How to be different in in vivo Car-T

After Astra's EsoBiotec takeover the battle for uniqueness begins.

After Astra's EsoBiotec takeover the battle for uniqueness begins.

AstraZeneca this week fired the starting pistol on biopharma's quest to develop an in vivo Car-T therapy, and already the battle lines are being drawn among the crowd of mostly preclinical companies jostling for attention in this burgeoning space.

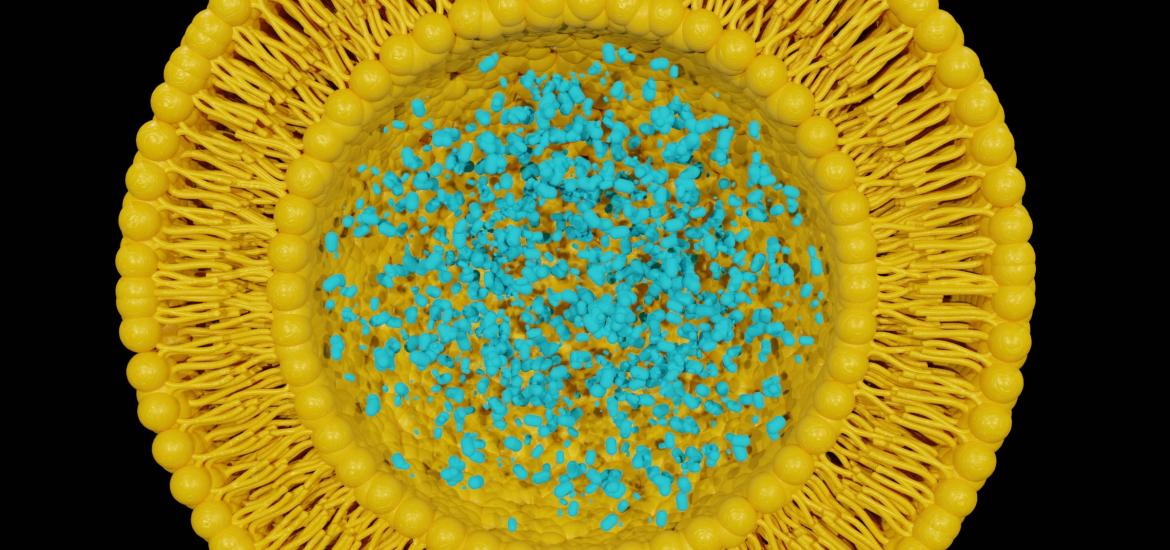

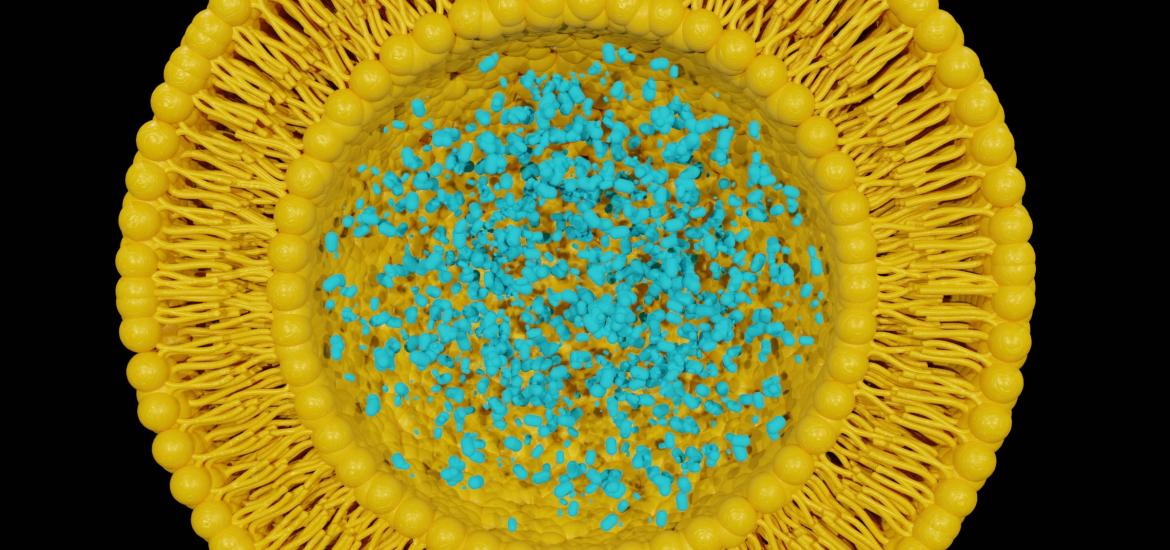

One difference between these is the type of genetic material each is trying to deliver, and the means of delivering it. Thus a key dividing line is between companies like EsoBiotec, which Astra just bought for $425m and which uses a lentiviral vector, and those like Tidal Therapeutics (bought by Sanofi for $160m) and Capstan, which deliver nucleic acids via nanoparticles.

Notably, none of the latter is in human trials, though Tidal and Capstan might be this year, according to presentations at this week's Terrapinn Advanced Therapies congress in London. The most advanced in vivo Car-T companies are the lentivirus players Interius, Umoja (notable for its option deal with AbbVie) and EsoBiotec.

