Two oncology floats to end the summer break

Bicara and DualityBio will soon test market appetite for new oncology issues.

Bicara and DualityBio will soon test market appetite for new oncology issues.

Duality Biologics’ just revealed plan to float on the Hong Kong stock exchange adds to Bicara Therapeutics’ Nasdaq IPO, first documented five days ago. Investors thus have two oncology-focused companies to look to after a somewhat low-key summer break.

Whether these IPOs happen depends on the markets remaining relatively favourable, which is by no means guaranteed, given broader volatility and the fact that 2024 is a US election year. In the US at least there are some positive signs: the Nasdaq biotech index is up 11% year to date, while the January floats of Arrivent and CG Oncology have outperformed.

At the start of this year both looked highly speculative; Arrivent is developing furmonertinib, which targets the competitive EGFR inhibitor space, which CG is working on an oncolytic virus, a strategy that has disappointed. But the former is today up 50% over its IPO price, while the latter’s stock doubled on its first day of trading, and has since maintained a resulting $2.5bn valuation.

One-asset play

Now Bicara will offer an investment that is almost entirely geared towards the success of its sole clinical-stage project, the anti-EGFR x TGF-β fusion protein ficerafusp alfa. Bicara has previously worked preclinically on other bispecifics, such as the anti-CAIX x IL-12 BCA356, but its IPO document makes no mention of this.

