Triple meeting 2023 – Relay shifts to a tumour-agnostic plan

The company’s FGFR2 inhibitor shows potential beyond cholangiocarcinoma, but the markets aren’t buying it.

The company’s FGFR2 inhibitor shows potential beyond cholangiocarcinoma, but the markets aren’t buying it.

Relay Therapeutics has followed impressive initial data on its FGFR2 inhibitor lirafugratinib presented at last year’s ESMO congress with an update at the Triple meeting suggesting that the agent might have potential in a tumour-agnostic setting, dependent only on cancers’ mutation status.

Nevertheless, the markets seemed unconvinced, and Relay stock opened down 4% today, after falling 11% yesterday – a day during which the S&P Biotech index lost 4%. Perhaps what spooked investors was Relay’s move to conserve cash and scrap a separate CDK2 inhibitor, not to mention lingering worries over its lead, the mutant PI3Kα-selective agent RLY-2608.

Whatever the concerns, lirafugratinib can now be seen as having potential beyond cholangiocarcinoma, the natural setting for FGFR inhibitors like Incyte’s Pemazyre and Otsuka’s Lytgobi. At last year’s ESMO lirafugratinib boasted an 88% ORR at its recommended dose in cholangiocarcinoma, efficacy said to be double that of pan-FGFR inhibitors.

Cholangio pause

However, having earlier completed enrolment into a pivotal cohort in cholangiocarcinoma, Relay yesterday decided to suspend “near-term commercial readiness activities” in this cancer type, and switch instead to a broad, tumour-agnostic approach.

This will apparently have three focal points: patients with FGFR2 fusions, those with FGFR2 amplification, and those with other FGFR2 mutations, in which ER-positive/HER2-negative breast cancer has yielded what Relay described as a strong signal.