High cost?

Still, lentiviral approaches are characterised by relatively poor scalability and high cost of goods, Jacek Lubelski, chief technical officer of NanoCell Therapeutics, told the Terrapinn meeting. His company is working on a non-viral vector with stably integrating "minicircle DNA", which he claimed had better properties and resulted in long-term durability.

NanoCell has generated proof-of-concept preclinical data with delivery of an anti-CD19 Car construct, and has also tested anti-CD22 and anti-CD19/CD22 Cars. For now it seems to be positioning itself as a technology player, and says it's open to collaborations and co-development.

Another private company, Alaya.bio, highlighted the potential of its polymeric nanoparticle delivery vehicle – something it has in common with the approach Sanofi has quietly been working on since buying Tidal in 2022.

This approach differs from lipid nanoparticles, as used by Capstan, Carisma and others, which can typically only deliver mRNA; polymeric nanoparticles are agnostic as to cargo, which can be RNA, DNA or protein, Alaya.bio's chief executive, Renauld Vaillant, told the meeting.

Alaya.bio boasts as scientific co-founder Dr Michel Sadelain, one of the pioneers of autologous Car-T therapy, and a co-founder of Juno Therapeutics. After his work at Juno Sadelain developed a Car construct that uses a 1XX signalling domain, said to give reduced toxicity and similar efficacy at low cell dosing versus standard approaches, and this had been licensed to Takeda.

Under a tie-up with Sadelain in January Alaya.bio can use an anti-CD19 Car with the 1XX domain for in vivo applications, and it plans to start phase 1 in the next 18 months, Vaillant said. Alaya.bio claims to have secured IP rights to the "collaboration outcomes", but presumably the construct remains Sadelain's property, and the study will be a proof of concept to guide future work.

Comparison of various in vivo Car-T approaches

| Company | Project (target) | Delivery | Note |

|---|---|---|---|

| Interius Biotherapeutics | INT2104 (CD20) | Surface-modified lentivector | Ph1 Invise (Australia & cleared in Germany) began Oct 2024 |

| Umoja/ AbbVie | UB-VV111 (CD19) | Surface-modified lentivector | Jan 2024 option deal; ph1 Invicta-1 (US & Australia) under way |

| AstraZeneca (via EsoBiotec) | ESO-T01 (BCMA) | “Immune shielded” lentivector | $425m takeover, Mar 2025; China ph1* began Dec 2024 |

| Kelonia Therapeutics/ Astellas | KLN-1010 (BCMA) | Surface-modified lentivector | Feb 2024 deal, $40m up front; preclinical data at AACR 2024 |

| Sanofi (via Tidal Therapeutics) | Undisclosed | Polymeric nanoparticle delivers RNA, DNA or protein | $160m takeover, Apr 2021 |

| Capstan Therapeutics | Unnamed (BCMA) | Lipid nanoparticle mRNA | Preclinical |

| Vyriad/ Novartis | Unnamed (CD19) | G-protein modified lentivector | Nov 2024 deal; preclinical |

| Nuntius/ Taiho (Otsuka) | Undisclosed | Peptide & lipid nanocarrier mRNA | Aug 2024 deal; preclinical |

| Carisma/ Moderna | Unnamed (GPC3) | Lipid nanoparticle mRNA | Jan 2022 deal; preclinical Car-macrophage |

| Alaya.bio | CD19-1XX (CD19) | Polymeric nanoparticle | Deal with Dr Michel Sadelain, proof-of-concept study to start 2027 (IND filing H2 2026) |

| Orna Therapeutics | ORN-101 (CD19) | Lipid nanoparticle circular RNA | Preclinical |

| Tessera | Undisclosed | Undisclosed non-viral | Tech poster at ASGCT 2024 |

| NanoCell Therapeutics | NCTX-01 (CD19/CD22) | Lipid nanoparticle minicircle DNA | Preclinical |

| Exuma Biotech | Unnamed (CD19) | Surface-modified lentivector | Preclinical poster at AACR 2023 |

| Strand Therapeutics | STX-004 (undisclosed) | Lipid nanoparticle circular mRNA | Preclinical |

Note: *investigator-sponsored trial. Source: company filings & OncologyPipeline.

One issue yet to play out fully for any of these players is how the regulators will view a therapy that comprises the delivery of genetic material that generates Car-T cells in a patient's body, rather than by transfecting cells ex vivo and reinfusing the resulting expanded cell product.

Alaya.bio says the EMA and the UK's MHRA have both validated its polymer technology and manufacturing process for a phase 1/2 study, but engagement with the FDA is still at the planning stage, with IND filings not expected until late 2026.

In an interview at the Terrapinn meeting, Miguel Forte, president of the International Society for Cell & Gene Therapy, told ApexOnco that regulatory agencies weren't completely in the dark, being able for instance to apply their experience of in vivo gene therapies.

That said, there will be "challenges", because regulators want to know about the product and how it's characterised. "When you take cells out (ex vivo) you characterise your product: the cell. When you do it in vivo you're delivering the message, but you don't control the message," Forte said. "Your product is no longer the cell, it's the payload, the gene."

1773