ESMO 2023 – Amgen’s Steap1 project spurs cautious optimism

But toxicity will be closely watched in future trials.

But toxicity will be closely watched in future trials.

Amgen is one of very few companies targeting Steap1, and is taking heart from early clinical data presented on xaluritamig (AMG 509) at ESMO on Friday, showing clinical responses with this bispecific T-cell engager in metastatic castration-resistant prostate cancer.

While the ESMO discussant, Professor Shahneen Sandhu of the Peter MacCallum Centre in Australia, described the efficacy data as “promising”, toxicity was relatively high, and “cautious optimism” is needed, she said. The question of tox is particularly relevant here, as Roche previously couldn't find a therapeutic window for its Steap1-targeting asset vandortuzumab vedotin.

Amgen reckons it has found a way forward, though. The phase 1 xaluritamig study, which enrolled patients who had already received a median of four prior therapies, tested various dosing regimens. Four of these were deemed not tolerable, but the group thinks it has identified the maximum tolerated dose, which involves a three-step titration to a 1.5mg weekly schedule.

Steap adverse event rates

Therefore, while the rate of grade 3 or higher treatment-related adverse events and treatment-related discontinuations – at 74% and 19% respectively – might look steep, these numbers included the non-tolerable cohorts, Dr William Kelly of the Sidney Kimmel Cancer Center noted when presenting the data.

When asked, he did not break out the adverse event rate in the MTD group, but said the major toxicities in this cohort were cytokine release syndrome, fatigue and muscle pain, as well as some grade 3 anaemia – similar to what was seen across cohorts.

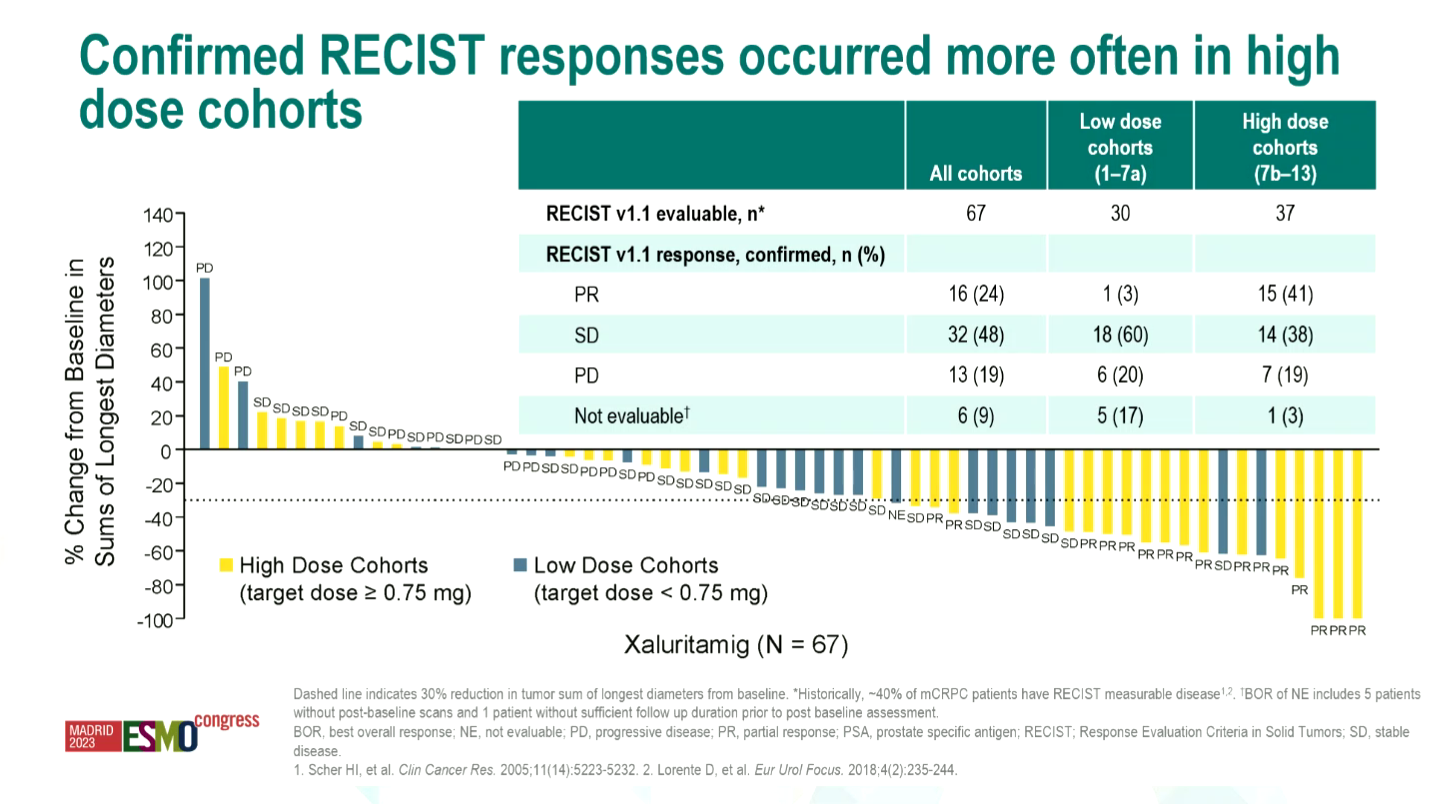

Overall there was a 24% overall response rate among the 67 evaluable patients across the study. Looking only at “high-dose” cohorts, defined as a target dose of 0.75mg or more, ORR rose to 41%. Meanwhile, five patients received the MTD: all five had PSA50 responses, and all four RECIST-evaluable subjects yielded RECIST responses.

PSA50 responses are defined as ≥50% PSA declines, and Kelly said these were seen overall in 43 of 87 evaluable patients; last year, this benchmark was hit in 14 of 30 patients.

Dose expansion and “optimisation” is ongoing, and it will be interesting to see how the chosen dose fares on the risk/benefit equation.

Little competition

Xaluritamig seems to be the only surviving active survivor of a 2015 collaboration between Amgen and Xencor to develop T-cell engaging MAbs, the lead of which, an anti-CD38 project for multiple myeloma, Amgen gave up on three years ago.

As for competing projects, the Nasdaq-listed, UK-headquartered Vaccitech is developing VTP-800 and VTP-850, which are prime-boost immunotherapies in clinical trials for prostate cancer. However, these trigger immune responses against PSA, PAP and 5T4 as well as Steap1; a phase 1/2 trial of VTP-800 combined with Opdivo saw PSA50 responses in five of 23 mCRPC patients.

The only other Steap1-targeting project to have made it into clinical studies, according to OncologyPipeline, appears to have been Roche’s vandortuzumab vedotin, an antibody-drug conjugate. However, after completing its phase 1 trial in 2016 Roche discontinued development.

It seems that finding a therapeutic window proved the undoing of vandortuzumab. Data presented at ASCO in 2014 led to the selection for phase 2 of a 2.4mg/kg dose, which had shown PSA50 responses in three of 21 patients; however, updated results later showed dose-limiting grade 3 transaminitis, as well as grade 3 hyperglycaemia and grade 4 hypophosphataemia.

Amgen still has a long way to go with xaluritamig, but it will hope to find the right balance where Roche couldn't.

2281