Tempest’s pivotal amezalpat conundrum

How does the micro-cap biotech now finance a 700-patient phase 3 study?

How does the micro-cap biotech now finance a 700-patient phase 3 study?

With a slight deterioration of the data, an updated analysis of a first-line liver cancer trial that includes a cohort testing Tempest Therapeutics’ PPAR⍺ antagonist amezalpat head to head against Roche’s Tecentriq plus Avastin appears still to support Tempest's approach.

An earlier iteration of the results transformed the fortunes of Tempest, a micro-cap biotech, last October, though since then its shares have sold off. And this morning Tempest lost a further 10%, presumably on financing fears; the most important aspect of the update is that it’s sufficiently positive for Tempest to propose running a registrational study in the same setting, but to do this will require more cash.

The results that have just been updated come from a multi-cohort, Roche-sponsored study called Morpheus-liver, which separately has prompted the Swiss firm’s anti-TIGIT MAb tiragolumab to be taken forward in front-line liver cancer.

Survival maturing

For Tempest the relevant comparison is for amezalpat on top of Tecentriq plus Avastin, versus the Tecentriq/Avastin regimen, which has a first-line liver cancer label on the basis of the Imbrave-150 trial.

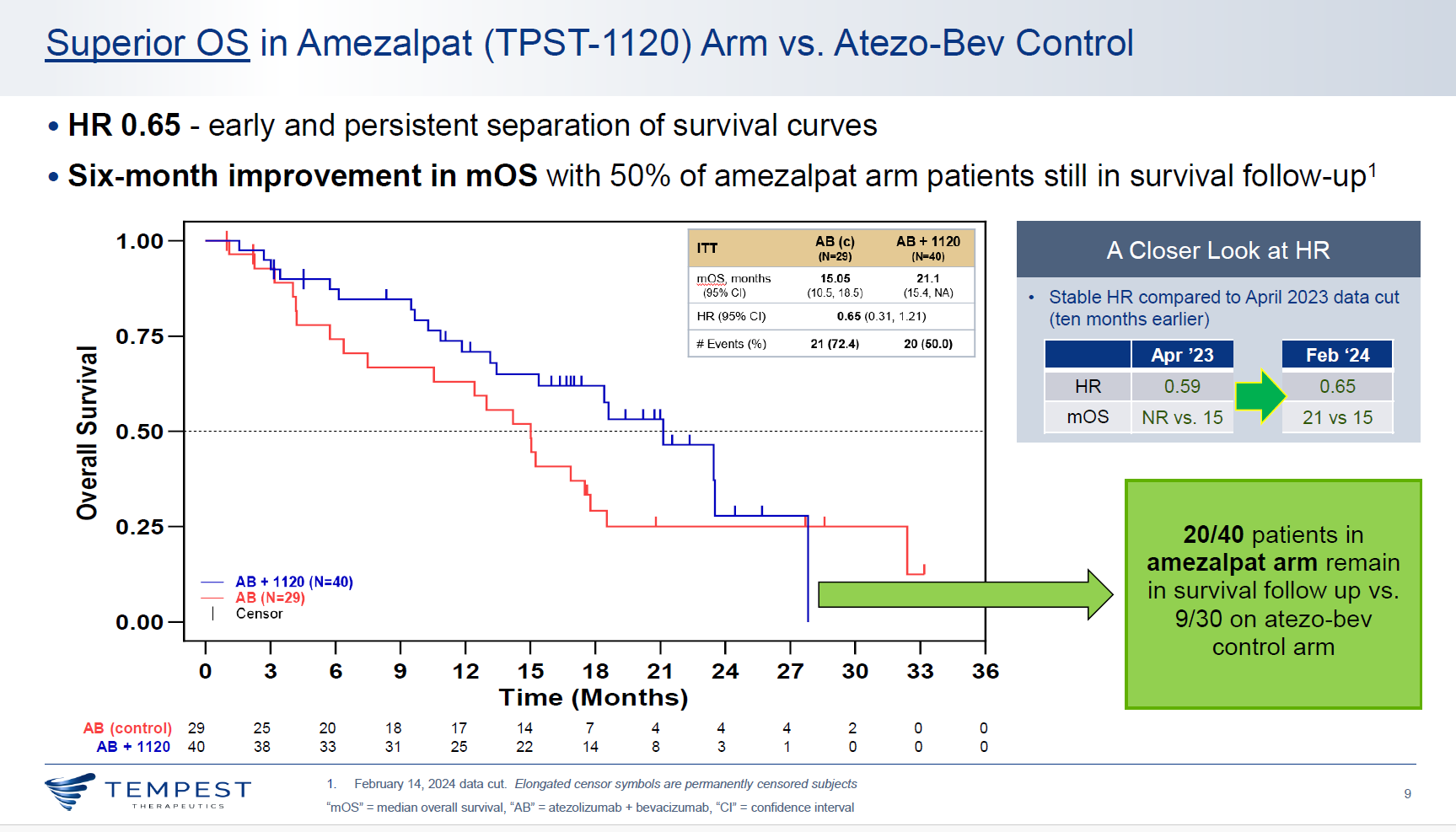

Tempest today updated survival hazard ratios from this comparison, saying reduction in risk of death supporting amezalpat now stood at 35%, while reduction in risk of progression or death was 20%. That’s a slight deterioration versus what was reported last October, when the risk reductions stood at 41% for OS and 30% for PFS.

Such deterioration isn’t unexpected with a more mature data cutoff, and there’s also good news with unveiling of the OS curves, which suggest that the control arm isn’t underperforming, as the earlier PFS numbers had suggested. Reading off the curves, Imbrave-150 and Morpheus-liver both show landmark 12-month OS of around 65% for Tecentriq plus Avastin.

Tempest also provided subgroup analyses in PD-L1-negative patients, where confirmed ORR was 27% versus 7% for control, as well as highlighting amezalpat’s activity in patients with the β-catenin mutation; however, it says activity is seen irrespective of β-catenin mutation status, supporting development in the overall population.

The company also talked up baseline imbalances that might have caused patients on Tecentriq plus Avastin alone to do better than expected, including that those in this control cohort were enriched for PD-L1-positive and other immunogenic tumours.

It now proposes to run a phase 3 trial, enrolling over 700 first-line liver cancer patients randomised to either amezalpat/Tecentriq/Avastin or Tecentriq/Avastin, and measuring OS as sole primary endpoint. In an investor presentation today it said this enrolment target should ensure 90% powering to detect statistical significance at a two-sided p threshold of 0.05.

Importantly, Tempest is still worth under $100m, and its data come from just 70 patients. Questions might also be asked of the mechanism of action of amezalpat (formerly coded TPST-1120): PPAR⍺ is a protein that Tempest claims is relied on for proliferation by tumours in which the β-catenin pathway is activated, but it's better known as a target in metabolic diseases.

In addition to such caveats, Tempest’s biggest problem now is funding pivotal development. The group last reported cash of $32m, at the end of the first quarter, and amezalpat won’t be able to start phase 3 without a fresh injection of funds.

1919