PD-1 drugs set to have their stomach cancer wings clipped

A US adcom strongly recommends restricting Keytruda, Opdivo and Tevimbra use to PD-L1 expressers.

A US adcom strongly recommends restricting Keytruda, Opdivo and Tevimbra use to PD-L1 expressers.

If the FDA follows Thursday’s advice of its advisory committee two expected US approvals of BeiGene’s Tevimbra plus chemo in first-line stomach cancer will be limited to patients whose tumours express PD-L1 at a level of at least 1%, a fact the company appeared to concede.

It’s a separate question what the regulator will do about corresponding approvals already granted to chemo combos of Keytruda and Opdivo; both carry all-comers labels, but on the adcom’s advice these should similarly be restricted to PD-L1 expressers. The panel also highlighted the disparate state of PD-L1 testing, and the importance of microsatellite status in these patients.

That last point will strike some as unusual. Whether a first-line cancer is MSS (microsatellite stable) or MSI-high has until now been a consideration only in endometrial and colorectal cancers; Keytruda does carry a tumour-agnostic label in MSI-high/dMMR cancers, but that’s only in the second-line setting.

Bringing order to chaos

The adcom, convened, according to an FDA speaker, “to bring order to a confusing situation”, considered the importance of PD-L1 status in two separate first-line settings: gastric/GEJ adenocarcinoma (studies Checkmate-649, Keynote-859 and Rationale-305), and oesophageal squamous cell carcinoma (Checkmate-648, Keynote-590 and Rationale-306).

Only the former considered MSI-high patients, who the FDA said did especially well on checkpoint blockade irrespective of PD-L1 status, and in whom restricting PD-1 drug use wasn’t being proposed. Only 3-5% of patients in the three gastric/GEJ adeno trials were MSI-high, so this is a small market; nevertheless, its relevance might impose an additional diagnostic burden.

On the broader question the panel members were nearly unanimous that a restriction, based on a 1% PD-L1 expression cutoff, should now be imposed. The votes in favour of a benefit in <1% PD-L1 expressers were 2-10 for gastric/GEJ adeno, and 1-11 in oesophageal squamous cell.

The FDA’s position is that PD-L1 expression is an imperfect biomarker, but that it does have predictive value, especially for PD-L1 <1% (“consistent lack of benefit”) and PD-L1 >10% (“clear benefit”). The agency said restricting use to ≥1% expressers would cut the addressable population by 10-20%, though Merck argued that the figure, at least in gastric/GEJ adeno, was “around 25%”.

The three companies each presented their cases to the adcom, and Merck’s was by far the most aggressive. The company argued that Keytruda should retain its all-comers labels in full, claiming that Keynote-859 and 590 both showed “efficacy trends” favouring its drug in PD-L1 non-expressers, and that PD-L1 status alone couldn’t predict who might benefit.

No scientific rigour

Merck hit out at the way the FDA had investigated subgroups at various PD-L1 cutoffs, stating that such post hoc analyses lacked scientific rigour and wouldn’t have met the agency’s own standards for drug labelling.

Meanwhile, Bristol argued that PD-L1 expression was dynamic and heterogeneous, that testing varied in practice, and that some patients had insufficient tumour tissue available for testing; only 60% of oesophageal squamous cell patients are routinely assayed, it said. It urged the panel to give prescribers flexibility, but claimed Opdivo to show a benefit across "all levels of PD-L1 expression" – pointedly conceding the PD-L1 <1% space.

That last point was even more readily conceded by BeiGene, which said that in gastric/GEJ adeno Tevimbra was most favourable at PD-L1 expression of at least 5%, with a “modest but still consistent benefit” at 1-10%. In oesophageal squamous cell the benefit was said to be favourable and clinically meaningful, “except in PD-L1 non-expressers”.

