J&J deal cements Ambrx’s transformation

Ambrx’s PSMA-targeting ADC generated puzzling data at ESMO, but J&J has seen enough to launch a premium-priced buyout.

Ambrx’s PSMA-targeting ADC generated puzzling data at ESMO, but J&J has seen enough to launch a premium-priced buyout.

Helped by data at last year’s ESMO meeting Ambrx today completed its riches-to-rags-to-riches transformation. A $2bn buyout by Johnson & Johnson values the biotech’s shares over twice as high as where they were trading last week, and an incredible 57 times higher than when the stock bottomed out in November 2022.

The move can most obviously be seen as yet another sign of interest in antibody-drug conjugates, the modality of Ambrx’s most advanced oncology-focused pipeline assets. Still, their targets, HER2, TROP2 and PSMA, are not a slam dunk; the first two face extensive advanced competition, while a drug targeting the last might be difficult to validate clinically.

That latter point has recently been demonstrated by Novartis and Point Biopharma (now owned by Lilly), which both struggled to convince with anti-PSMA radiopharmaceuticals in pivotal prostate cancer trials. Notwithstanding a strong mechanistic rationale, the problems include a likely need to test for PSMA expression and difficulty designing a controlled clinical trial that fits such a drug into a complex current treatment paradigm.

ESMO puzzle

It was Ambrx’s anti-PSMA ADC, ARX517, that yielded data at ESMO, from the Apex-01 study in prostate cancer patients unselected for PSMA expression, who were described as having exhausted available and appropriate treatment options.

However, the results were somewhat opaque. On the plus side, cohorts 6-8 in this multi-cohort dose-escalation trial were highlighted as backing efficacy, with Ambrx citing a 52% rate of ≥50% PSA reduction, including three such responses among six patients in whom PSMA-directed radionuclide therapy had failed. ARX517 also seemed relatively safe.

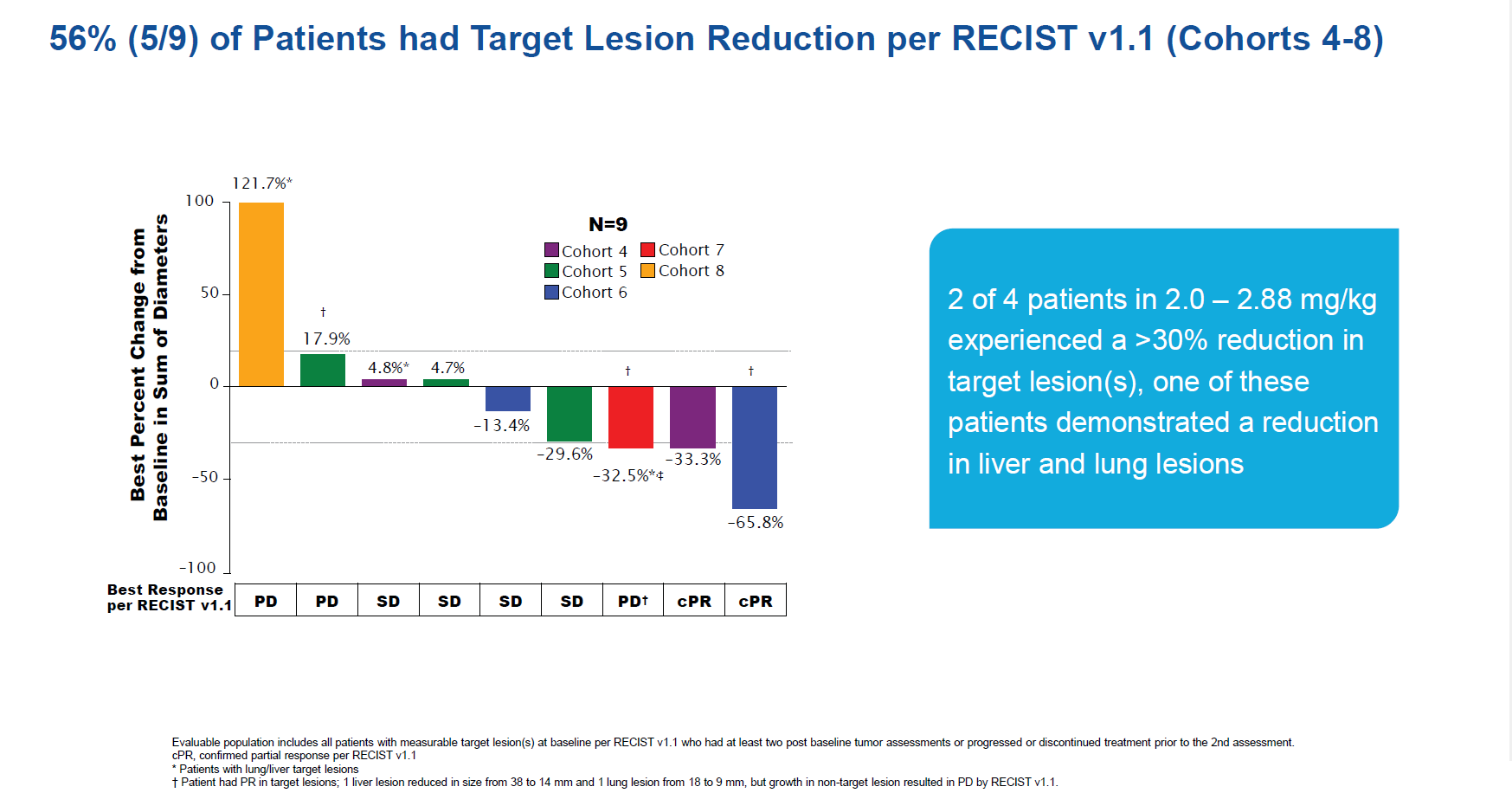

However, in terms of strict responses according to Recist criteria there was less to shout about. Only one new Recist-evaluable patient was added versus a February update, yielding just four evaluable cohort 6-8 patients. One PR was seen in a cohort 4 subject, and if the data were extended to all nine Recist-evaluable subjects across cohorts 4-8 the confirmed ORR was 22%.

Source: ESMO 2023.

Any lingering doubts now become J&J’s problem. The acquirer has clearly seen enough to bet not only on ARX517 but on Ambrx’s entire ADC concept, which is claimed to involve a conjugation technology that uses synthetic amino acids to prevent premature release of a toxic payload.

In the case of ARX517 that payload is AS269, a tubulin polymerisation inhibitor, applied in a drug-to-MAb ratio of 2. The same formula is used in Ambrx’s furthest-advanced ADC, ARX788, which hits HER2; a third ADC, ARX111, targets TROP2 and uses an undisclosed toxin.

Ambrx argued that ARX111 had a differentiated payload that could lead to activity in patients resistant to ADCs that use a topoisomerase inhibitor, such as Gilead’s Trodelvy and Daiichi Sankyo/AstraZeneca’s datopotamab deruxtecan. Meanwhile, ARX788 was being targeted at patients who progressed on Enhertu, Ambrx having cited a 24% relapse rate among Enhertu-treated breast cancer patients within 12 months.

After being spun out of the Scripps Research Institute in 2003 Ambrx floated in mid-2021 at $18 a share, but within 18 months the stock slumped to just 49 cents, before a resurgence, driven presumably by growing interest in ADCs in general, brought the stock back to around $14. J&J has paid $28 a share.

1239