ASCO-GU – Keytruda strengthens its kidney cancer monopoly

Merck adds an overall survival benefit while Bristol sinks further.

Merck adds an overall survival benefit while Bristol sinks further.

Merck & Co has scored a double win over its rival Bristol Myers Squibb in adjuvant treatment of renal cell carcinoma. Not only has Bristol failed to pull a rabbit out of the hat with part B of the Checkmate-914 study, confirming Opdivo to be a bust in this indication, Keytruda’s own US approval looks set to be reinforced with overall survival data from Keynote-564.

ASCO’s Genitourinary Cancers Symposium has just heard late-breaking presentations covering both trials. Coupled with the previously documented failure of Roche’s Tecentriq in the Immotion-010 study, Merck thus seems set to keep its monopoly in the adjuvant setting for a while longer, at a time when Keytruda is separately putting up a strong fight in front-line metastatic disease.

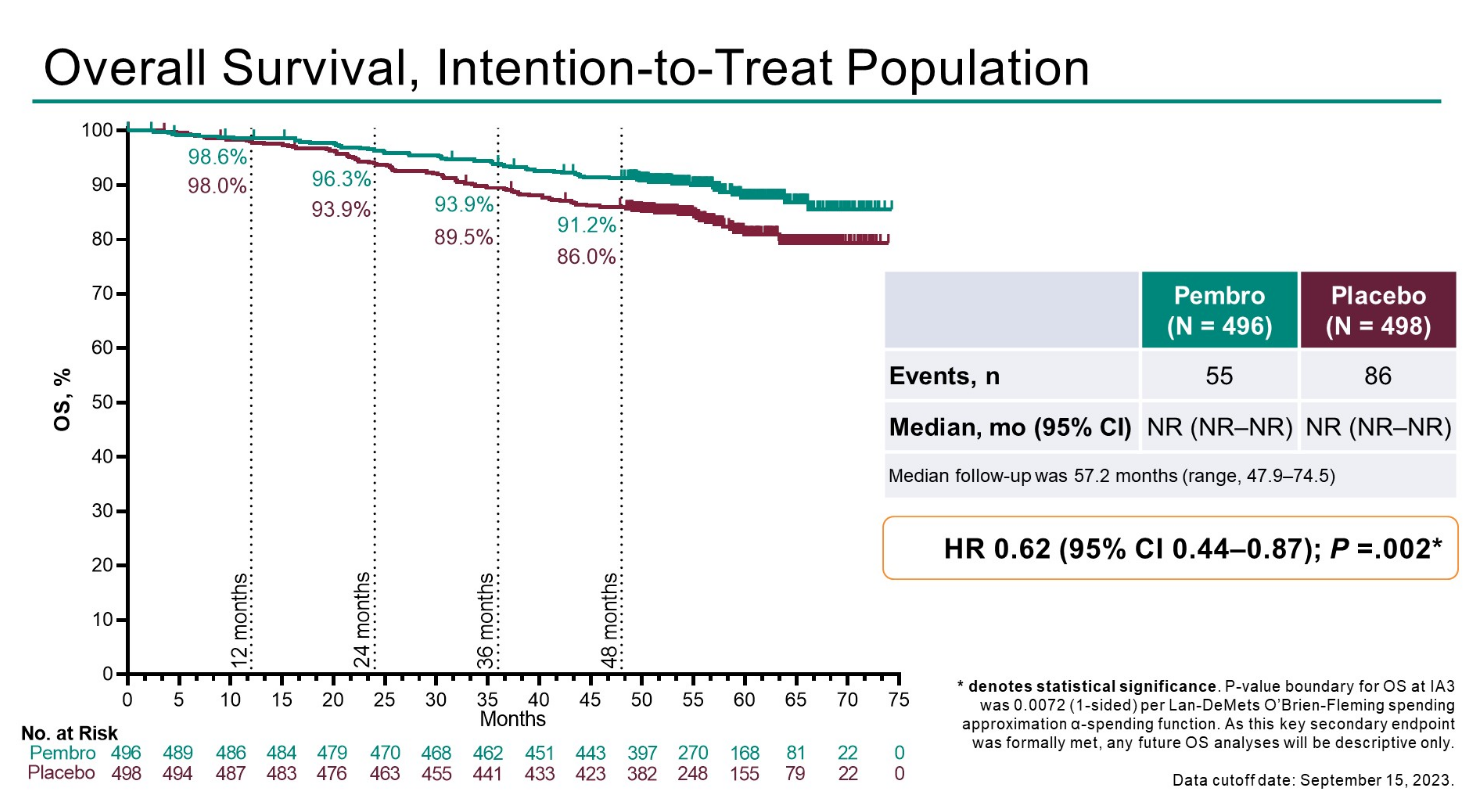

Keytruda secured US approval for adjuvant treatment of renal cell carcinoma in November 2021, on the strength of disease-free survival versus placebo in the Keynote-564 study. ASCO-GU revealed updated overall survival data from this trial, which at median follow-up of 57.2 months showed a 38% reduction in risk of death versus placebo – a benefit described as statistically significant and clinically meaningful.

The presenting author, Dana-Farber’s Dr Toni Choueiri, told ApexOnco that the first randomised trial in adjuvant treatment of kidney cancer was carried out in 1973, since when Keynote-564 remains the only one to show an OS benefit.

Not only that, but Keynote-564 is the only solid tumour study with anti-PD-1 monotherapy in the adjuvant setting to be positive for OS, he said. Strictly speaking, the periadjuvant Keynote-671 trial did show an OS benefit for Keytruda monotherapy in an adjuvant NSCLC setting, but in its neoadjuvant phase it combined Keytruda with chemotherapy.

