Gilead and Galapagos's conscious uncoupling

Galapagos distances itself from Gilead, and offers a pure-play oncology cell therapy focus.

Galapagos distances itself from Gilead, and offers a pure-play oncology cell therapy focus.

The latest stage of Gilead's disastrous 2019 deal with Galapagos will see the two companies embark on a slow process of uncoupling, with Galapagos formally discontinuing the remaining assets involved before the companies decide how to proceed further with what remains of the tie-up.

For Galapagos the most important aspect is that it will retain its R&D pipeline, the key focus of which is now the Car-T project GLPG5101, which made a splash at last year's ASH conference, and whose claim to fame is a planned decentralised manufacturing process. All obligations of the 2019 deal will reside with a new entity, to be spun out and listed in Europe separately from Galapagos.

Under that 10-year deal, which had a small-molecule non-oncology focus, Gilead paid Galapagos $3.95bn plus a $1.1bn equity investment, but numerous failures followed. This included a much-vaunted "Toledo" programme in inflammation, and the JAK inhibitor Jyseleca, approved in the EU but hit with a US CRL, after which Gilead handed back rights.

Discount to cash

Largely thanks to the deal Galapagos has a current cash balance of €3.3bn, and a measure of investors' lack of faith is that the company's shares today trade at a 45% discount to that cash.

The money will now be split, with €2.45bn assigned to the as yet unnamed new company. Galapagos itself, armed with the remainder, will discontinue small-molecule drug development, cut 40% of its staff, and effectively focus on cell therapy. The company will put its small-molecule projects up for licensing out, but won't fund any further development.

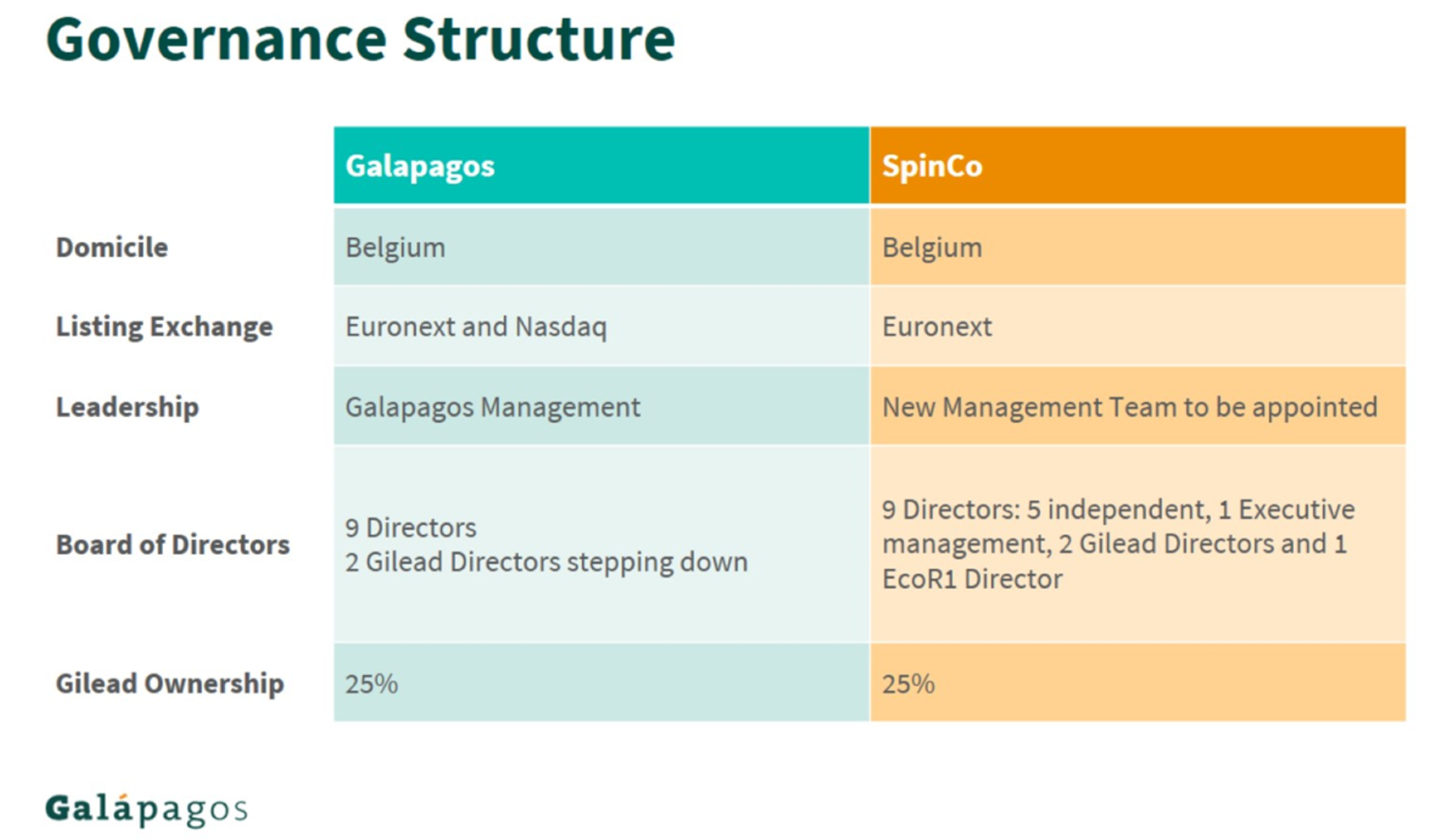

Gilead stands to benefit most significantly via the 25% stakes that it will retain both in Galapagos and in the new company. Thus Gilead stands to benefit indirectly from any advances Galapagos's cell therapies make at the expense of its own Car-T products, which include Yescarta and Tecartus.

However, the only direct rights it will have over Galapagos will be a royalty on sales, presumably of any of the existing small molecules that are taken on by new partner(s); apart from this any Gilead rights under the 2019 deal, largely amounting to opt-ins, will apply only to the new company.

While Galapagos thus takes on a pure-play oncology cell therapy aspect, the new entity's focus is broader. On an investor call Galapagos pointed to difficult financial markets forcing some biotechs to give up on promising projects to conserve cash, and the new company will aim to identify such projects, and seek to gain rights to them through licensing deals and/or acquisitions.

These will include the therapy areas of immunology and/or virology, as well as oncology, Galapagos said.