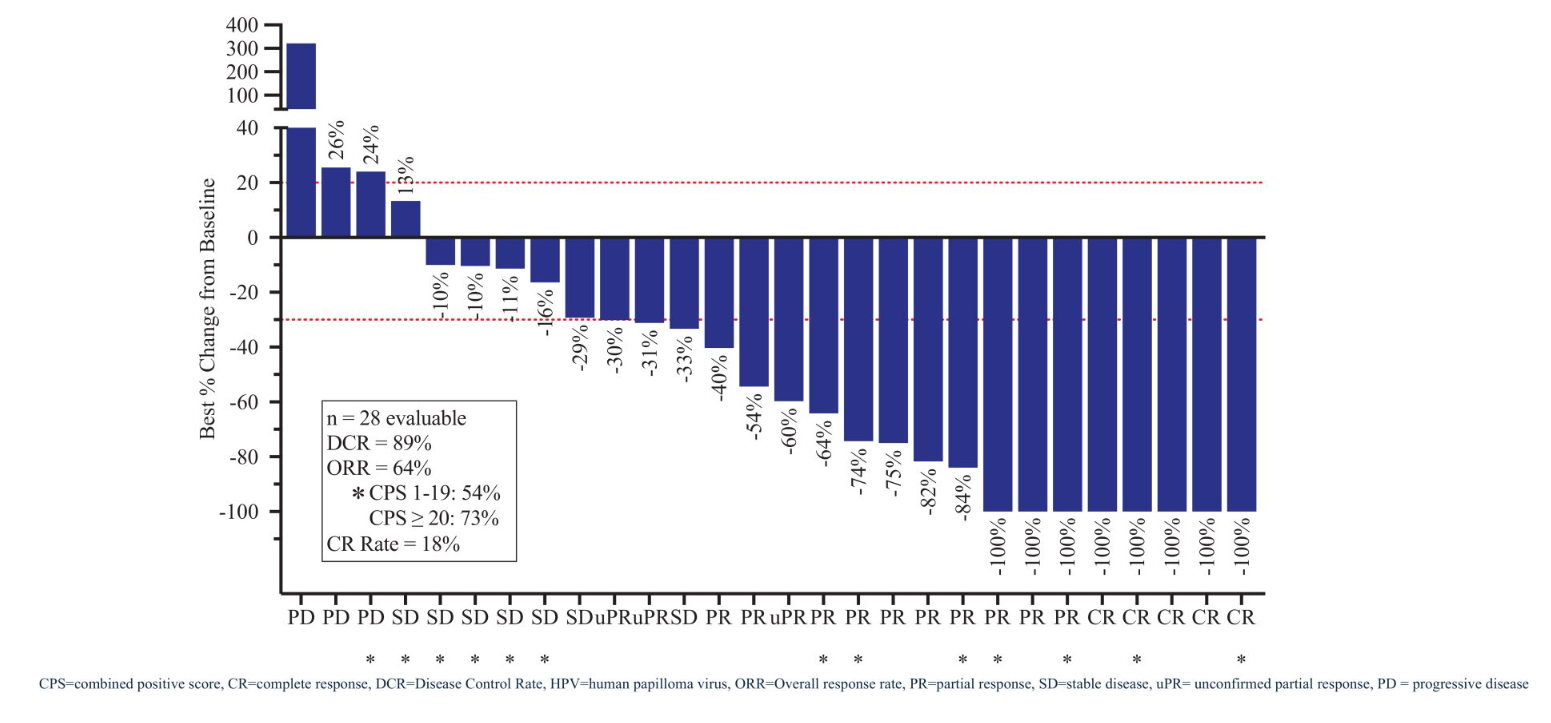

Remarkably, though a phase 2/3 ficerafusp/Keytruda combo study is planned for next year, the project is still only in phase 1. Here Bicara is targeting first-line head and neck cancer, and in June reported a 64% ORR and 9.8-month median PFS in HPV-negative patients, a result that seems to have driven its decision to go public.

The data looked competitive versus Merus’s EGFR-targeting project petosemtamab, though that has yet to generate PFS numbers and is also targeting HPV-positive disease, which Bicara has given up on. Another relevant factor for investors interested in the IPO is treatment discontinuations due to adverse events, which appear to be higher with ficerafusp than with petosemtamab.

Phase 1 ficerafusp alfa + Keytruda data in 1st-line, HPV-negative head & neck cancer

If Bicara is a one-project company the same can’t be said about China's Duality, which specialises in antibody-drug conjugate design and has a broad pipeline of mono and bispecific ADCs; three, targeting HER2, B7-H3 and TROP2, are licensed to BioNTech, while an anti-B7-H4 ADC is partnered with BeiGene.

Such high-profile partners undoubtedly give Duality’s approach validation in investors’ eyes, especially given the problems BioNTech hit temporarily with a separate HER3-targeting ADC, BNT326, which is licensed not from Duality but from MediLink.

Including the partnered assets Duality has six clinical-stage ADCs, which additionally include a wholly owned anti-B7-H3 x PD-L1 bispecific that recently entered phase 1. The group splits its approach into three waves, respectively Ditac (immune toxin ADCs), Dibac (bispecific ADCs) and Dupac (“unique payload” ADCs).

As is typical for Hong Kong flotations, much of Duality’s IPO document has been redacted. At present it’s also not been decided how much either Duality or Bicara aim to raise, or at what price.

Duality’s oncology pipeline (disclosed targets only)

| Project | Partner code | Target | Partner | Status |

|---|---|---|---|---|

| Ditac* projects | ||||

| DB-1303 | BNT323 | HER2 | BioNTech | Ph3 in various breast cancer settings & HER2+ve endometrial cancer |

| DB-1311 | BNT324 | B7-H3 | Ph2 in SCLC, prostate & oesophageal cancers | |

| DB-1305 | BNT325 | TROP2 | Ph2 in NSCLC & others | |

| DB-1312 | BG-C9074 | B7-H4 | BeiGene | Ph1 in solid tumours |

| DB-1310 | NA | HER3 | Unpartnered | Ph1 in NSCLC & others |

| Dibac** projects | ||||

| DB-1419 | NA | B7-H3 x PD-L1 | Unpartnered | Ph1 in solid tumours |

| DB-1418 | NA | HER3 x EGFR | Unpartnered | Preclinical |

Notes: *Duality immune toxin antibody conjugate; **Duality innovative bispecific antibody conjugate. Source: IPO document.

1229