ESMO 2023 – GSK sets up Pfizer battle in B7-H4

Early data on Hansoh’s HS-20089 were enough to tempt GSK, but Seagen isn't far behind.

Early data on Hansoh’s HS-20089 were enough to tempt GSK, but Seagen isn't far behind.

The first day of ESMO saw one huge ADC-focused deal – plus another one not so huge. GSK’s licensing of Hansoh Pharma’s B7-H4-targeted asset HS-20089 yesterday might have been overshadowed by Merck & Co’s tie-up with Daiichi Sankyo, but the UK group’s new project had a chance to shine today.

Early data with HS-20089 in late-line triple-negative breast cancer look promising, but the project has a long way to go, and it isn't alone in this niche. Notably Seagen, soon to become part of Pfizer, also has a B7-H4-targeted ADC, which will feature at ESMO on Monday.

TNBC focus

Still, the latest results were clearly enough to tempt GSK, which on Friday licensed HS-20089 outside China for $85m up front, and up to $1.5bn in milestones.

The Chinese phase 1 dose-escalation trial of HS-20089 primarily enrolled breast cancer patients, with a focus on TNBC, but it also included a handful of ovarian and endometrial cancers.

Across the study, subjects were heavily pretreated, with a mean five prior lines of therapy. Patients were not preselected for B7-H4 expression.

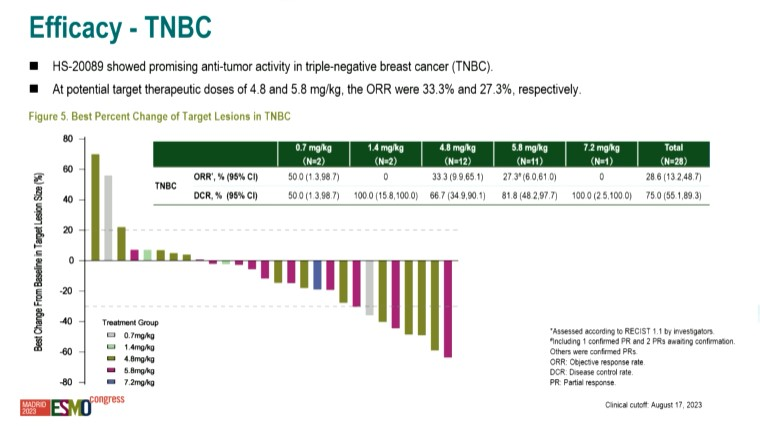

At a cutoff date of 17 August, there was a 29% ORR among 28 evaluable TNBC patients receiving various doses of HS-20089. Focusing on the 4.8mg/kg and 5.8mg/kg doses that are being taken forward, the ORR was 33% in 12 patients and 27% in 11 respectively. This looks to have slipped slightly versus the ESMO abstract, when five partial responses were seen in 12 patients across these two doses.

Data were also presented on a small number of TNBC patients who had previously received PARP or checkpoint inhibitors. Response rates were 75% among four post-PARP patients and 43% among seven post-PD-1 patients. These results will clearly need to be confirmed in more subjects, but suggest a role for HS-20089, and possibly other B7-H4-targeting projects, after these more established therapies.

Another factor to consider is how the TNBC landscape will evolve with the use of Enhertu in HER2-low breast cancer, which could encompass some patients currently categorised as triple negative.

Here, the sequencing of ADCs could become a hot topic, noted the discussant, Dr Giampaolo Bianchini of the Ospedale San Raffaele Cancer Institute, especially given that, like Enertu, HS-20089 uses a topoisomerase inhibitor as a payload. However, the exact payload of HS-20089 is unknown. It is also currently unclear what drives resistance to ADCs – payload, target or linker – and this will need to be elucidated.

Ovarian promise

An intriguing finding in phase 1 was a 67% ORR among three ovarian cancer patients, but the numbers here are too small to draw any firm conclusions.

As for safety, the presenter, Professor Jian Zhang of the Fudan University Shanghai Cancer Center, noted two dose-limiting toxicities with 7.2mg/kg, after which the 5.8mg/kg was deemed the maximum tolerated dose.

He said that at the go-forward doses toxicity was manageable, adding that there were no adverse events leading to death. Side effects were mostly haematologic, including white blood cell count decreases and anaemia.

GSK plans to begin phase 1 studies of HS-20089 outside China in 2024. Hansoh has already started a phase 2 Chinese trial in ovarian and endometrial cancers, which is yet to start recruiting.

There are not too many other groups looking at B7-H4-targeted ADCs, an analysis of OncologyPipeline shows. As well as Seagen’s contender, Mersana and AstraZeneca both have projects that are further behind.

GSK’s recent efforts to become an oncology player have not met with much success. The group will hope that this time it has selected a better target.

B7-H4 ADCs in clinical development

| Project | Company | Payload | DAR | Status | Note |

|---|---|---|---|---|---|

| HS-20089 | GSK (via Hansoh Pharma) | Topoisomerase inhibitor | 6 | Ph1 China study in solid tumours | ESMO 2023: 29% ORR across TNBC pts; 27-33% ORR at target doses |

| SGN-B7H4V | Seagen (Pfizer) | Monomethyl auristatin E | 4 | Ph1 in solid tumours | ESMO 2023 abstract: responses in breast (7/25), ovarian (2/15), endometrial (1/16) & biliary tract (2/9) cancers; full data on Monday |

| XMT-1660 | Mersana Therapeutics | Auristatin hydroxypropylamide | 6 | Ph1 in solid tumours | Dose escalation to complete 2023; dose expansion to begin 2024 |

| Puxitatug samrotecan (AZD8205) | AstraZeneca | Topoisomerase inhibitor | 8 | Ph1/2 in solid tumours | Data expected >2024 |

Source: OncologyPipeline.

4343