After failing to get Seagen Merck turns to Daiichi

In paying $5.5bn for immediate rights to three Daiichi Sankyo assets Merck & Co has made its biggest bet on ADCs to date.

In paying $5.5bn for immediate rights to three Daiichi Sankyo assets Merck & Co has made its biggest bet on ADCs to date.

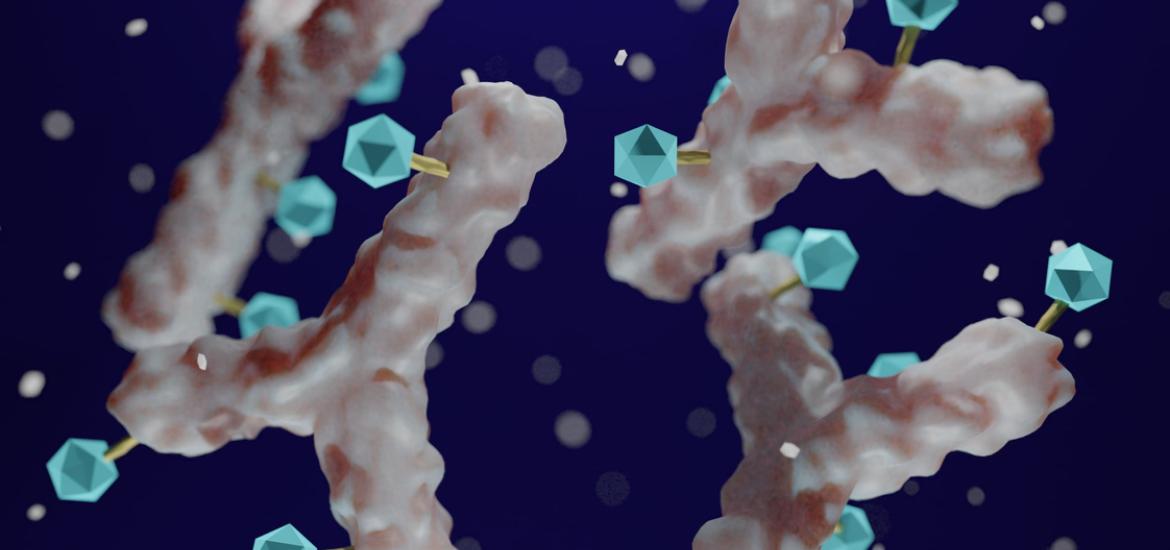

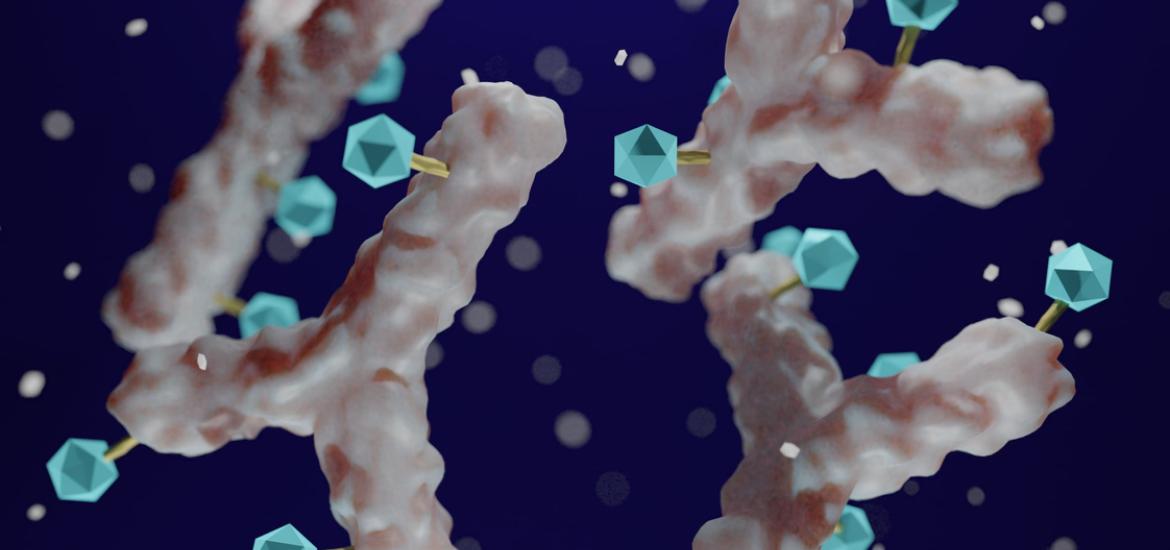

It seems Merck & Co liked what it saw with Kelun’s antibody-drug conjugates, but for its big bet on this modality it’s turned to Daiichi Sankyo. Merck picking up three Daiichi ADCs for $5.5bn up front last night represents one of the biggest ever licensing deals in biopharma.

For Daiichi, therefore, ADCs continue to deliver. The Japanese group’s first two shots, Enhertu and datopotamab deruxtecan, drew respective $1.4bn and $1bn up-fronts from AstraZeneca, and the three follow-on ADCs Merck has licensed use the same technology. It’s worth remembering that Merck wanted to buy Seagen for around $40bn but was outbid by Pfizer, so clearly it’s serious about ADCs.

Merck’s deal spells out separate terms relating to the three Daiichi ADCs to which it's picking up global ex-Japan rights: patritumab deruxtecan, targeting HER3, raludotatug deruxtecan (CDH6) and ifinatamab deruxtecan (B7-H3).