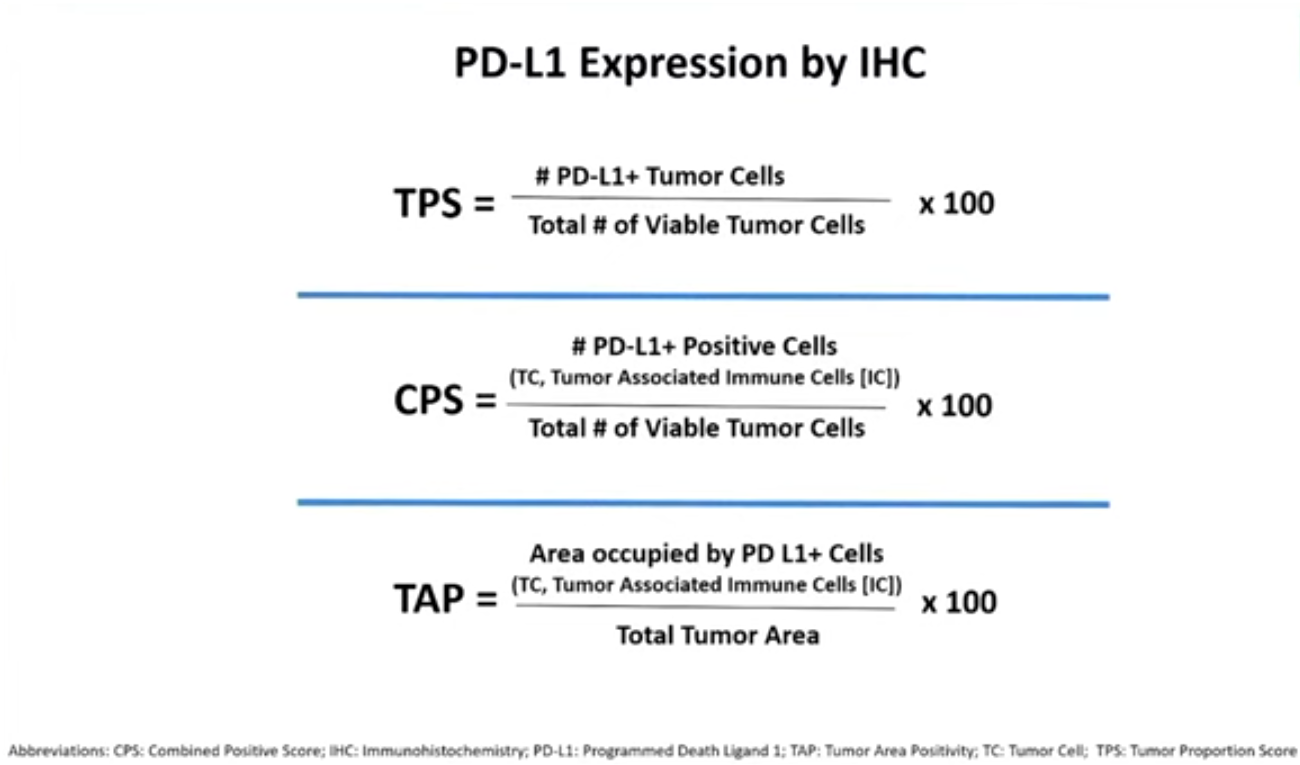

CPS vs TPS vs TAP

In terms of future direction for industry the adcom highlighted the striking disparity in assays used to detect PD-L1 status.

The three companies had apparently each relied on different IHC-based assays in their trials: Merck used Agilent’s combined positive scoring (CPS), Bristol initially relied on tumour proportion score before switching to CPS, and BeiGene used Ventana’s tumour area positivity assay. The first two involve counting cells, while the last is a visual estimation of tumour area.

One message seemed to be that this lack of uniformity was unsustainable, though this wasn’t considered in any voting question. “We fully support efforts towards assay harmonisation across the class,” Mark Lanasa, BeiGene’s chief medical officer for solid tumours, told the adcom.

Tevimbra now faces two regulatory decisions: a missed July PDUFA date in oesophageal squamous cell, and a verdict in gastric/GEJ ademo, which carries a December action date. And, despite Merck’s protestations, the omens for Keytruda and Opdivo’s existing uses aren’t great: Keytruda has already had an all-comers label in HER2-positive gastric/GEJ ademo restricted to PD-L1 expressers.

Source: US FDA.

1980