Regimen | Comparator | Primary endpoint | Status |

|---|---|---|---|---|---|

| Viktoria-1 | 2nd-line | Gedatolisib + Faslodex +/- Ibrance | PIK3CAwt: Faslodex; PIK3CAm: Faslodex + Piqray | PFS | Data in PIK3CAwt pts due H1 2025; data in PI3CAm pts due H2 2025 |

| Viktoria-2 | 1st-line, endocrine therapy resistant | Gedatolisib + Faslodex +/- Ibrance/Kisqali | Faslodex + Ibrance/Kisqali | PFS | To start Jun 2025 |

Source: OncologyPipeline & clinicaltrials.gov.

The first-line Viktoria-2 study will test gedatolisib plus AstraZeneca’s injectable SERD Faslodex, plus investigator’s choice of CDK4/6 inhibitor (Ibrance or Kisqali), versus Faslodex plus a CDK4/6 inhibitor.

The trial will enrol ER-positive, HER2-negative breast cancer patients who’ve had no prior treatment for advanced or metastatic breast cancer, but whose disease has progressed with adjuvant endocrine therapy. This population is relatively small, at around 15,000 US patients, Celcuity estimates.

PIK3CA mutated and wild-type patients will be included; a separate analysis for the primary endpoint, progression-free survival, will be carried out on each cohort.

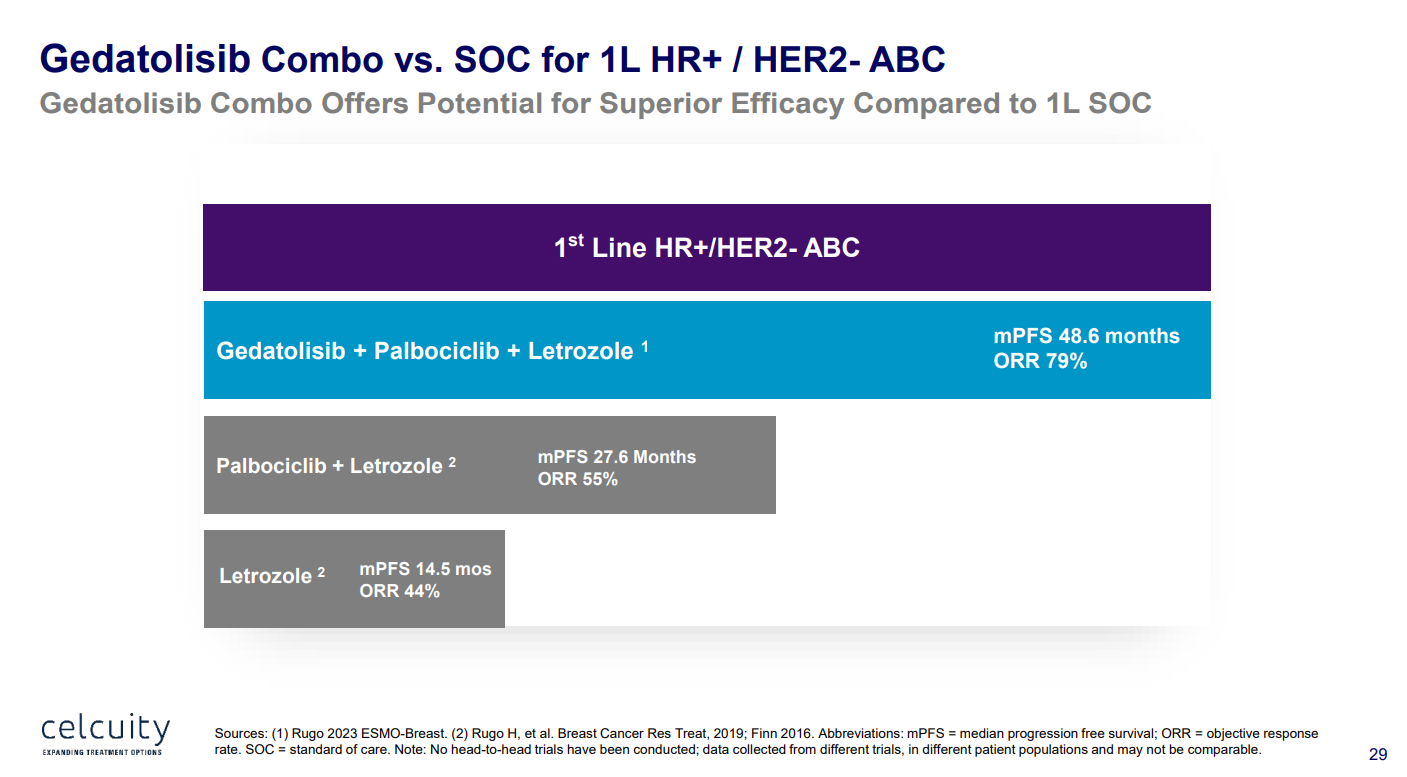

Celcuity has pointed to a 79% overall response rate among 33 first-line patients in the phase 1 B2151009 trial; however, this tested gedatolisib plus Femara (rather than Faslodex) and Ibrance.

