Bicycle aims to follow in Padcev’s slipstream

A study to back accelerated approval is to start next year, but the prospect of seeing a fully greenlit Padcev before then looms large.

A study to back accelerated approval is to start next year, but the prospect of seeing a fully greenlit Padcev before then looms large.

Bicycle Therapeutics has long had to contend with questions about the advantages of its conjugation approach, and what regulatory pathway its lead asset, zelenectide pevedotin, might have to pursue to get to market. So its claim that the FDA had agreed to an accelerated approval plan was naturally greeted positively, and the group’s stock closed up 8% yesterday.

Central to the issue is Seagen/Astellas’s Padcev, which like zelenectide is an ADC that targets the Nectin-4 antigen, but which is already greenlit in three urothelial bladder cancer settings, two of which carry formal approval. As such the status of Padcev should be seen as a threat, especially as its confirmatory EV-302 study is due to end in two months.

Should EV-302 read out positively it would support Padcev’s full approval across all three of its current settings, and whether an accelerated pathway still exists after that will become apparent. Bicycle yesterday said it had reached “alignment” with the FDA regarding regulatory path and phase 2/3 design, but of course the actual FDA commentary remains confidential.

Backing the plan is the FDA’s Project Frontrunner, designed to circumvent the traditional development approach to first target late-line patients who have exhausted available treatment options. This, analysts say, could allow zelenectide to be developed in an earlier clinical setting.

Duravelo-2

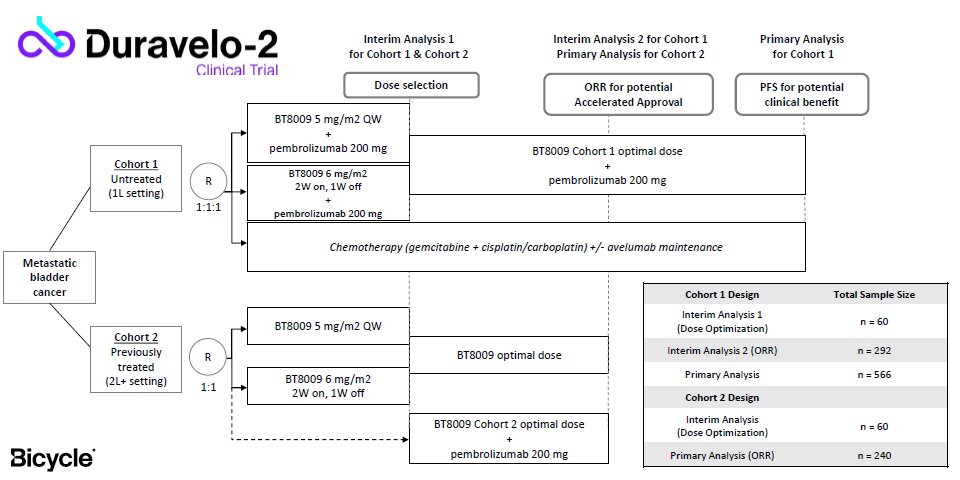

According to Bicycle just one clinical trial will suffice: the phase 2/3 Duravelo-2 study will have two Keytruda combo cohorts, the first in untreated bladder cancer, and the second in second-line-plus disease.

There are two other key points: the FDA has agreed to a chemotherapy comparator for both cohorts, Bicycle says, and to remission rates as support for accelerated approvals. There had been the risk of having to use Padcev as a tougher active comparator, and of delaying matters by having to wait for survival data.

Analysts at Jefferies and B Riley – the latter had earlier been highly critical of Bicycle – both called this a best-case scenario. PFS from the first cohort will serve to formalise first-line zelenectide use, Bicycle says, while design of a second-line confirmatory trial is still being discussed.

That the FDA should be so willing to see an anti-Nectin-4 conjugate speed through to market in indications where a similarly acting drug is already fully approved is unusual. Agenus, for instance, had faced this issue in cervical cancer when the 2021 full green light for Keytruda closed off its own accelerated pathway for balstilimab.

Padcev monotherapy is fully approved for second-line cisplatin-ineligible bladder cancer and third-line post PD-(L)1/chemo use – notably settings that Duravelo-2’s second cohort could include. Padcev’s first-line Keytruda combo has accelerated approval, which is to be confirmed by the EV-302 trial that is due to end in November.

Zelenectide pevedotin, formerly coded BT8009, is a synthetic bicycle toxin conjugate, which Bicycle claims has a better safety profile versus traditional ADCs, with less neuropathy, ocular toxicity and severe skin reactions. However, B Riley had earlier written that it had “yet to witness a specific target or indication where [Bicycle’s] new modality would showcase a clear and meaningful therapeutic edge”.

These doubts were evident at February’s ASCO-GU conference, where Bicycle showed efficacy in line with Padcev on a cross-trial basis, with similar rates of severe adverse events. Moreover, though zelenectide has been dosed up to 10mg/m2 every two weeks, Duravelo-2 focuses on lower, more frequent, dosing.

Developments will be closely watched by other companies working on Nectin-4, which according to OncologyPipeline comprises just seven active clinical-stage projects. Among the preclinical players, the private Adcentrx Therapeutics closed a $38m series A financing in April, and shortly afterwards revealed that Nectin-4 was the target of its lead ADC, ADRX-0706.

Clinical-stage projects targeting Nectin-4

| Project | Company | Mechanism | Indication | Status | Trial |

|---|---|---|---|---|---|

| Padcev | Astellas/ Seagen | ADC | 3L (post PD-(L)1 + platinum chemo) bladder cancer | Accelerated approval Dec 2019 | EV-201 cohort 1 |

| Full approval Jul 2021 | EV-301 | ||||

| 2L (cisplatin-ineligible) bladder cancer | Full approval Jul 2021 | EV-201 cohort 2 | |||

| 1L (cisplatin-ineligible) bladder cancer, Keytruda combo | Accelerated approval Apr 2023 | EV-103 cohort A & K | |||

| Confirmatory trial | EV-302 | ||||

| Zelenectide pevedotin (BT8009) | Bicycle Therapeutics | Bicycle toxin conjugate | 2L+ bladder cancer, Keytruda combo | Phase 2/3 | Duravelo-2 cohort 2 |

| 1L bladder cancer, Keytruda combo | Phase 2/3 | Duravelo-2 cohort 1 | |||

| Solid tumours | Phase 1/2 | NCT04561362 | |||

| 9MW2821 | Mabwell Bioscience | ADC | Solid tumours | Phase 1/2 | NCT05216965 |

| BT7480 | Bicycle Therapeutics | CD137 agonist bicycle | Nectin-4+ve solid tumours | Phase 1/2 | NCT05163041 |

| BAT8007 | Bio-Thera Solutions | ADC | Solid tumours | Phase 1 | NCT05879627 |

| Nectin4/FAP CART | Zhejiang Qixin Biotech | Dual-acting (also FAP) Car-T | Solid tumours | Phase 1 | NCT03932565 |

| SKB410 (A410) | Kelun Biotech | ADC | Solid tumours | Phase 1 | NCT05906537 |

| CRB-701/ SYS6002 | Corbus/ CSPC | ADC | Solid tumours | Phase 1 | CTR20222932 |

| SBT6290 | ARS Pharmaceuticals | TLR8 agonist ImmunoTAC | Solid tumours | Phase 1/2 trial withdrawn* | NCT05234606 |

| AGS-22M6E | Astellas | ADC | Solid tumours | Phase 1 trial completed | NCT01409135 |

Note: *ARS reversed into Silverback Therapeutics, SBT6290’s originator. Source: OncologyPipeline.

1865