Triple meeting 2023 – a p53 double-whammy for PMV

Data on PMV’s p53 reactivator prompt a 26% selloff before their presentation, and 48% afterwards.

Data on PMV’s p53 reactivator prompt a 26% selloff before their presentation, and 48% afterwards.

Attempts to target malfunctioning of the p53 protein, sometimes called the guardian of the genome, continue to prove elusive, as investors in PMV Pharma found to their cost – again – this week.

A late-breaking update on data from the Pynnacle study of PMV’s p53-directed project PC14586 at the Triple meeting was billed as evidence of efficacy across multiple tumour types. But PMV sold off massively, shedding nearly two thirds of its market cap, on the revelation of no efficacy in KRAS-mutant tumours and on repeated warnings over toxicity.

The latter isn’t a new problem. When earlier Pynnacle data were presented at ASCO 2022 it was already clear that PMV would have a tough job finding a therapeutic window for PC14586. At that point 1.5g twice daily yielded dose-limiting toxicities, so whether the group manages to avoid these with its now planned 2g daily phase 2 dose is a relevant question.

The KRAS revelation was new, though it’s not clear that this really matters much. If PC14586 doesn’t work in KRAS mutations that only eliminates a small part of the market, according to Evercore ISI analysts, and a tumour-agnostic label, based purely on mutation status, looks still to be on the cards.

Reactivation

PC14586 is a p53 “reactivator” that selectively binds to p53 carrying the Y220C hotspot mutation, aiming to restore p53 wild-type activity, and in the uncontrolled Pynnacle trial it’s being tested in a variety of cancers that are p53 Y220C positive.

On Wednesday the abstracts for the Triple (AACR-NCI-EORTC) meeting went live, and the Pynnacle data were sufficiently worrying to send PMV down 26%. On presentation of the updated results, with a 5 September cutoff, yesterday PMV fell another 48%.

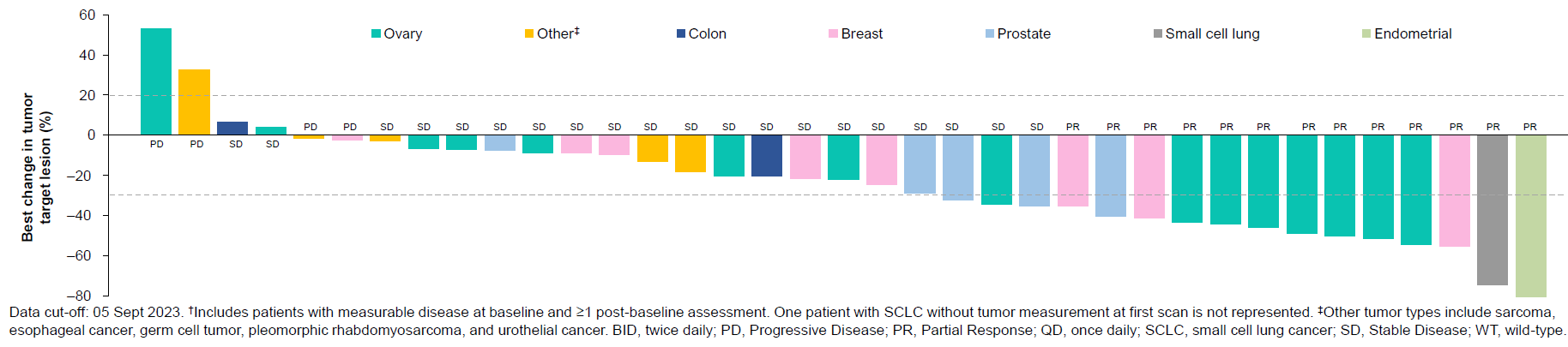

The headline efficacy number concerns PC14586 dosed at 1.15g daily to 1.5g twice daily: across 53 efficacy evaluable patients there were 13 confirmed partial remissions. All 13 were in KRAS wild-type patients, of whom there were 38, for a 34% ORR in this group; there were zero responses in the remaining 15, who had KRAS-positive cancers.

Efficacy at 1.15g daily to 1.5g twice daily in p53 Y220C mutant/KRAS wild-type efficacy evaluable patients

PMV zeroed in on 16 patients with p53 Y220C-mutant KRAS wild-type tumours given the go-forward 2g daily dose, six of whom went into partial remission. That’s probably not bad given that patients had failed a median three prior therapies.

But toxicity remains something of a concern. The Triple meeting poster listed 16% and 15% respective rates of ALT and AST increases across 67 safety-evaluable patients; raised levels of these liver enzymes was the commonest grade 3 treatment-emergent adverse event, seen in 4.5% of subjects for ALT and 3.0% for AST.

Whether PC14586 has a therapeutic window had caused concern at last year’s ASCO, where efficacy data were cited as evidence that p53 was becoming “druggable”, but two dose-limiting toxicities occurred at 1.5g twice daily: one grade 3 AST/ALT increase and one grade 3 acute kidney injury.

Addressable population

Assuming that 2g daily avoids such concerns investors will want to know how big a market exists if KRAS-mutated cancers come out of the equation.

Evercore reckons the only problem is with pancreatic and colorectal cancers. PMV presented an analysis claiming 94% and 46% respective rates of p53/KRAS co-mutation in these tumour types, saying that in other solid tumours p53 mutation coincided with KRAS wild-type status in around 90% of cases.

The company yesterday unveiled plans for an uncontrolled phase 2 basket study of 2g twice-daily PC14586, planning to enrol 114 patients in ovarian, lung, breast, endometrial and “other” cancer cohorts. Inactivation of p53 by Y220C mutation is said to be present across 1% of all solid tumours, so a cancer-agnostic label could still amount to a significant opportunity for PC14586.

Still, ongoing problems remain fresh in the memory. For example, Aprea’s lead asset was once the p53 reactivator eprenetapopt, but this flunked phase 3 in front-line p53-mutant myelodysplastic syndromes, and suffered two clinical holds. Aprea became a listed shell into which the private group Atrin reversed.

The Taiwan-based Senhwa Biosciences is still developing pidnarulex (CX-5461), an RNA polymerase inhibitor said to work by activating p53. Other p53 players included Actavalon, CDG Therapeutics, Cotinga Pharmaceuticals and Innovation Pharmaceuticals, but none now seems to have an active presence here.

If PMV has shown that it can do better its investors have yet to be convinced.

2135