Those wanting to sound a note of caution will note a slight deterioration in the Keynote-564 dataset. A very early OS analysis from the trial, presented at ASCO in 2021, showed a 46% reduction in risk of death, but that concerned only the first 51 deaths (the event number now stands at 141). Also, the hazard ratio for DFS has worsened slightly from 0.68 on Keytruda’s label to 0.72 as updated at ASCO-GU.

Competing failures

Still, these will likely be seen as minutiae, especially given Keytruda’s approved status and the failure of competitors to make headway in this indication.

At ESMO 2022 Roche and Bristol Myers Squibb slipped up, with the Immotion-010 trial of Tecentriq, and part A of the Checkmate-914 study of Opdivo plus Yervoy, both showing sub-10% numerical improvements in risk of progression or death versus placebo. The highly non-significant p values offered no hope, and Checkmate-914 investigators noted higher discontinuations due to adverse events with Opdivo plus Yervoy than with placebo.

And last October Bristol disclosed that Checkmate-914’s part B, testing Opdivo monotherapy, was also a bust. The company’s ASCO-GU late-breaker has just revealed the DFS numbers here, and a p value of 0.396 for Opdivo versus placebo confirms this failure as being unequivocal.

Cross-trial comparison in adjuvant renal cell carcinoma

| Keytruda | Opdivo + Yervoy | Opdivo | Tecentriq | |

|---|---|---|---|---|

| Trial | Keynote-564 | Checkmate-914 part A | Checkmate-914 part B | Immotion-010 |

| DFS | NR vs NR | NR vs 50.7mth | NR vs NR | 57.2 vs 49.5mth |

| HR=0.72 (0.59, 0.87)* | HR=0.92 (0.71, 1.19), p=0.535 | HR=0.87 (0.62, 1.21), p=0.396 | HR=0.93 (0.75, 1.15), p=0.495 | |

| OS | NR vs NR | Not disclosed | Not disclosed | NR vs NR |

| HR=0.62 (0.44, 0.87), p=0.002 | HR=0.97 (0.67, 1.42) | |||

| Status | US approved Nov 2021 | Study fail | Study fail | Study fail |

Notes: *label cites earlier analysis, giving HR=0.68 and p=0.001; p value not formally tested in subsequent DFS analysis; NR=not reached; HR=hazard ratio (95% confidence intervals in brackets). Source: ASCO & Esmo.

This is an updated version of a story published earlier.

1008