Tempest kicks up a storm as Morpheus strikes again

Tempest Therapeutics confirms an earlier success with its lead project, and this time investors respond.

Tempest Therapeutics confirms an earlier success with its lead project, and this time investors respond.

The Morpheus-liver study this year breathed new life into Roche’s anti-TIGIT MAb tiragolumab, and now it’s done even more for Tempest Therapeutics, a little-known micro-cap biotech that closed up 30-fold yesterday on data emerging from this multi-project trial.

The results appear to support the activity of the PPAR⍺ antagonist TPST-1120, Tempest’s lead asset, in front-line liver cancer. Not only is PPAR⍺ antagonism a highly unusual oncology mechanism, but Tempest already reported very similar data from Morpheus-liver in April, and on that occasion the results elicited no discernible investor response.

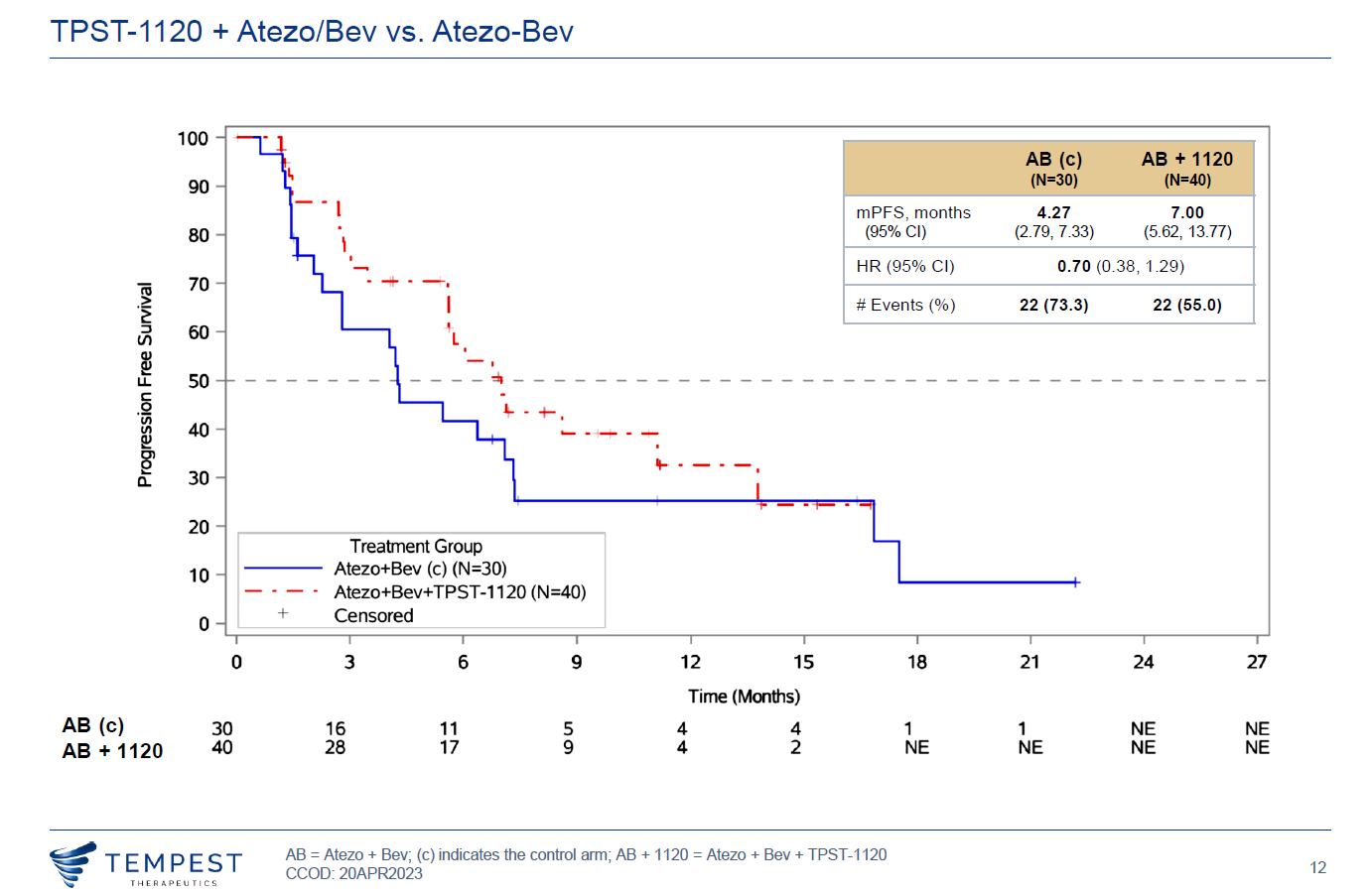

Perhaps the difference is the confirmation of patient remissions. In April Tempest claimed a 30% unconfirmed ORR among 40 patients given TPST-1120 on top of Tecentriq plus Avastin, versus 17% for those given the two Roche drugs alone; only seven of the 12 triplet responses were confirmed, however, and Tempest said nothing at the time about survival data.

Yesterday the narrative moved up a gear as Tempest said the 30% ORR was now confirmed in its entirety, and the result was flattered further because one control arm remission failed to be confirmed, resulting in an ORR for the doublet of 13%.

There is now also a survival advantage, with risk of death cut by 41%, Tempest said, and a hazard ratio of 0.7 for PFS. And the icing on the cake is that remissions with TPST-1120 appear to be independent of patients’ PD-L1 status: the confirmed ORR in PD-L1-negatives is 27% for the triplet, whereas for Tecentriq plus Avastin it falls to just 7%.

Small numbers

Naturally, investors will want to know whether the data from this open-label trial are legit, and perhaps the most obvious caveat is that a total patient population of 70 amounts to a relatively small study, in which the chances of a lucky break are high.