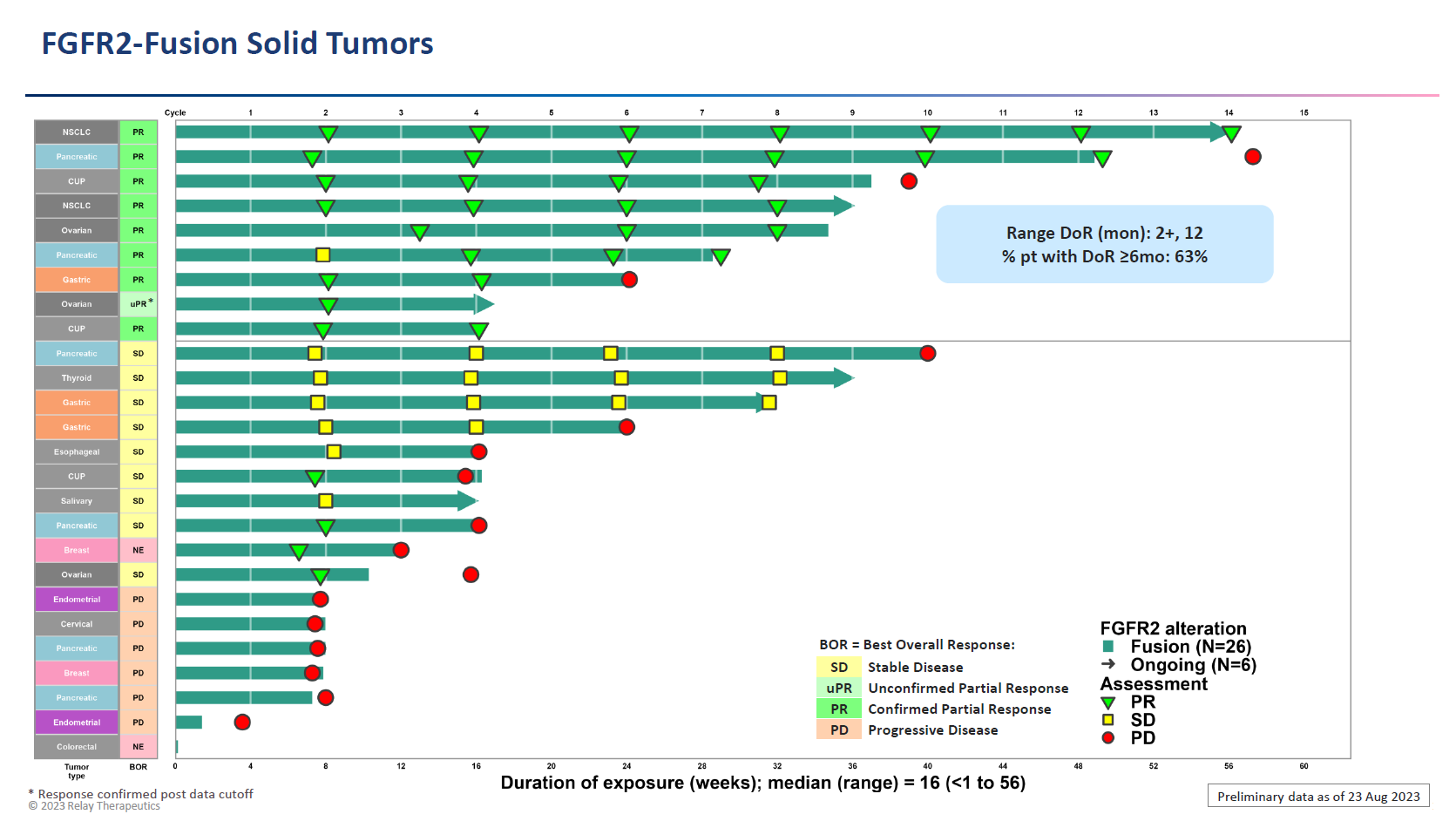

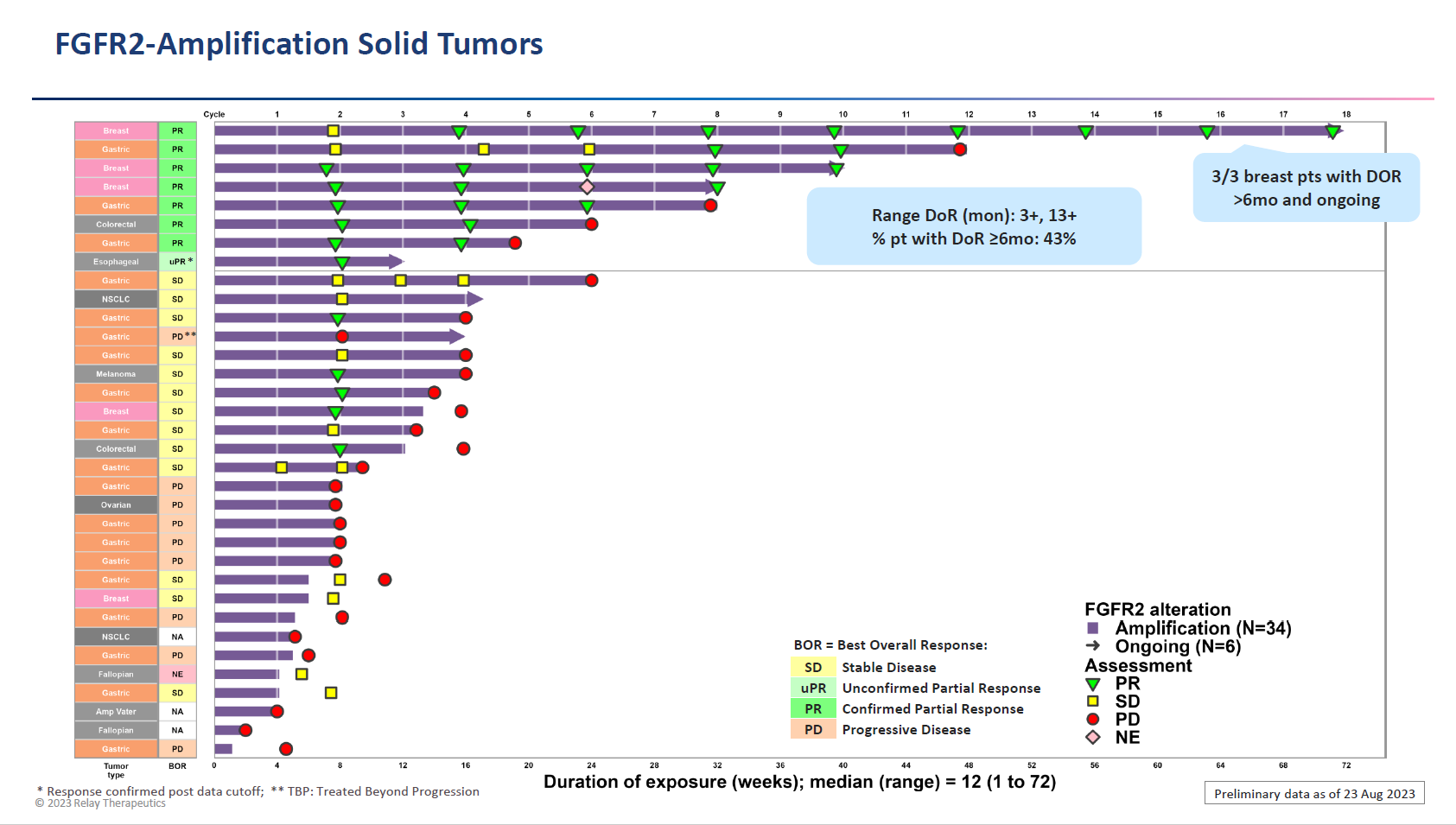

After market close yesterday the company presented at the Triple (AACR-NCI-EORTC) meeting, with results from 26 FGFR2 fusion patients showing a 35% ORR across various cancers. Meanwhile, in FGFR2 amplification (34 patients in total) the ORR was 24%, and here efficacy was said to be driven by key tumour types, in particular breast and colorectal.

Zeroing in on breast cancer, Relay cited long-term responses in 10 heavily pretreated patients. These amounted to four remissions, one ongoing at 18 months and two at 10 and eight months, while the fourth, a subject with a non-fusion/amplification FGFR2 mutation, relapsed at one year.

Pemazyre and Lytgobi are approved for cholangiocarcinoma, while Johnson & Johnson’s FGFR inhibitor Balversa has a urothelial carcinoma label, but all are associated with high levels of toxicity, specifically diarrhoea and hyperphosphotaemia.

Relay claims that such adverse events are associated with molecules that hit the 1 and 4 receptor subtypes. In contrast, lirafugratinib has managed to avoid them, possibly thanks to its FGFR2-selective design, though the Triple data showed 11% and 7% respective rates of grade 3 stomatitis and palmar‐plantar erythrodysesthesia.

Cash conservation

