AbbVie banishes the ghost of Stemcentrx

Yet another ADC deal sees AbbVie buy ImmunoGen, ending a 40-year rollercoaster ride with a 100% overnight premium.

Yet another ADC deal sees AbbVie buy ImmunoGen, ending a 40-year rollercoaster ride with a 100% overnight premium.

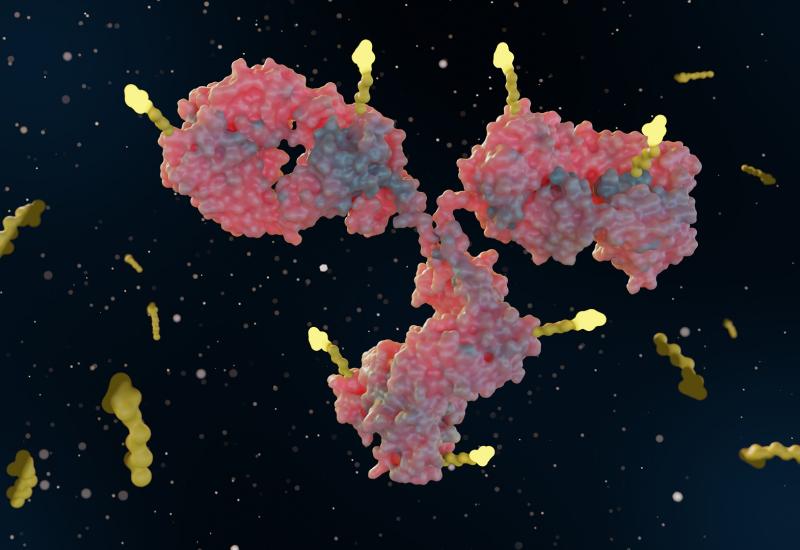

AbbVie has made previous attempts to become a player in antibody-drug conjugates – remember its 2011 tie-up with Seagen and the disastrous $5.8bn takeover of Stemcentrx in 2016 – but today’s $10.1bn takeout of ImmunoGen marks the group’s boldest move into this burgeoning space.

Of course the markets today aren’t what they were a few years ago, so any comparisons between the buyout valuations of ImmunoGen and Stemcentrx have to be made in this context. That said, the Immunogen deal isn’t an opportunistic one: the target company hasn’t traded at the $31.26 per share AbbVie is paying for over 20 years, and ImmunoGen investors have doubled their money overnight.

That ImmunoGen stock was yesterday changing hands at just $16 seems remarkable given that the company had, at long last, made a breakthrough with the US approval of Elahere, an anti-FRα ADC that looks set to transform treatment of ovarian cancer.

Elahere seems to be the key reason why AbbVie has pulled the acquisition trigger. The drug secured accelerated approval for second-line or later FRα-positive ovarian cancer on the back of the Soraya trial, and a knockout result in the Mirasol study in May has put it well on the path to full approval – notwithstanding the ocular toxicity about which its current label warns.

In Mirasol Elahere beat chemo on progression-free as well as overall survival, and with AbbVie behind it the drug looks set to make the most of this advantage. Not only that, but any competing FRα-directed projects, such as Sutro’s luveltamab tazevibulin, which was also to follow an accelerated approval pathway, will have their work cut out.

But AbbVie will also be making a bet on ImmunoGen’s pipeline, which the Elahere success has validated. This primarily comprises an Elahere follow-on, and a separate ADC that targets CD123.

Turnaround

This is quite the turnaround for ImmunoGen, which remarkably has been working on ADCs since it was founded over 40 years ago. But its early attempts to design ADCs were flawed, and success at last with a marketed product – ImmunoGen’s technology lay behind Roche’s Kadcyla, launched in 2013 – proved to be a false dawn as projects against CD19, CD56 and CD37 foundered.

Much subsequent work will have gone into designing a more appropriate linker technology, a problem that most ADC players struggled with until recently. It’s notable that many of the early problems are being ironed out, not only for ImmunoGen but for the rest of the ADC field.

Just how far ADCs have come recently was illustrated by the overwhelming focus of the recent ESMO meeting on this modality, for instance. And multi-billion dollar deals have seen AstraZeneca and Merck & Co tie up with Daiichi Sankyo, Gilead buy Immunomedics for $21bn in 2020 and Pfizer move to take over Seagen for $43bn this year.

AbbVie too saw the potential early, though the failure of Rova-T, an anti-DLL3 ADC, meant that the $5.8bn it had spent on Stemcentrx was money wasted. AbbVie has other irons in the ADC fire, and just yesterday claimed a mid-stage win with the cMet-directed asset telisotuzumab vedotin in second-line non-small cell lung cancer.

There’s nothing wrong with trying again if initial success proves elusive, so AbbVie must now hope that ImmunoGen fares better than Stemcentrx.

AbbVie and ImmunoGen's combined ADC pipeline

| Project | Target (payload) | Source | Key trial |

|---|---|---|---|

| Elahere | FRα (DM4) | ImmunoGen | Mirasol (confirmatory study in FRα-high ovarian cancer) |

| Telisotuzumab vedotin | cMet (auristatin) | AbbVie | Ph3 Telimet NSCLC-01 in 1st-line NSCLC |

| ABBV-400 | cMet (Topo1) | AbbVie (via Seagen deal) | Ph2 in colorectal cancer |

| IMGC936 | ADAM9 (DM21-C) | ImmunoGen | Ph1/2 in solid tumours |

| Pivekimab sunirine | CD123 (DNA alkylator) | ImmunoGen | Ph1/2 Cadenza (blastic plasmacytoid dendritic cell neoplasm) |

| IMGN151 | FRα biparatopic (DM21) | ImmunoGen | Ph1 in ovarian cancer |

| ABBV-319 | CD19 (steroid-based) | AbbVie | Ph1 in lymphoma |

| ABBV-706 | SEZ6 (Topo1) | AbbVie | Ph1 in solid tumours |

| ABBV-637 | EGFR (anti-Bcl-xL) | AbbVie | Ph1 in solid tumours incl NSCLC (Tagrisso combo) |

| ABBV-155 | B7-H3 (anti-Bcl-xL) | AbbVie | Ph1 in solid tumours |

| ABBV-969 | PSMA x Steap1 (unknown) | AbbVie | Preclinical |

2995