It’s also important to stress that Tempest is a micro-cap, which on Tuesday had been valued at just $3m. Even after yesterday’s success its market cap stands at $95m, so the 2,900% share price surge must be viewed in this context; little wonder that Tempest yesterday adopted a shareholder rights plan to ward off any bids it might view as opportunistic.

Perhaps a more fundamental concern about the data is that Tecentriq plus Avastin looks to be underperforming the data generated in Imbrave-150, the Roche doublet’s registrational first-line liver cancer trial. Here median PFS was 6.8 months, versus just 4.3 being cited in Morpheus-liver (OS data in Morpheus-liver are insufficiently mature to allow a meaningful cross-trial comparison).

Clearly, seven months of median PFS for the TPST-1120-containing triplet looks unimpressive if compared against the 6.8 months in Imbrave-150. Still, Morpheus-liver is a controlled study, so some credit for this should be given rather than leaping immediately to an unfavourable cross-trial comparison – while noting the small data caveats above.

Investors will recall that Roche’s TIGIT optimism was blunted by similar concerns about Morpheus-liver’s control arm underperforming, though in that case a retrospective Bayesian analysis suggested that the data still held up.

Morpheus-liver, a Roche-sponsored trial, includes TPST-1120 thanks to a 2021 clinical trial collaboration with Tempest; the Swiss group has a similar alliance with Adagene, resulting in the latter’s masked anti-CTLA-4 MAb ADG126 also being evaluated in a separate triplet cohort.

TPST-1120 is an antagonist of PPAR⍺, a protein Tempest claims is relied on for proliferation by tumours in which the β-catenin pathway is activated. The company is now touting a pivotal first-line liver cancer trial as the "next appropriate step" for TPST-1120.

The fact PPAR⍺ is much more commonly associated with metabolic disease drugs – which agonise rather than antagonise it – is just another intriguing aspect of yesterday’s dataset.

PFS curves in Morpheus-liver

2367