The immediate up-fronts are $750m, $750m and $1.5bn respectively, followed by a further $750m in 12 months for patritumab and $750m in 24 months for raludotatug. Merck can opt not to pay out this additional $1.5bn, but since the amount appears not to be tied into any specific future milestone it’s probably acceptable to include it in the total up-front deal valuation.

The most relevant downstream value, meanwhile, is captured largely as a commitment by Merck to fund R&D. This amounts to the company contributing $500m each to the development of patritumab and ifinatamab, and these amounts are also payable immediately, so technically can also be considered up front. There is also a separate Merck commitment to finance $1.5bn of the first $2bn of raludotatug’s development.

Rich pickings: Daiichi’s key ADCs

| Project | Target | DAR | Key studies/tumours | Deal terms |

|---|---|---|---|---|

| Enhertu | HER2 | 8 | Approved for HER2+ve breast, NSCLC & gastric cancers, & HER2-low breast cancer | Astra paid $1.35bn up front, $3.8bn due in regulatory and other milestones |

| Datopotamab deruxtecan (DS-1062) | TROP2 | 4 | Tropion-Lung01 & Tropion-Breast01 data at ESMO 2023 | Astra paid $1bn up front, $1bn due in regulatory approval milestones |

| Patritumab deruxtecan (U3-1402) | HER3 | 8 | Herthena-Lung01 in post-Tagrisso+chemo EGFRm NSCLC | Merck paid $1.5bn up front ($750m of which is subject to decision in 12mths), plus $500m immediate R&D cost |

| Raludotatug deruxtecan (DS-6000) | CDH6 | 8 | Ph1 in renal & ovarian cancers | Merck paid $1.5bn up front ($750m of which is subject to decision in 24mths) |

| Ifinatamab deruxtecan (DS-7300) | B7-H3 | 4 | Ideate-01 trial in SCLC | Merck paid $1.5bn up front, plus $500m immediate R&D cost |

| DS‐3939 | TA-MUC1 | ? | Just started ph1/2 in solid tumours | Wholly owned by Daiichi, uses gatipotuzumab MAb licensed from Glycotope |

| DS-9606 | Claudin6 | ? | Ph1 in solid tumours | Wholly owned by Daiichi, described as a 2nd-gen ADC |

Note: DAR = drug to antibody ratio; all use a deruxtecan payload and cleavable linker, except DS-9606 (undisclosed properties). Source: company statements & OncologyPipeline.

This is a considerably larger bet than Astra had made on Enhertu, though the potential of Daiichi’s ADC technology is now much clearer than when Astra was doing that deal over four years ago. Indeed, the UK company had been criticised for shelling out so much, but with time that cash looks to have been a wise gamble.

Mizuho analysts wrote last night that any weakness in Merck’s shares today would likely be down to investor concerns that the company was overpaying. However, patritumab’s 2025 approval and gaining of a solid footing in post-TKI EGFR-mutated NSCLC would mitigate near-term dilution, they added.

Targeting ADC

It’s clear that this is just the latest attempt by Merck to break intro ADCs. Last year the group had apparently put up around $43bn to buy Seagen, but that approach was rejected. Later, with Seagen’s stock falling, Merck was still valuing the business at about $39bn, but in the event Seagen fell this year to Pfizer, for $43bn.

In 2020 Merck had given Seagen, then known as Seattle Genetics, $600m plus a $1bn equity investment in a deal that included rights to the anti-LIV-1 ADC ladiratuzumab vedotin. Two months later it bought VelosBio for $2.75bn; that company was developing the ROR1-directed ADC zilovertamab vedotin.

In May 2022 Merck paid Kelun $47m for undisclosed ADC projects later revealed to include the TROP2-directed sacituzumab tirumotecan, following that last December with $175m for a further seven preclinical molecules. One relevant question therefore is where the Daiichi deal leaves Kelun, though with the targets behind most of Kelun/Merck deal undisclosed it’s hard at present to gauge any threat.

Sacituzumab tirumotecan is clearly intended as Merck’s answer to Daiichi/Astra datopotamab, and early evidence is already emerging at ESMO this weekend that through Kelun Merck has found an ADC that’s at least as good. The other relevant TROP2 ADC is the underwhelming Trodelvy, which Gilead got through the $21bn acquisition of Immunomedics.

Yesterday’s deal puts extra focus on upcoming ESMO data on raludotatug, with an abstract showing a 38% confirmed ORR in ovarian cancer, an 8mg/kg maximum tolerated dose and 14% rate of treatment-related discontinuation.

Meanwhile, at World Lung in September Daiichi had presented data on patritumab and ifinatamab. The former’s Herthena-Lung01 trial showed 30% ORR and 11.9 months of median overall survival in EGFR-mutated NSCLC patients who had failed Tagrisso and chemo, with one treatment-related death. Patritumab is slated for a US filing in the first quarter of next year.

For ifinatamab early data in SCLC showed a 52% confirmed ORR and 9.9 months of median OS. This seemed highly promising given the struggles Y-Mabs and Macrogenics have had developing B7-H3-targeting agents, though these companies’ respective omburtamab and enoblituzumab don’t use the ADC modality.

All these data underline the promise of Daiichi’s entire deruxtecan-based ADC platform. Merck has made no secret of taking seriously the looming loss of Keytruda’s patent, and clearly wants ADCs to make up a big chunk of the shortfall.

3604