A short-lived hold for Arcellx & Gilead

Less than two months after a patient death CART-ddBCMA’s pivotal multiple myeloma trial is cleared to restart.

Less than two months after a patient death CART-ddBCMA’s pivotal multiple myeloma trial is cleared to restart.

US clinical holds have become common for cell and gene therapies, so it will come as a relief to Arcellx that the one concerning its lead cell therapy, CART-ddBCMA, lasted less than two months. Yesterday the FDA said the project’s pivotal Immagine-1 study could resume, after modifications to its protocol.

Not only is this good news for Arcellx, it will come as a relief for Gilead, which paid $325m last December for rights to CART-ddBCMA, but whose other recent attempts to make a mark in oncology have yet to score a notable success. Though in the event the clinical hold proved short lived, the extent to which it might have thrown Immagine-1 off course is as yet unclear.

The Immagine-1 hold had come on 16 June after the death a patient who it it was later revealed had received the Car-T therapy despite becoming ineligible for it, and having been managed “in a manner that conflicted with the trial protocol”.

At the time Arcellx said it could continue treating patients who had already undergone lymphodepletion, meaning that all 17 patients who had been enrolled but not yet dosed could go on to receive CART-ddBCMA seamlessly. This should raise hope that any delay will be minor, and Arcellx is guiding to preliminary data readout in the second half of 2024.

However, some amendments to Immagine-1 have had to be made. Yesterday Arcellx said the study protocol was changed to allow expanded bridging therapies, which help keep a patient stable between apheresis and Car-T cell infusion, and added that it had retrained clinical sites.

Best in class?

CART-ddBCMA is an autologous Car-T therapy against BCMA – a a hugely competitive space. Arcellx has argued that CART-ddBCMA has best-in-class potential thanks to its use of an artificial, rather than antibody-derived, binding domain, which it claims results in more transduced cells being Car-positive than with J&J’s Carvykti, allowing lower effective cell dosing and less toxicity.

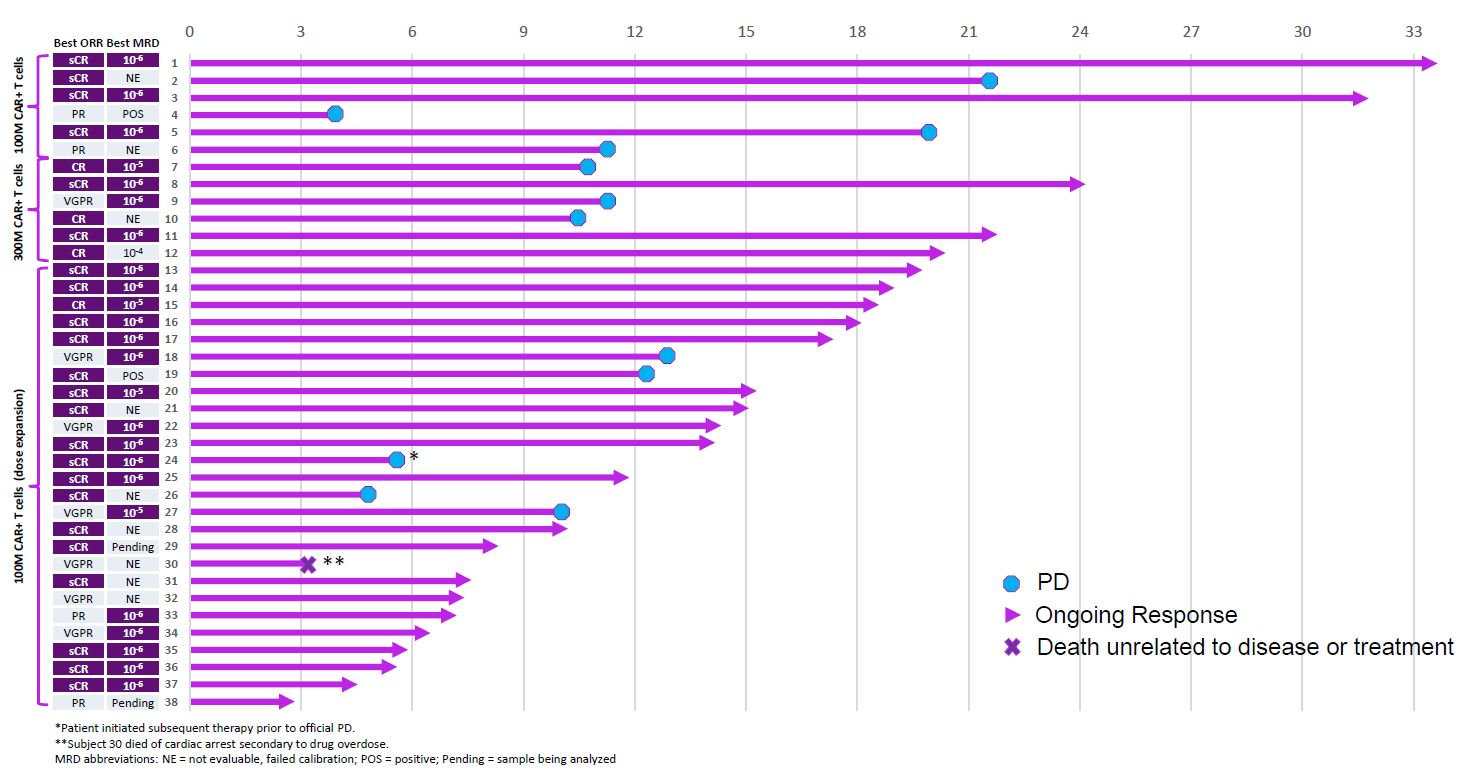

At last year’s ASH conference a phase 1 study of CART-ddBCMA showed impressive initial efficacy, with all 38 multiple myeloma patients treated going into remission. Moreover, manufacturing success rate was 100%, and safety appeared clean: among grade 3 events there was just one cytokine release syndrome and two neurotoxicity cases.

That said, many of the remissions were short-lived. Close inspection of the swimmers plot showed that 12 patients initially responding to CART-ddBCMA relapsed, most by around 12 months, and one patient died from reasons unrelated to disease or treatment. As such, at 18 months the response rate stood at 50% – 11 of 22 patients.

But any initial doubts were swept when Gilead struck its deal, shortly after the ASH data presentation, giving Arcellx $225m in cash and making $100m equity investment for rights to CART-ddBCMA.

Gilead cannot afford many more slip-ups in oncology. Its $21bn acquisition of Immunomedics resulted in the underwhelming breast cancer drug Trodelvy, the $4.9bn buyout of Forty Seven gave it magrolimab, whose pivotal myelodysplastic syndromes study Enhance was last month scrapped for futility, and efforts in TIGIT, through a $725m opt-in with Arcus, are firing blanks.

True, the company has at last started making something out of its $12bn acquisition of Kite Pharma, which gave it a Car-T presence, but Christi Shaw, brought in to oversee that business, resigned unexpectedly in February.

Notably, until the Arcellx deal Gilead had no presence in BCMA, having discontinued the Kite-originated KITE-585 and incurring a resulting $820m write-off. With two approved Car-T therapies, Carvykti and Bristol Myers Squibb’s Abecma, the space has also seen Bristol discontinue orva-cel ($470m write-off).

Beyond Car-T J&J secured US approval for a BCMA-directed T-cell engager, Tecvayli, last October, and only yesterday Pfizer’s competing bispecific elranatamab was greenlit by the FDA as Elrexfio.

400