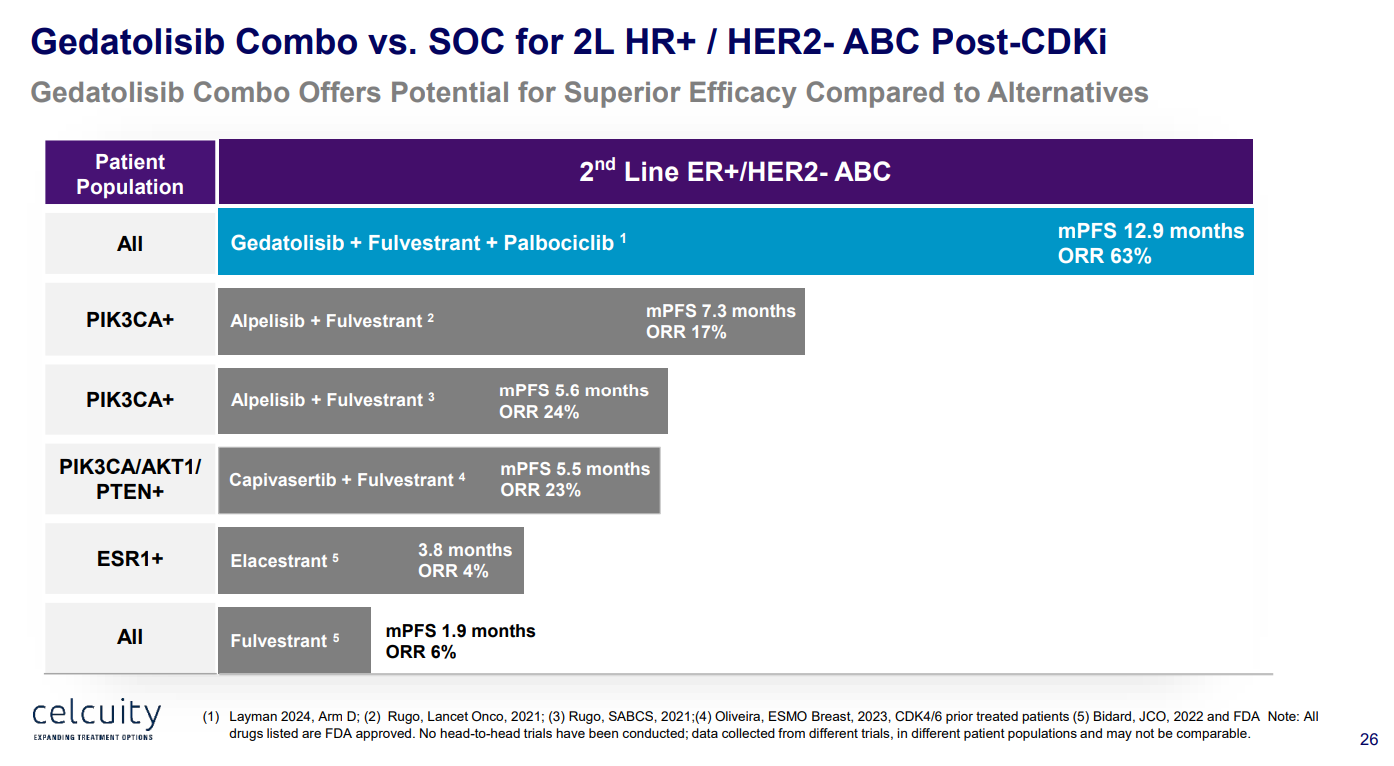

A nearer-term look at gedatolisib will come from the second-line Viktoria-1 trial, which is set to yield data this year, initially in wild-type patients. Here, gedatolisib plus Faslodex, with or without Ibrance, is being pitted against Faslodex alone.

Among 27 second and third-line patients, the B2151009 study found a 63% ORR with gedatolisib plus Faslodex plus Ibrance, although two of the 17 responses were unconfirmed.

Safety will also be closely watched; in phase 1 under 4% of patients discontinued this regimen owing to an adverse event.

Celcuity reckons these results could make gedatolisib competitive, although Pfizer clearly didn’t see much promise in the project. It should soon become apparent who was right.

928