CD19 is worth $700m to Merck

Merck turns to China for a molecule against one of biopharma’s most extensively studied antigens.

Merck turns to China for a molecule against one of biopharma’s most extensively studied antigens.

It seems that what Merck & Co really needed, after gaining rights through various licensing deals to projects against targets from ROR1 through Claudin18.2 to B7-H3, was access to one that hits the tried and tested CD19.

Under today’s tie-up with the private Chinese company Curon Biopharmaceutical, Merck has acquired global rights to a CD19-targeting T-cell engager coded CN201. It’s likely that the driver for the deal was phase 1 CN201 data released at ASCO in May, but the big surprise is that CD19 – the target of over 500 industry projects, according to OncologyPipeline – should have attracted a $700m up-front fee from Merck.

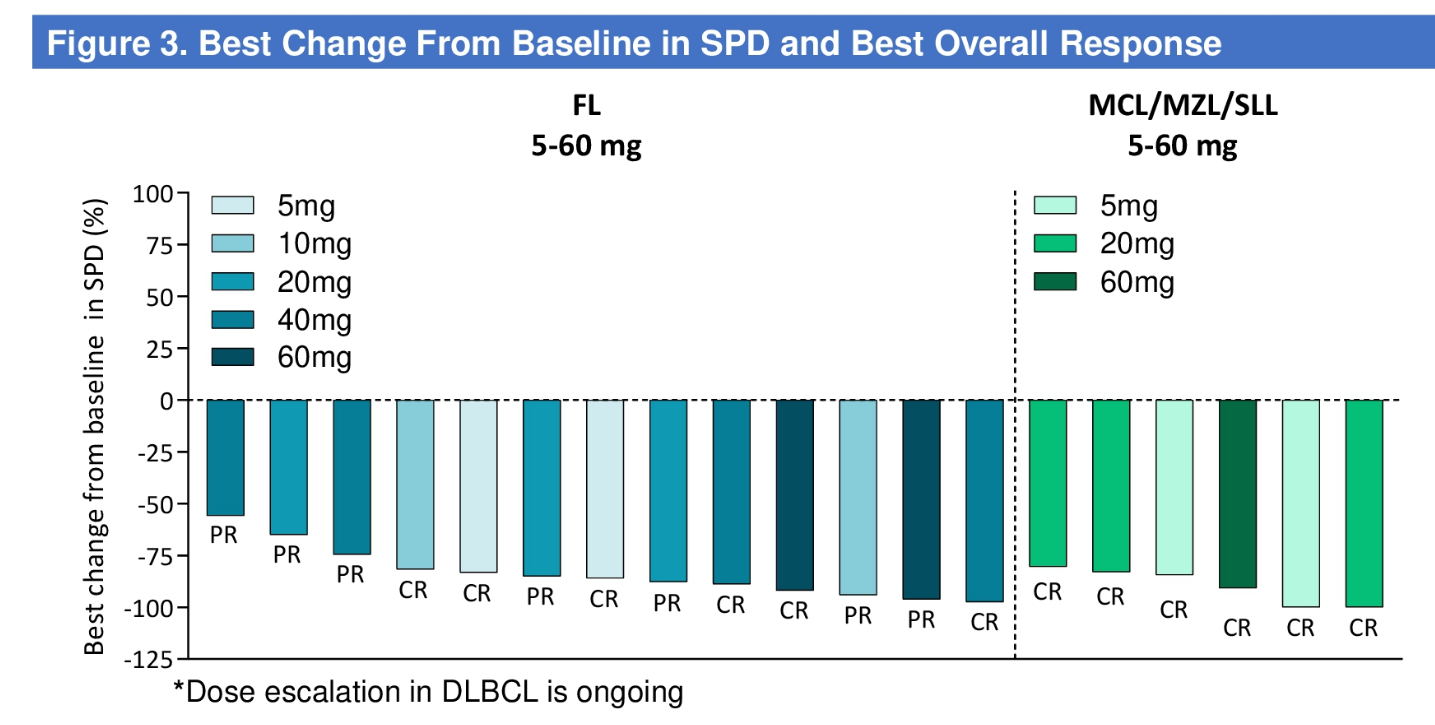

CN201 is in a phase 1 trial in B-cell non-Hodgkin’s lymphoma, and an ASCO poster revealed this to have yielded a 100% ORR among 19 patients with follicular/mantle cell/marginal zone lymphomas given doses above 5mg. However, the trial actually included 59 efficacy-evaluable subjects, 37 of whom got doses above 5mg, but nothing was said about the 18 with more aggressive lymphomas.

Still, perhaps the really attractive feature of CN201 was the low 7% rate of any-grade cytokine release syndrome (none at grade 3 or above), and complete absence of neurotoxicity in a 74-patient safety dataset. Approved anti-CD19 Car-T therapies, and Amgen’s Bite format T-cell engager Blincyto, carry boxed warnings of both toxicities.

CN201 efficacy in indolent lymphomas

Until now Curon was perhaps best known in the west for having licensed China rights to Rhizen Pharmaceuticals’ PI3K delta & gamma inhibitor tenalisib. Curon, which has also been known as Tongrun Biomedicine, raised $150m in a series A round six years ago.

Little is known about the detailed structure of CN201, but the ASCO poster revealed it to use a standard MAb format, binding CD19 with one arm and CD3 with the other. The bispecific was said to have a prolonged half life, “lower affinity” to CD3, and an active Fc domain.

Given such unexpected big pharma interest in the saturated space of CD19, investors might now be wondering what other T-cell engagers are in development that also use this approach. OncologyPipeline reveals several, and Roche is also known to have patented multispecific anti-CD19 immunoglobulins that use this modality.

Notable also is Cullinan’s CLN-978. As Cullinan turned to autoimmune disease it discontinued this project’s development in lymphoma in April – one month before Curon presented its ASCO poster and, presumably, started licensing talks with Merck.

Selected clinical-stage anti-CD19 x CD3 T-cell engagers

| Name | Company | Status |

|---|---|---|

| Blincyto* | Amgen | Approved for CD19+ve B-cell ALL |

| YK012 | Excyte Biotech | Ph2 China trial in ALL |

| AZD0486 | AstraZeneca | Ph1/2 for CD19+ve B-cell ALL |

| GNR-084 | Generium | Ph1/2 for B-cell ALL |

| CN201 | Merck & Co (ex Curon) | Ph1 in B-cell non-Hodgkin’s lymphoma |

| PIT565** | Novartis | Ph1 in B-cell malignancies |

| VNX-101^ | Vironexis | Ph1 for B-cell ALL |

| A-319 | ITabMed | Ph1 in r/r B-cell lymphoma |

| K193 | Beijing Luzhu | Ph1 China trial in indolent lymphoma |

| LNF1904 | Lunan | Ph1 China trial in lymphoma |

| CLN-978 | Cullinan Therapeutics | Ph1 lymphoma development discontinued to focus on autoimmune disease |

Notes: *uses Bite format, a MAb fragment; **also hits CD2; ^generated via AAV gene transfer. Source: OncologyPipeline.

2912