At ESMO 2022 Relay’s cholangiocarcinoma data were impressive enough to fuel a $300m equity raise; clearly nothing like this is possible in the current market, and perhaps as a result Relay has moved into cash-conservation mode.

The company said it was canning the CDK2 inhibitor RLY-2139, as well as an ERα degrader programme, moves that along with suspending its chalongiocarcinoma-specific lirafugratinib plan would enable current cash of $872m to last into the second half of 2026. After yesterday’s fall Relay is capitalised at just under $1bn, showing either zero confidence in the new strategy or assuming further punitive dilution.

Still fresh in the memory will be April’s AACR data on lead asset Relay’s RLY-2608, which was seen to be doing precisely what it was supposed to mechanistically, while showing no meaningful efficacy. RLY-2608 is designed to inhibit only mutated PI3Kα, something backed by the AACR presentation, in which there was just one unconfirmed partial response across 27 subjects with PIK3CA-mutant breast cancer, and no responses in a further 15 subjects with other tumour types.

However, developing RLY-2608 remains a key focus for Relay, both as monotherapy and in combinations with endocrine therapy and CDK4/6 blockade. Perhaps lirafugratinib will in time provide a handy pivot, though for now neither dataset is cutting much ice.

This story has been amended to correct Relay's share price movements.

1423