The pieces of Vor’s puzzle start to come together

The depressed company could use Mylotarg as a stepping stone in AML.

The depressed company could use Mylotarg as a stepping stone in AML.

Vor’s valuation has shrunk by some 95% since the company floated on Nasdaq in 2021, but two key pieces of its plan are now coming together. Last year’s ASH showed the promise of its anti-CD33 Car-T therapy, and last week brought important validation for its “shielded” stem cell transplant source, tremtelectogene empogeditemcel.

Together these developments could help Vor break into acute myelogenous leukaemia. Ironically the stepping stone to this blood cancer is Pfizer’s Mylotarg, an ADC that was first launched in 2000, then pulled from the market, before being relaunched. Vor’s plan could initially give Mylotarg a surprise boost, before the group tries to substitute its own Car-T therapy.

The link here is the CD33 antigen. Mylotarg is an ADC that targets CD33 and is approved for CD33-positive AML, and trem-cel is a preparation of allogeneic stem cells in which CD33 has been edited out. The idea is that an AML patient transplanted with such a CD33-depleted product could be treated with an anti-CD33 therapy, which would have no effect on the graft.

Normally such a procedure wouldn't be considered because a standard graft, whose cells express CD33, would be targeted and destroyed by the anti-CD33 therapy. Mylotarg is indicated for patients who have not received stem cell transplant, and if one is carried out subsequently its label recommends delaying the procedure for at least 90 days after Mylotarg.

New data

Now Vor hopes to turn the paradigm on its head, and yesterday unveiled data from its VBP101 phase 1/2 study in which AML patients are first transplanted with trem-cel before receiving maintenance Mylotarg.

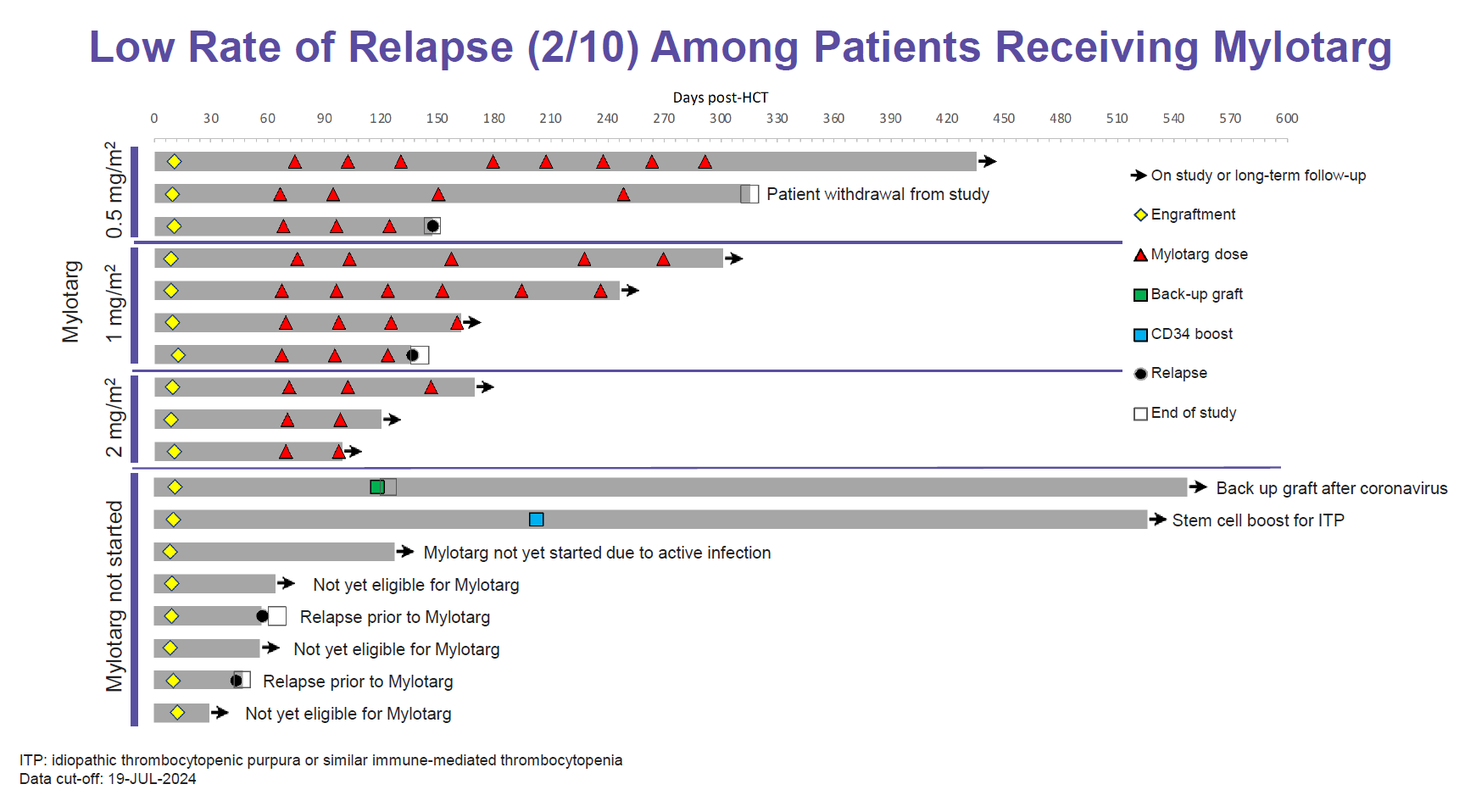

This comprised 18 patients, versus eight at the last update in May. Trem-cel engrafted successfully in all 18, and at a median 169 days’ follow-up there have been just four relapses, two of those in patients not yet given Mylotarg. Among post-Mylotarg patients the longest relapse-free period is ongoing at 430 days after transplant.

This, along with pharmacokinetic data suggesting that trem-cel widens Mylotarg’s therapeutic index, seems impressive, but even more important is Vor’s first release of survival data. These indicate that at the median 5.5-month follow-up period median relapse-free survival has yet to be reached; Vor gave historical controls citing median RFS of 6.2 and 3.8 months for standard allo transplant.

Mylotarg looks like it might give Vor the means of starting a pivotal trem-cel study a year earlier than planned, and the company said it would meet the FDA by the year end to discuss this. Earlier it supposed that it would have to await data from its anti-CD33 Car-T therapy before testing this in phase 3 with trem-cel, but now Mylotarg might do instead.

Any boost to Mylotarg use might be temporary as Vor would seek later to switch out the Pfizer drug in favour of its own Car-T therapy VCAR33ALLO. Presumably such a plan will require a separate pivotal trial of trem-cel plus VCAR33ALLO.

The company yesterday also said the first three patients given the lowest dose of VCAR33ALLO, a transplant donor-derived anti-CD33 Car in the phase 1/2 VBP301 trial, experienced “encouraging” in vivo expansion. At last year’s ASH meeting Vor stock rose on an academic trial of an autologous version of the same Car construct, showing a 40% complete response rate among five AML patients.

Still, Mylotarg’s activity in this setting might dampen enthusiasm for a more complex Car-T therapy, so if a path forward for trem-cel now exists the same can’t yet be said for VCAR33ALLO. Vor’s stock is up 30%, though the company is still worth just $75m.

This story has been updated.

662