More doubts swirl around Lumakras

With sales of the Amgen KRAS inhibitor flatlining an advisory panel is called to discuss its continued US approval.

With sales of the Amgen KRAS inhibitor flatlining an advisory panel is called to discuss its continued US approval.

It’s not unheard of for US adcoms to be called to discuss confirmatory trials of drugs available under accelerated approval – think dangling PD-(L)1s, or the PI3K inhibitors in the past two years alone. Still, the one revealed yesterday to discuss full approval of Amgen’s Lumakras raises key questions.

Most importantly, what is its purpose, and what’s at stake? Lumakras has been available under accelerated approval since May 2021, becoming the first KRAS G12C inhibitor to hit the market. However, despite the fanfare its sales have flatlined, and its confirmatory trial, unveiled at last year’s ESMO meeting, raised questions about efficacy and concerns over liver toxicity.

The formally announced reason for the 5 October adcom is to discuss Lumakras’s full approval filing for second-line, KRAS G12C-mutated NSCLC, as backed by the confirmatory Codebreak-200 trial.

Convertible?

Lumakras’s accelerated approval is based on Codebreak-100, a single-cohort study in which the drug yielded a 36% ORR. But Codebreak-200 is vital given the FDA’s calls on companies to get accelerated approvals converted expeditiously, and its outcome was disappointing.

In a late-breaker at last year’s ESMO Codebreak-200 met its primary PFS endpoint, beating docetaxel by just over a month at median, with a 0.66 hazard ratio (p=0.002). However, the emergence of liver toxicity was alarming, with six patients quitting treatment because of grade 3 or higher ALT elevation, and another two discontinuing owing to drug-induced liver injury, though there were apparently no cases of Hy’s law.

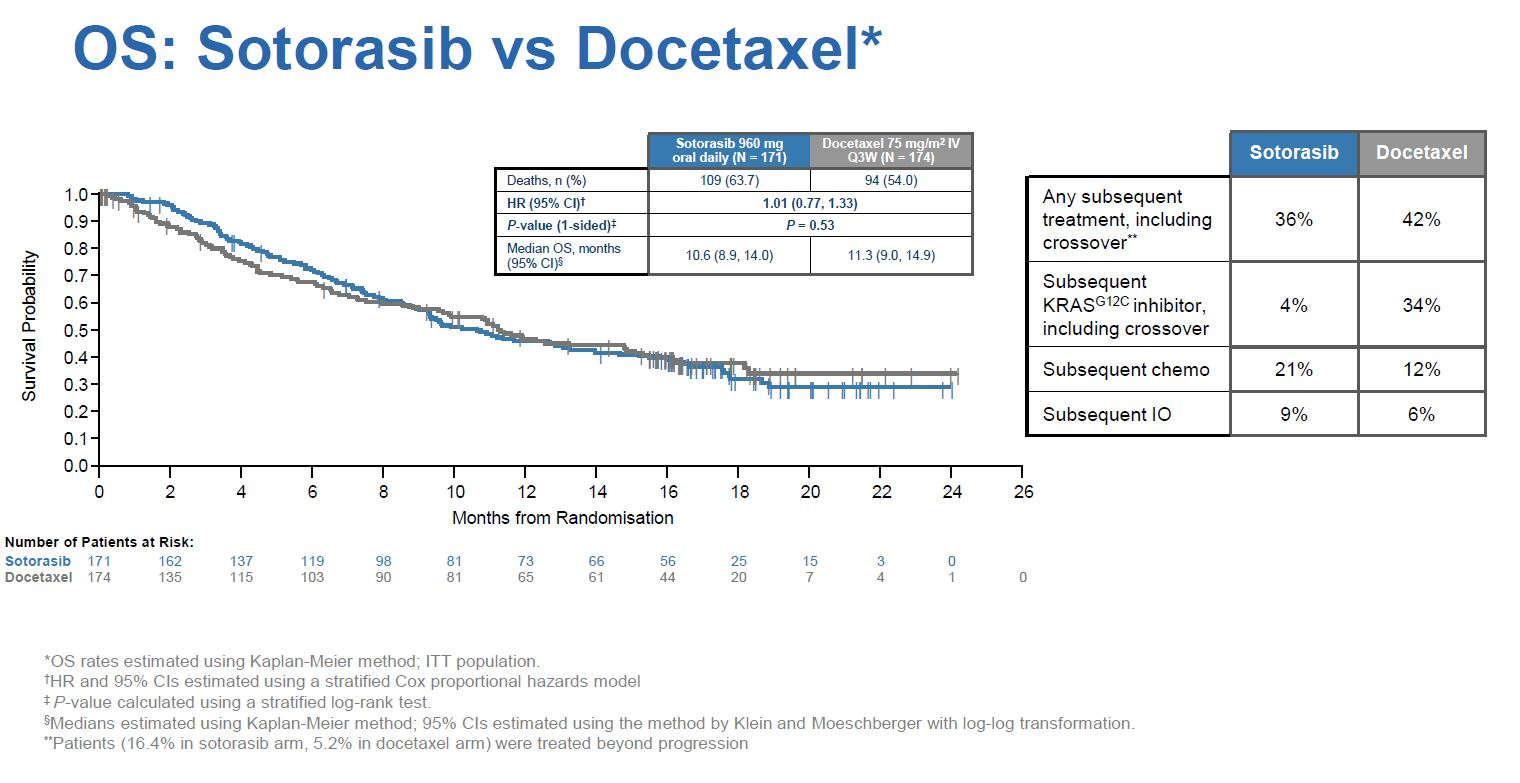

Not only was the median PFS benefit somewhat underwhelming, Codebreak-200 showed no effect on its key secondary overall survival endpoint, with a hazard ratio just above 1.00 across the entire study.

One possibility, therefore, is that the FDA is unconvinced by these confirmatory data, and wants advice on whether to rescind Lumakras’s approval – a worst-case scenario for Amgen.

Still, there are a few caveats. Patient crossover – 34% of control cohort patients switched to a KRAS G12C inhibitor after progressing on docetaxel – will likely have confounded the OS analysis, for instance. And Codebreak-200 suffered from underpowering: it was originally to enrol 650 patients, but an FDA-requested February 2021 protocol amendment halved the targeted recruitment.

There is a social dimension too, in that Lumakras costs about $18,000 a month, versus about $2,000 for docetaxel. Without a clear survival benefit this looks unsustainable, though of course cost lies outside the FDA’s remit.

The right dose

And there is a more subtle consideration, for the basis of which you need to go back to April 2021.

Back then, with Lumakras’s ultimately approved 960mg dose still under review, the FDA surprisingly called for Amgen to see how a lower, 240mg dose compared against 960mg. The subsequent emergence of liver toxicity hints at why the company was asked to do this, and the results of the comparison trial were submitted to the agency along with the full Codebreak-200 data.

If the right dose of Lumakras is the issue then all rests on what the comparison showed. That has not publicly been disclosed, but for a hint check out the separate Codebreak-300 trial in colorectal cancer, which tested 960mg as well as 240mg doses of Lumakras (plus Vectibix), and where both doses were said to have shown a PFS benefit.

Perhaps, therefore, the FDA might not want to convert the 960mg dose into a full approval, but will instead call on Amgen to conduct a confirmatory trial looking specifically at 240mg. More clarity will come a day or two before the adcom, when the FDA will publish briefing documents, but until then Lumakras’s US approvability will hang in the balance.

686