A Leap into the subgroups

On a wing and a prayer Leap heads for phase 3.

On a wing and a prayer Leap heads for phase 3.

What was already evident a year ago – that Leap Therapeutics' lead project, sirexatamab, was underwhelming in part A of its Defiance study in colorectal cancer – has been confirmed in the trial's part B, unveiled on Tuesday.

However, this hasn't put off the company, which moved to highlight subgroups in which it claimed to see activity, as well as revealing plans to move sirexatamab into phase 3. Investors took flight, unimpressed perhaps by the prospects of funding the pivotal trial of an unpromising project, as well as by the separate discontinuation of a gastric cancer programme, and sent Leap stock crashing 71%.

The gastric cancer development came after an analysis of the Distinguish trial, where sirexatamab was combined with BeiGene's Tevimbra plus chemo in first-line HER2-negative gastric/gastroesophageal junction cancers. On Tuesday Leap said interim analysis of PFS, the primary endpoint, yielded a median of just 9.7 months, versus 12.0 months for Tevimbra plus chemo control.

Leap admitted that this was a clear indication that Distinguish would fail, and scrapped plans to go into phase 3 in gastric cancer. This was despite a possible signal in DKK1-high tumours, where confirmed ORR was 59%, versus 36% for control; notably, however, the median PFS result in this subgroup was still a bust, at 7.7 months versus 7.8 months.

Déjà vu?

Sirexatamab (earlier coded DKN-01) is a MAb targeting DKK1, so it logically follows that activity should be better in patients preselected for DKK1 expression. But Distinguish suggests that even this isn't enough, and Leap now risks committing the same mistake in colorectal cancer.

A year ago part A of the Defiance study, in second-line microsatellite-stable colorectal cancer, yielded results where a similar lack of correlation between ORR and PFS was seen, albeit in small numbers of patients. Leap shares fell, but the company held out the hope of controlled data from part B, where sirexatamab plus Avastin and chemo is being compared versus Avastin plus chemo alone.

It is part B that was toplined on Tuesday, with Leap citing an ORR of 35% for the active triplet versus 23% for control across all 188 patients. This result suggests a somewhat mediocre benefit, and Leap moved to highlight the heterogeneous nature of the patients enrolled, again picking out DKK1 expression, as well as tumour sidedness and RAS status as subgroups that might indicate a better activity signal.

