Lyell takes on J&J and Gilead

The players are vying in the CD19 x CD20 Car-T arena.

The players are vying in the CD19 x CD20 Car-T arena.

Various companies are trying to improve Car-T efficacy by targeting both CD19 and CD20, and on Tuesday Lyell strengthened its bid here with updated results from a phase 1/2 trial of LYL314 in relapsed/refractory aggressive large B-cell lymphoma.

The data look in line with those reported recently by Johnson & Johnson and Gilead with similarly acting projects, in a similar Car-T-naive setting, with the caveat of cross-trial comparisons. But Lyell reckons it’ll be able to compete with these bigger rivals, and has already sped into a pivotal study, Pinacle, in third-line disease.

Still, investors seemed cool on the data, with Lyell's stock closing down 5% on Tuesday. One problem might be that LYL314's activity isn't meaningfully different from the competitors, though if the logic behind bispecifics plays out – that these could delay time to relapse by CD19 antigen escape – then the proof will lie in response durability.

Pinacle is in fact an extension of the phase 1/2 study, and will be uncontrolled, but Lyell believes that this will be enough to gain FDA approval. When asked about the hurdle LYL314 will have to clear, the company’s chief executive, Lyn Seely, estimated an overall response rate of “better than 60-70%”.

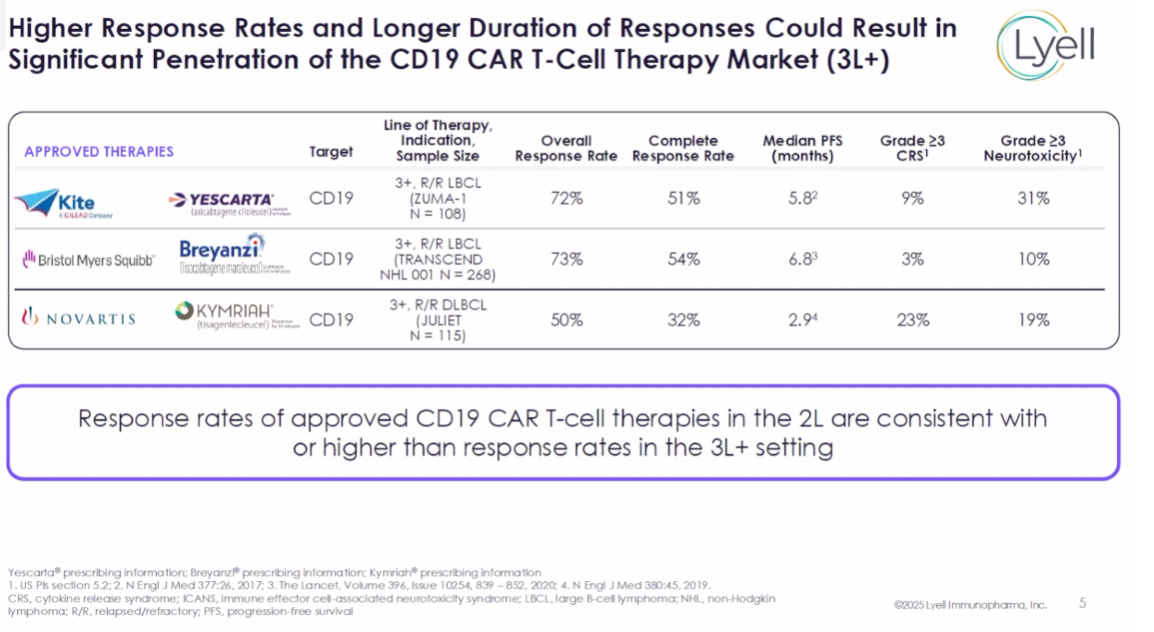

She added that approved CD19 Car-Ts, like Bristol Myers Squibb’s Breyanzi and Gilead’s Yescarta, have produced ORRs of around 70% in the third line, and complete response rates of around 50%.

Based on the data so far, the dual targeting Car-Ts seem to look better than the incumbents on efficacy, as well as showing lower rates of grade 3 cytokine release syndrome and immune effector cell-associated neurotoxicity syndrome (ICANS).

Lyell reported data on Tuesday from Car-T-naive patients in its trial, most of whom had received the recommended phase 2 dose of 100 million Car-T cells.

Among 25 third-line or later patients, LYL314 produced an ORR of 88% and a complete response rate of 72%. This looks similar to early data presented recently at EHA by J&J on its contender, JNJ-90014496.

Gilead’s KITE-363, meanwhile, produced an ORR of 100% in its phase 1 trial, presented at ASCO – however, this was only in seven patients. All had Car-T-naive, third-line or later LBCL, and received the go-forward dose of two million Car-T cells.

Cross-trial comparison of CD19 x CD20 Car-Ts in Car-T naive r/r B-cell lymphoma

LYL314 | JNJ-90014496 | KITE-363 | ||||

|---|---|---|---|---|---|---|

| Company | Lyell (via ImmPACT Bio) | J&J (via AbelZeta) | Gilead (via Kite) | |||

| Trial | Ph1/2 in aggressive r/r LBCL | Ph1 in r/r LBCL | Ph1 in r/r BCL | |||

| Venue | ICML 2025 | EHA 2025* | ASCO 2025** | |||

| Setting | 3rd-line-plus | 2nd-line | 3rd-line | 2nd-line | 3rd-line LBCL | 2nd-line LBCL |

| ORR | 88% (22/25) | 91% (10/11) | 92% (11/12) | 100% (10/10) | 100% (7/7) | 80% (12/15) |

| CR | 72% (18/25) | 64% (7/11) | 75% (9/12) | 80% (8/10) | 100% (7/7) | 67% (10/15) |

| ≥Gr3 CRS | 0% | 0% | 4% | |||

| ≥Gr3 ICANS | 14% | 4% | 8% | |||

Note: *JNJ4496 data with RP2D of 75m Car-T cells; **KITE-363 data with RP2D of 2m Car-T cells. Source: company releases, EHA & ASCO 2025.

Data also looked good in the second line. Here, Lyell is planning a pivotal randomised, controlled trial in second-line LBCL, slated to start by early 2026. As for adverse events, LYL314 had no high-grade CRS, but ICANS rates look a little higher than its competitors.

Lyell acquired LYL314, previously known as IMPT-314, last October via the takeover of ImmPACT Bio. J&J licensed JNJ-90014496 from AbelZeta in 2023, and that project now has the INN prizloncabtagene autoleucel, and is in a Chinese phase 2, Elevation.

Meanwhile, Gilead has previously said that KITE-363 was one of three projects is could take into pivotal trials, along with two fast manufactured Car-Ts: KITE-753, which also hits CD19 and CD20, and KITE-197, which targets CD19.

1463