Immutep stumbles on into phase 3

Predictably Tacti-003 fails, but funding is secured – from investors, not a partner.

Predictably Tacti-003 fails, but funding is secured – from investors, not a partner.

It didn’t happen the way Immutep might have hoped for, but the company is taking its Lag3 project eftilagimod alpha into a phase 3 lung cancer trial at last. The bull case was that Immutep would attract a lucrative licensing deal – or even a buyout – but in the event it was investors who had to stump up the cash for the phase 3 to be run by Immutep alone and without a partner.

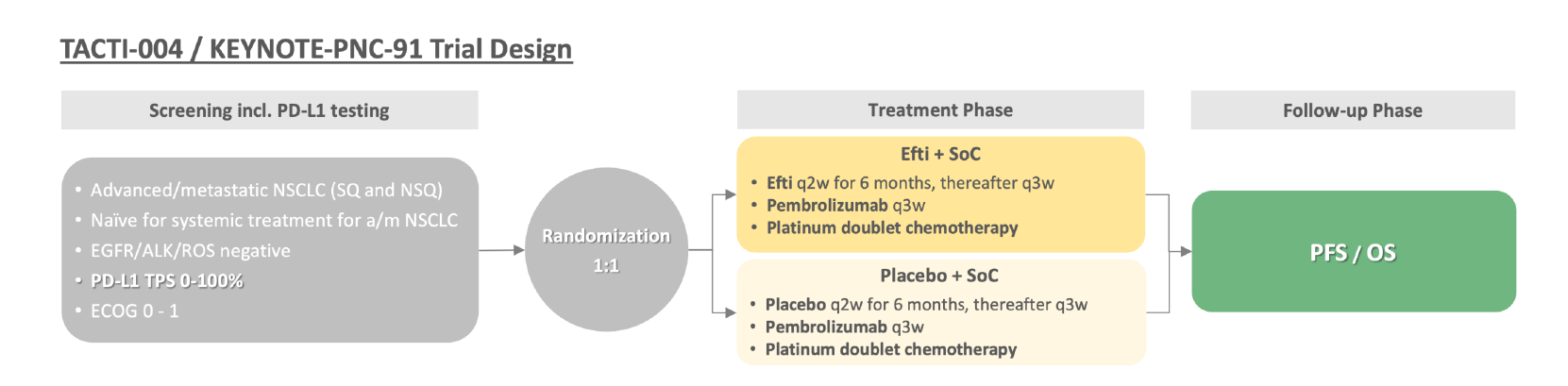

Details are emerging of the planned 750-patient study, Keynote-PNC-91, which has been designed to hit a futility analysis in 2025/26, and thanks to June's $60m equity raise Immutep now has enough cash to get beyond this point. Perhaps the company’s most impressive feat has been to avoid the negative optics of the Tacti-003 head and neck cancer study, which failed this week.

That failure was quite predictable, and ApexOnco had argued that the precedent of Keytruda in the Keynote-048 trial made for the Tacti-003 readout to be very confusing. Not only did Tacti-003 have a somewhat complex design, involving different cohorts across different levels of patients’ PD-L1 expression, its primary endpoint, ORR, hasn’t been especially informative in head and neck cancer.

Tacti-003 was a controlled phase 2 trial, primarily comparing efti plus Keytruda versus Keytruda alone in first-line head and neck cancer patients, split across cohorts involving high (≥20%) and low (1-19%) PD-L1 expressers. A separate cohort was uncontrolled, and involved just the efti/Keytruda combo in patients whose cancers were negative for PD-L1 expression.

Across all three efti-containing cohorts the ORR was around 30%, but the problem is with the Keytruda comparator. Only the PD-L1-high comparison looks numerically positive, and Keytruda did better in patients with low than high PD-L1 expression. In PD-L1 non-expressers Immutep cites 5% ORR for Keytruda, but that’s on a cross-trial basis from a sub-analysis of Keynote-048.

Cross-trial comparison in 1st-line head and neck cancer

Tacti-003 | Keynote-048 | |||

|---|---|---|---|---|

Eftilagimod + Keytruda | Keytruda | Keytruda | Erbitux + chemo | |

| ORR in PD-L1 high (≥20%) | 31% (n=29) | 19% (n=27) | 23% (n=133) | 36% (n=122) |

| ORR in PD-L1 low (1-19%) | 35% (n=29) | 33% (n=33) | 15% (n=18) | 34% (n=45) |

| ORR in PD-L1 negative (<1%) | 27% (n=26)* | – | 5% (n=44)** | 42% (n=45) |

Notes: *number to be updated at ESMO virtual plenary on 11 July 2024; **ORR 31% for Keytruda + chemo (n=39). Source: ASCO & prescribing information.

Immutep said Keytruda outperformed historical data in low PD-L1 expressers, suggesting baseline imbalances as a possible reason. In PD-L1-high cancers 19% ORR is in line with Keynote-048, but the efti combo’s 31% is no better than Erbitux plus chemo (or Keytruda plus chemo in all-comers) – precisely the scenario ApexOnco had suggested might arise.

However, the fact that each Tacti-003 cohort enrolled only around 30 patients severely limits what can intelligently be gleaned from this confusing readout. In head and neck cancer survival data are far more instructive, and it’s on OS versus Erbitux plus chemo that Keytruda secured its US label in first-line, PD-L1-positive disease.

To add to the confusion, Tacti-003 enrolled 171 patients, but Immutep said 149 were evaluable, and presented data on only 144. The company plans to reveal further data from Tacti-003’s PD-L1 non-expressing cohort at an ESMO virtual plenary session on 11 July, and has submitted the full study for presentation at a conference in the second half.

Off 32%

On Thursday Immutep stock lost 32% after the Tacti-003 failure was revealed, but in reality that fall shouldn't bother the company too much.

That’s because Immutep had already secured $60m in an institutional placement and offer on 5 June. That was two days after the company announced that Merck & Co had agreed to provide Keytruda for the Keynote-PNC-91 study, even though this was a mere clinical supply agreement, rather than a licensing deal with a financing commitment.

Immutep’s next goal is to get Keynote-PNC-91 under way. The company says it wants to “discuss potential options with regulatory agencies” regarding the Tacti-003 readout, but the NSCLC opportunity must now be its priority.

1634