Lung cancer switch does the job for Black Diamond

First data with the biotech’s new EGFR project prompts a 236% share price bump.

First data with the biotech’s new EGFR project prompts a 236% share price bump.

Corporate turnarounds usually take more than a year to bear fruit, but for Black Diamond Therapeutics the scrapping of a pipeline lead seems to have achieved just that. First clinical data on its new lead, BDTX-1535, sent the stock up 236%, to levels not seen since October 2021.

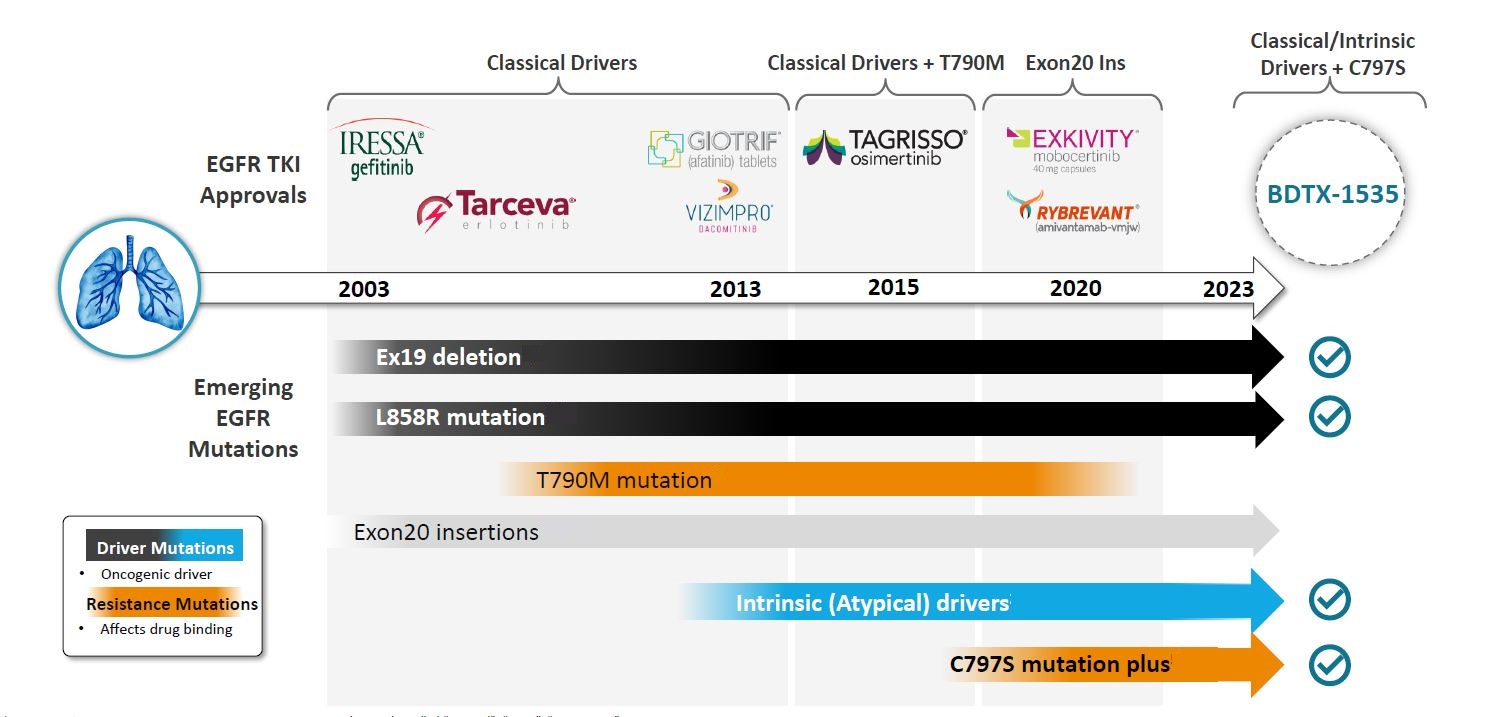

True, the data are very early, but they do seem to back the premise thatBlack Diamond has designed BDTX-1535 as a molecule able to hit a variety of EGFR mutations in lung cancer. The race is now on to develop a tyrosine kinase inhibitor active in patients who have failed on Astrazeneca’s blockbuster Tagrisso, which effectively controls this space.

This is perhaps the most important aspect of the data Black Diamond presented yesterday, from a phase 1 BDTX-1535 trial that relatively quickly has managed to enrol and treat 51 patients so far. All six NSCLC subjects said to have responded had failed Tagrisso, four in the front-line setting and two after chemotherapy and/or checkpoint blockade.

BDTX-1535 is a fourth-generation tyrosine kinase inhibitor with brain penetration and covalent activity against mutant EGFR, Black Diamond says; 27 of the 51 phase 1 subjects had glioblastoma multiforme, but no efficacy data were provided for these.

Respectable

Instead, the company zeroed in on 21 NSCLC patients given 100-400mg BDTX-1535, excluding three given lower, “sub-therapeutic” doses. Black Diamond also tried to exclude eight NSCLC subjects from the efficacy-evaluable population to claim a 50% response rate, a trick that investors should probably ignore; a denominator of 21 yields a still respectable 29% ORR.

Five of the six responders had classical driver EGFR mutations, once the domain of Astra’s Iressa, for which Tagrisso is now used first line. The sixth had an unusual “intrinsic driver” mutation, L747P, and must presumably have received front-line Tagrisso off label. Four of the six also had acquired resistance mutations.

To an extent this backs up Black Diamond’s broad EGFR claim. However, its trial excludes T790m mutations, and the company does not claim that BDTX-1535 is active here. It was T790m, an EGFR mutation acquired after Iressa treatment, that served as Targisso’s first approved setting, though perhaps with Tagrisso established front line its importance is waning.

Projects aiming to improve on Tagrisso include, most importantly, Dizal’s sunvozertinib, as well as Blueprint’s BLU-945, Novartis’s nazartinib, Scorpion’s STX-241 and Theseus’s THE-349.

Neither does Black Diamond claim activity in EGFR exon 20 insertion, a setting in which Takeda’s Exkivity and Johnson & Johnson’s bispecific MAb Rybrevant are approved. At Asco this year sunvozertinib prompted responses in NSCLC patients with exon 20 insertions, as well as those with EGFR activating mutations, some post-Tagrisso.

Pivot away from exon 20

Exon 20 represented Black Diamond’s first foray into EGFR-mutant NSCLC, with a project coded BDTX-189. But BDTX-189 disappointed at Asco 2021, and was discontinued in April 2022 as Black Diamond refocused and cut staff. It also became evident that exon 20 was a tiny niche, whose most prominent casualty has been Spectrum’s poziotinib.

By the end of the year Black Diamond wants to deliver BDTX-1535 data in glioblastoma. It also plans to start expansion cohorts testing BDTX-1535 specifically in NSCLC patients with resistance and driver mutations after progression on Tagrisso, a second-line setting where Stifel cautions durability will be the true test of the project’s potential.

Thanks to the 2022 cost cutting Black Diamond had $103m in the bank at the end of the first quarter, enough to last into the second half of 2024. The company therefore still has a cushion, and even after the 236% surge its valuation stands at a mere $225m. It should probably strike while the iron is hot, and raise more cash now.

638