Black Diamond joins ArriVent in the PACC pack

BDTX-1535 takes aim at PACC mutations and Tagrisso resistance.

BDTX-1535 takes aim at PACC mutations and Tagrisso resistance.

Black Diamond Therapeutics has joined ArriVent Biopharma in zeroing in on so-called PACC mutations as a key atypical EGFR mutation that can be hit with an EGFR inhibitor. In Black Diamond’s case that inhibitor is BDTX-1535, and the specific setting is lung cancer patients who relapse on AstraZeneca’s Tagrisso.

BDTX-1535 on Monday yielded its first data from the second cohort of a phase 1/2 study, where a 200mg dose chosen for pivotal development yielded a 36% response rate. The jury is still out on durability, and some responses have yet to be confirmed, but BDTX-1535 appears able to hit PACC as well as C797S, the two mutations Black Diamond says account for 20% of Tagrisso resistance.

For this reason the group has selected post-Tagrisso patients with either PACC (P-loop alpha-c helix compressing) or C797S resistance mutations as those in whom it will run a pivotal BDTX-1535 study, though regulatory feedback on a precise path to approval won’t emerge until the first quarter of 2025. After initially trading up as high as 15% Black Diamond stock closed down 5%.

Fourth generation

Until now Black Diamond had touted BDTX-1535 as a fourth-generation molecule able to hit C797S as well as several other atypical resistance mutations. Just over a year ago the first phase 1 backing for this emerged, with a 29% ORR in 21 subjects given 100-400mg doses seemingly justifying the company’s switch away from the exon 20 insertion niche to BDTX-1535.

Monday brought an update from a more mature cut of the same study, comprising more patients from cohort 1, as well as cohort 2, which looked specifically at C797S-mutant NSCLC patients who had progressed on Tagrisso as their only prior anti-EGFR drug. Moreover, the update concerned only BDTX-1535 at 200mg, which Black Diamond said had been selected mostly for its favourable toxicity profile.

The headline number here was a 36% ORR among 22 efficacy-evaluable patients (a further five were excluded for failing to meet protocol requirements). Black Diamond also attempted to exclude three non-responders who had neither a PACC nor C797S mutation, for a 42% ORR.

Though a 36% ORR sounds respectable in this patient population, perhaps the fact that three of the eight responses – all in patients on treatment for under three months – were unconfirmed caused investor concern. There would have been two additional responders in this dataset, but these patients had progressive disease on second scan.

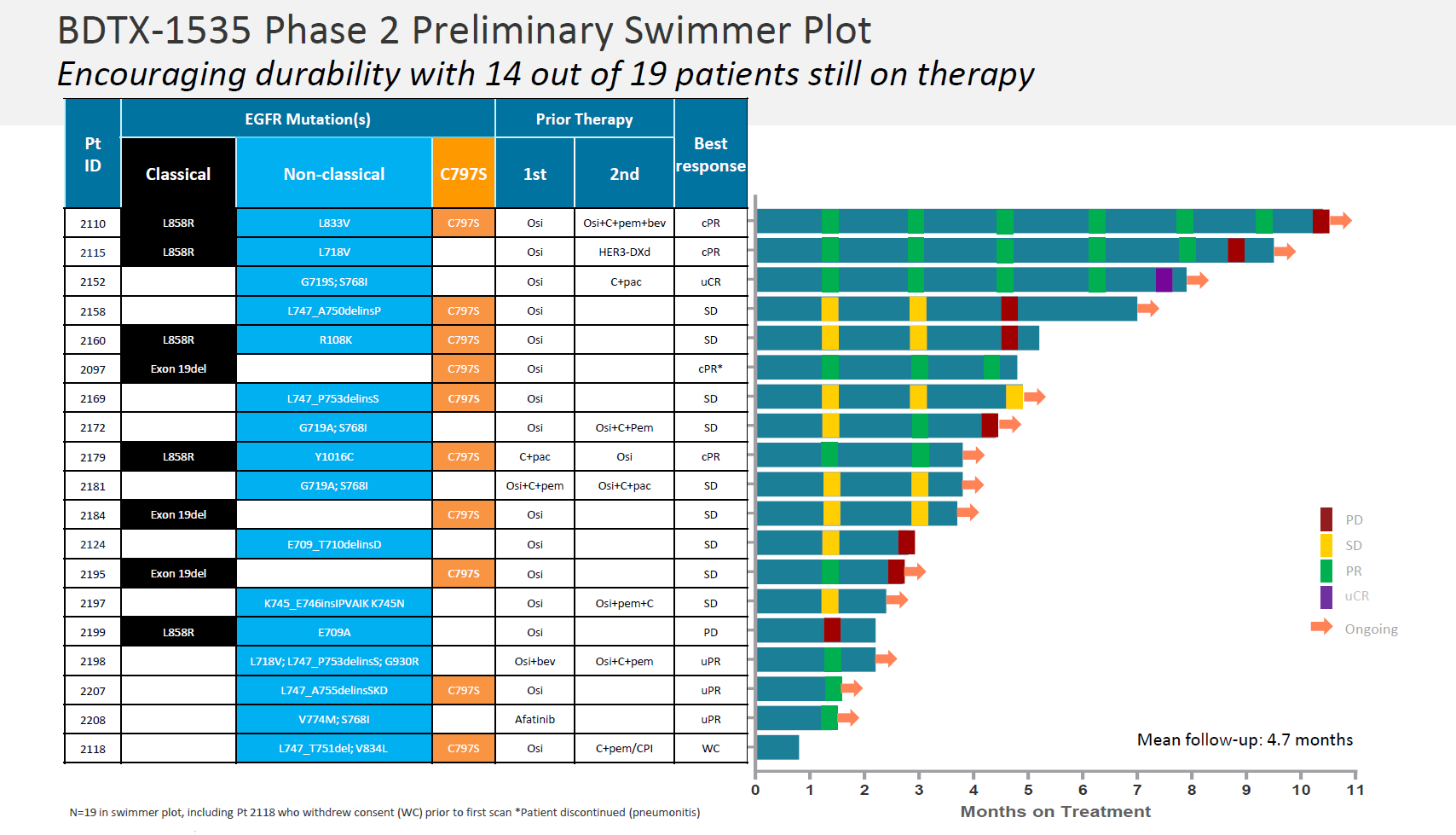

As for durability, in the three patients on therapy longest, two relapsed at around 10 and nine months, while the third went from confirmed partial to an unconfirmed complete remission at eight months. Black Diamond said 14 of the 19 PACC/C797S patients remained on BDTX-1535 as of the 17 August cutoff; however, only five of these are still in response while on therapy.

Source: Black Diamond presentation.

In the 19 patients whose NSCLC mutations comprise the pivotal population, responses were seen in four of nine with PACC mutations, and four of 10 with C797S. Black Diamond highlighted the lack of grade 3-4 diarrhoea, and no liver enzyme elevation or QTc prolongation among 20 patients evaluated for safety at a 15 June cutoff.

For its part, ArriVent came to the recent World Conference on Lung Cancer with data on its Allist-originated EGFR inhibitor firmonertinib, in which it claimed a 64% rate of confirmed and unconfirmed responses among 45 patients given 160mg or 240mg daily. However, the dataset isn’t comparable, as these patients were all TKI-naive rather than Tagrisso-relapsed.

Perhaps the most curious aspect of ArriVent’s claim is that firmonertinib isn’t a fourth-generation drug but a molecule with structural similarity to Tagrisso, and is actually marketed in China in Tagrisso-like settings. Black Diamond is enrolling into a first-line BDTX-1535 cohort, and promises initial data in the first quarter.

1254