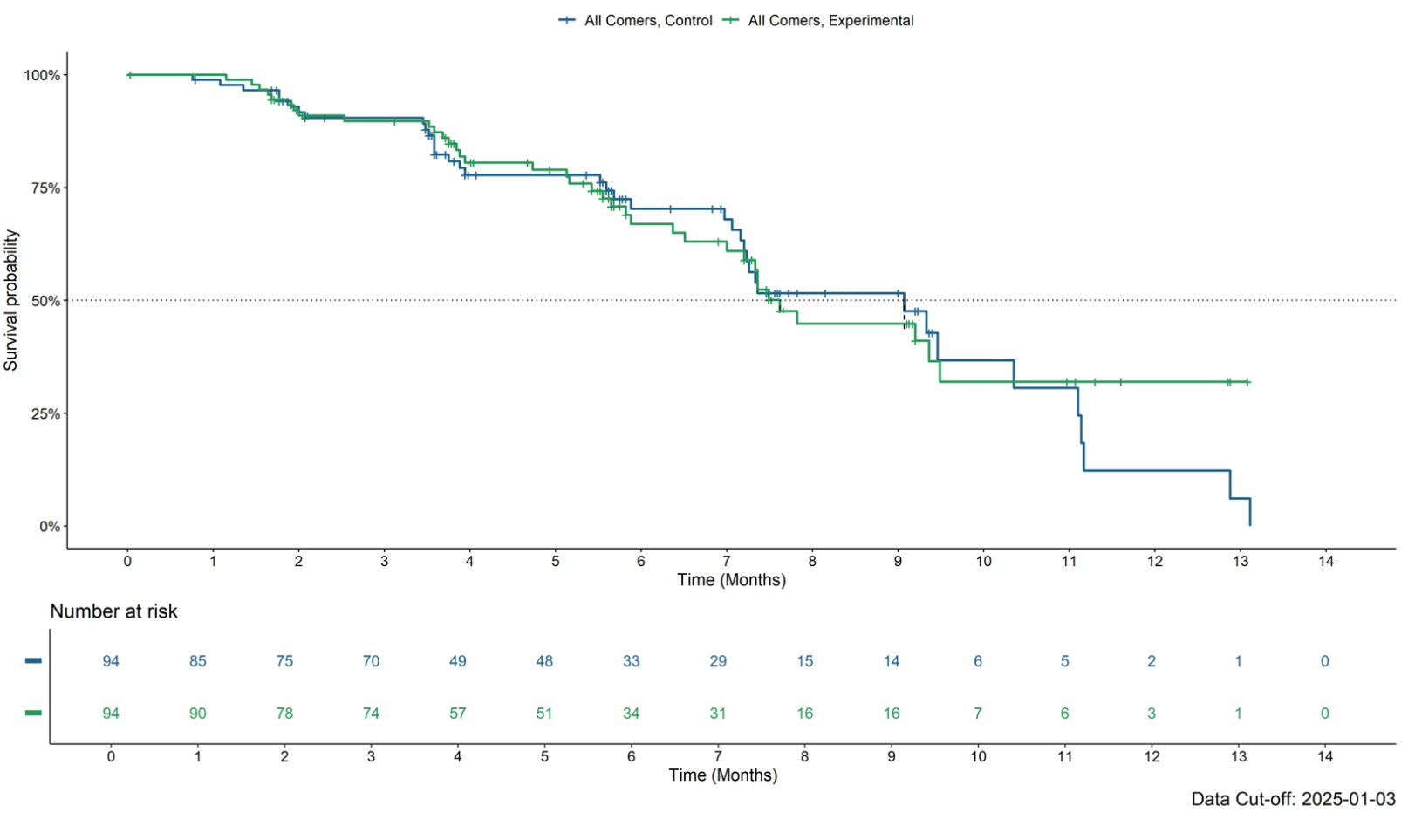

However, these subgroup analyses all concerned response data, and PFS, Defiance's primary endpoint, is showing a negative trend. With a 40% rate of PFS events at this point the medians in all-comers are around 7.5 months for the active group, versus 9 months for control.

PFS curves at 40% maturity in the all-comers population

And, with that, Leap is heading into phase 3 in second-line colorectal cancer, claiming a "strong signal from the Defiance study".

Presumably such a trial won't be undertaken in all-comers, and Leap floated the possibility of several defined populations, including DKK1 biomarker-selected, anti-VEGF naive, anti-EGFR experienced, and RAS wild-type patients. The group says it will continue considering what the optimal population is while the Defiance data mature.

In the meantime, it had $63m in the bank at the end of last September, and now has a market cap of just $25m. It promises more data, possibly including mature PFS analysis, this year, so its remaining investors face another nervous wait.

Defiance data, cut by key subgroups

| Patients | ORR | Median PFS* | |

|---|---|---|---|

| Intent-to-treat | 188 | 35% vs 23% | 7.5mth vs 9.0mth |

| Above median DKK1 expression | 85 | 39% vs 22% | 7.0mth vs 7.0mth |

| Left-sided tumour | 144 | 38% vs 25% | 7.5mth vs 9.5mth |

| No prior VEGF treatment | 94 | 51% vs 29% | 9.5mth vs 10.5mth |

| Prior EGFR treatment | 50 | 54% vs 27% | 7.5mth vs 10.5mth |

| RAS wild-type | 60 | 43% vs 32% | 7.5mth vs 9.5mth |

Note: *40% data maturity, mPFS read off Kaplan-Meier curves. Source: Leap presentation.

1386