One ricochet of the ivonescimab bullet

The small cap biotech Instil Bio tries to follow in Summit’s slipstream.

The small cap biotech Instil Bio tries to follow in Summit’s slipstream.

Any doubts about the robustness of the Harmoni-2 trial of Akeso/Summit’s ivonescimab haven’t stopped Summit stock surging 85% since the data were presented on Sunday. There’s been at least one other, somewhat lower-key, beneficiary: Instil Bio, whose shares have more than doubled in the same timeframe, including a 21% climb yesterday.

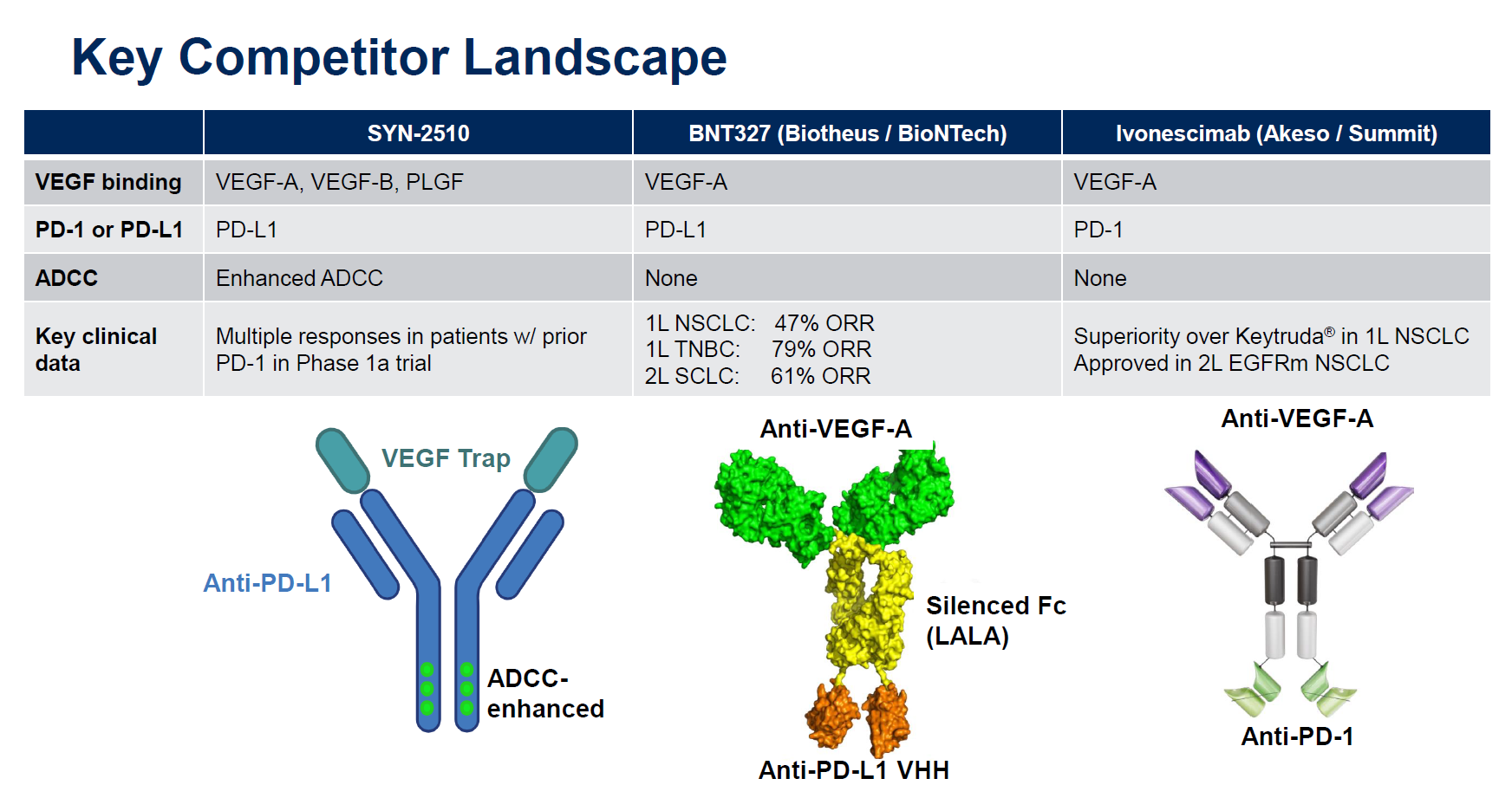

What’s the connection? Ivonescimab is, like Instil’s recently promoted lead project SYN-2510, a bispecific combining PD-(L)1 blockade with anti-VEGF activity, and both molecules were licensed from Chinese companies. Investors who might have missed the latter deal during the summer lull will be pondering the two companies’ valuations: Summit is worth $16bn versus Instil’s $193m.

However, there are important differences between ivonescimab and SYN-2510. The former is a MAb against VEGF-A and PD-1, while the latter is a VEGF “trap” with anti-PD-L1 activity on a different part of the molecule, enhanced for ADCC (antibody-dependent cellular cytotoxicity) activity.

So far SYN-2510 hasn’t produced the type of knockout data that have stoked the enthusiasm of Summit investors. Summit licensed ivonescimab from Akeso for $500m up front, and the cause of the latest market surge is the Harmoni-2 data, presented at World Lung over the weekend, showing – with caveats – a win over Keytruda in terms of PFS in first-line PD-L1 ≥1% NSCLC.

Pivot to ImmuneOnco

For its part Instil licensed SYN-2510 last month for just $50m in “up-front and potential near-term payments” from China’s ImmuneOnco, which originated the molecule under the lab code IMM2510.

The transaction also included ImmuneOnco’s anti-CTLA-4 MAb IMM27M, and was notable not only in mirroring Summit’s focus on combining PD-(L)1 and VEGF blockade, but also for serving as Instil’s pivot away from tumour-infiltrating lymphocytes (TILs).

Instil floated on Nasdaq in 2021 on the back of a pipeline of TIL therapies – hence the company’s name and ticker symbol, “TIL”. However, its stock collapsed when it hit manufacturing problems, which ultimately led to the discontinuation of its lead project, the TIL preparation TIL-168, and the elimination of 60% of the company’s workforce.

As such the ImmuneOnco deal provided what now looks like the perfect pivot. Instil now lists SYN-2510 as its lead, followed by IMM27M/SYN-27M, and Costar-TIL. The last, comprising TILs directed against folate receptor-alpha, appears to be the last remnant of Instil’s past.

Similar but different

Anyone wondering why Instil isn’t enjoying the same market popularity as Summit can look no further than ImmuneOnco’s SYN-2510 presentation at this year’s ASCO, listing just three partial responses among 25 evaluable solid tumour patients.

True, 27% of all subjects had progressed after prior anti-PD-(L)1 therapy, but these early findings are nowhere near the blow ivonescimab delivered head to head against Keytruda in its Chinese study, not to mention the kudos that Summit has with investors by virtue of being led by Bob Duggan, the chief exec who sold his previous company, Pharmacyclics, to AbbVie for $21bn.

And there’s a third key player in the VEGF bispecific game, BioNTech, which has BNT327/PM8002, a project licensed last year from China’s Biotheus for $55m. Like SYN-2510 the Biotheus MAb hits PD-L1, and BioNTech has argued that activity on PD-L1, which is expressed on tumour cells, anchors BNT327 and allows more targeted VEGF blockade than, say, using Avastin.

Only more data will determine whether either the PD-1 or PD-L1 bispecific approach has legs, and if so which one is best, but for now the markets have decided that Summit is the winner.

2885