Sana regains some of its shine

The first case reports with the group’s lead Car-T therapy, plus talk of autoimmune diseases and diabetes, prompt a 39% share price surge.

The first case reports with the group’s lead Car-T therapy, plus talk of autoimmune diseases and diabetes, prompt a 39% share price surge.

After causing a splash as a preclinical-stage company with a $676m Nasdaq float in 2021, Sana Biotechnology now has clinical data to back some of the hype. First case reports with its lead allogeneic Car-T project, SC291, revealed at this week’s JP Morgan healthcare conference, helped send the group’s stock up 39% yesterday.

Part of the hype was down to the fact that Sana is chaired by Hans Bishop, founding chief executive of Juno Therapeutics, and recent market turmoil means that even after the climb Sana today stands 70% below its IPO price. But this still amounts to a $1.4bn market cap, and investors might wonder whether this is commensurate with data from just four patients.

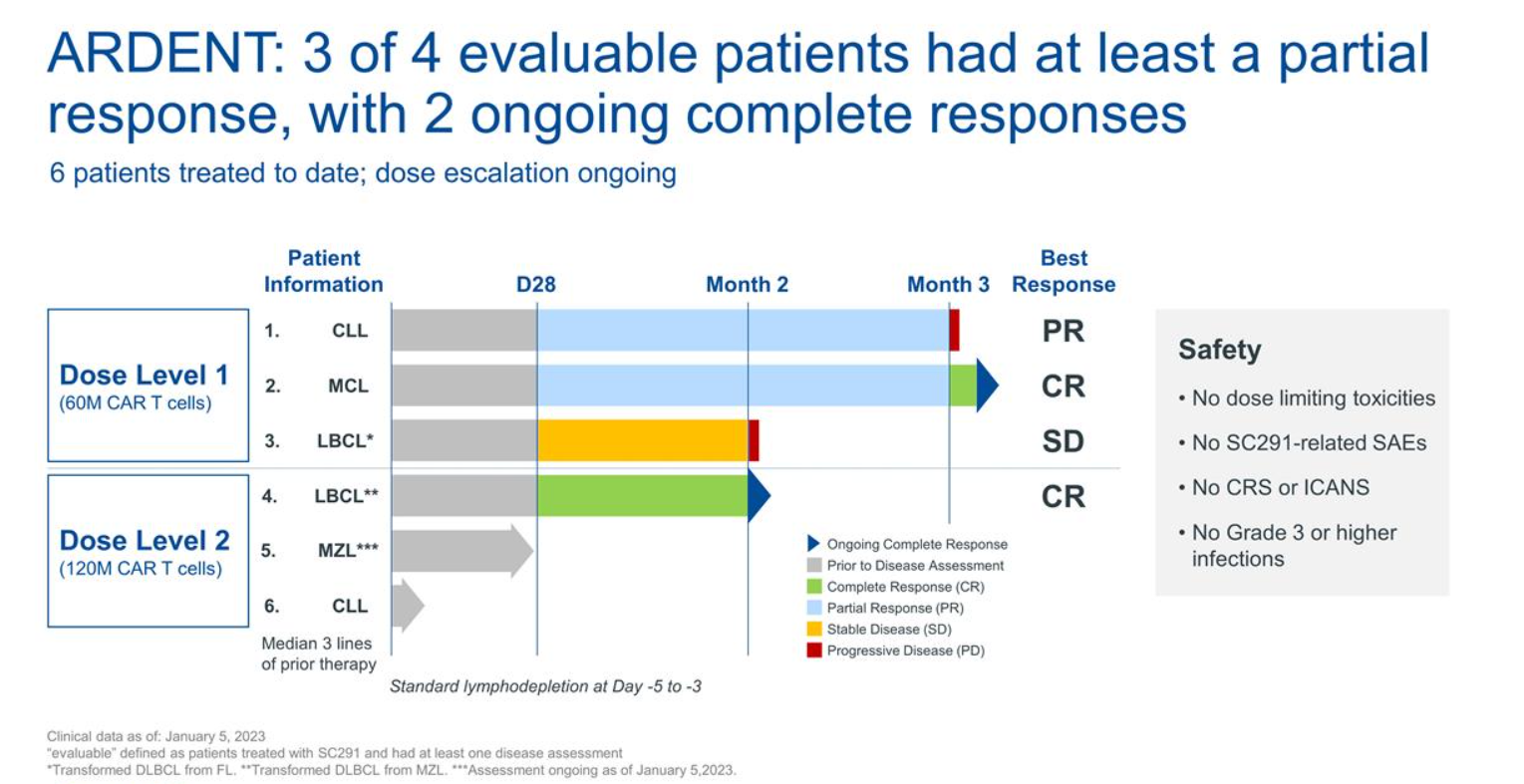

That’s what Sana revealed in its JP Morgan presentation, from the phase 1 Ardent trial of SC291 in patients with B-cell malignancies. Six subjects have received one of the first two doses so far and, while two have yet to undergo assessment, three of the other four yielded responses.

CD47 special sauce

That’s at least some backing for SC291, a healthy donor-derived off-the-shelf project that targets CD19. SC291 can be given allogeneically by virtue of Crispr-Cas12b knock-out of the usual alloreactive elements of a T cell, and it also features overexpressed CD47.

CD47 overexpression is what Sana calls its “special sauce”, and it’s based on the finding that CD47 suppresses the innate immune system. The company’s belief is that other allogeneic projects, which merely knock out MHC I and II and/or disrupt the T-cell receptor, are prone to rejection by the innate immune system, something that could explain the poor response durability that has hit many.

Unfortunately for Sana it’s still far too early to say with any confidence that SC291 won’t suffer the same fate. The SC291 patients haven’t been assessed beyond three months, at which point one of them, a CLL subject with partial response, had already relapsed. Among the three lymphoma patients, one didn’t respond, and two are in complete remission at two and three months.

Of course, this alone won’t account for Sana’s valuation, which will also be down to the promise of its work in autoimmune disease and diabetes, though these projects are still at the preclinical stage.

Sana promises more data from Ardent this year. It also hopes to present the first data from the Vivid study of its second oncology asset, SC262, an allogeneic Car-T therapy against CD22 that is based on work licensed from the NCI three years ago. SC262 uses the same Crispr-Cas12b edits (the editing technology is licensed from Beam Therapeutics) and CD47 upregulation as SC291.

Targeting the CD22 antigen is a strategy aimed at patients who relapse on CD19-directed therapy through antigen loss, and Vivid will initially enrol subjects with relapsed/refractory B-cell malignancies who have received prior anti-CD19 Car-T therapy.

All this work is promising, but the markets won’t forget that it’s only three months since Sana shelved work on in vivo engineered Car-T therapy, one of the main attractions at the time of its IPO. The group still has much to prove.

1668