ESMO 2023 – low-dose volrustomig hints at a therapeutic window

But efficacy still needs to go up, as several groups try to combine PD-1 and CTLA-4 using differing approaches.

But efficacy still needs to go up, as several groups try to combine PD-1 and CTLA-4 using differing approaches.

AstraZeneca’s volrustomig, plagued by liver toxicity, might have found a therapeutic window, an ESMO presentation suggested today. The data, from a first-line kidney cancer trial, hint at why the company has been sufficiently bold to launch two phase 3 volrustomig studies so far this year.

The project is Astra’s attempt to combine PD-1 and CTLA-4 blockade in a single bispecific, following success in getting the monospecific Imjudo approved as only the west’s second anti-CTLA-4 MAb after Bristol Myers Squibb’s Yervoy. Agenus hopes to become the third player here, though its data – one of several ESMO presentations on the PD-1/CTLA-4 theme – suggest a future stumbling block.

For Astra volrustomig has become an important pipeline asset, and the first two of five planned phase 3s test it in first-line NSCLC (Evolve-Lung02) and cervical cancer maintenance (Evolve-Cervical). Its problem has been grade 3/4 liver toxicity, seen previously in 25% of patients given a 1.5g dose.

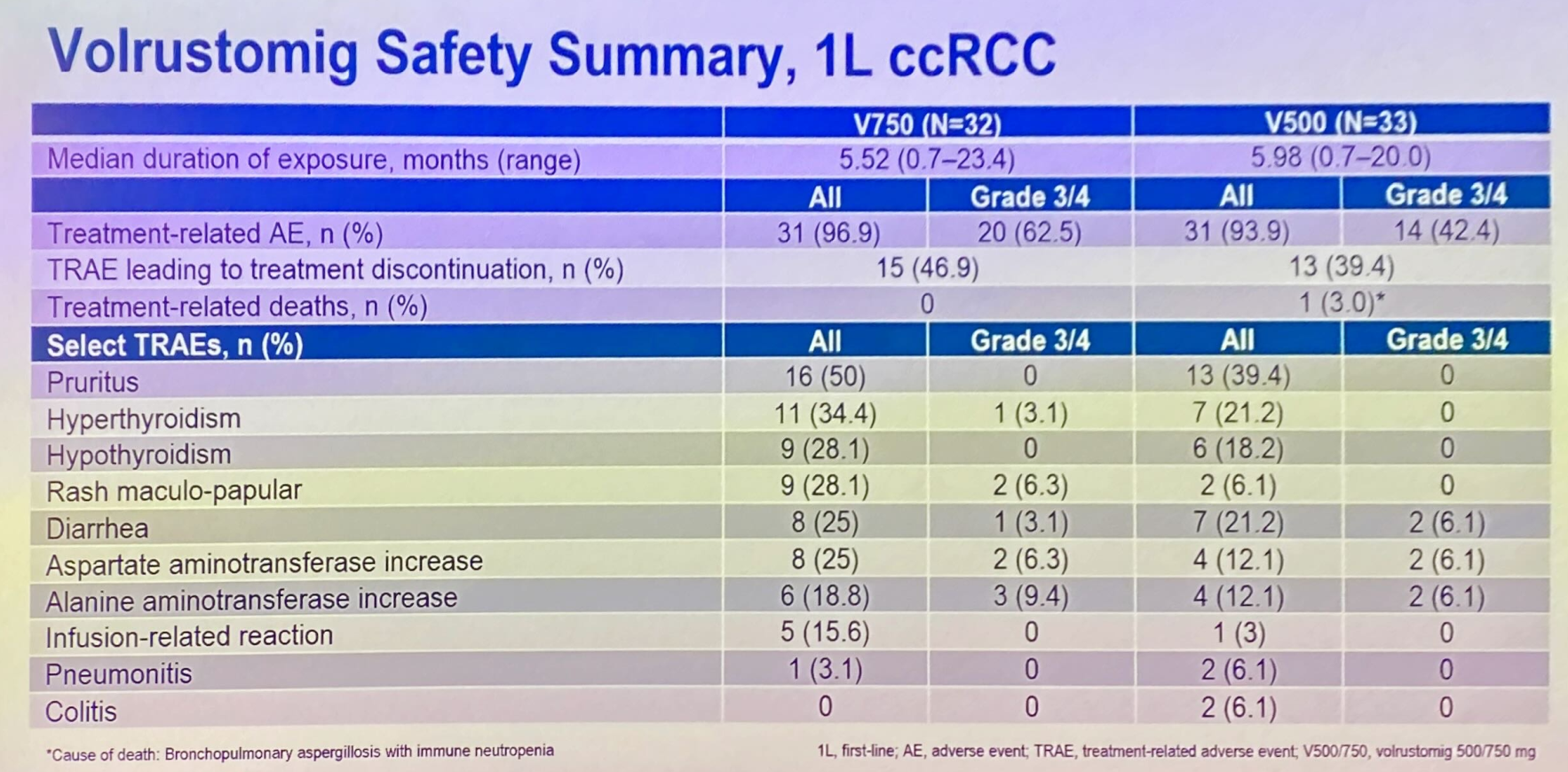

ESMO saw the presentation of a first-line renal cancer subgroup of a phase 1 solid tumour study, specifically investigating lower, 500mg and 750mg, volrustomig doses. Here 46% and 48% overall response rates were reported among 33 and 31 patients given these two respective doses.

Importantly, these ORR figures aren’t far off the 58% generated by 1.5g. Even more importantly, grade 3/4 liver enzyme elevations were seen in 6-9% of patients across the 500mg and 750mg cohorts.

Still, this efficacy is some way off the leading front-line renal cancer therapy, Keytruda plus Inlyta, which yielded a 71% ORR in its registrational Keynote-581 trial, with a 9% rate of grade 3/4 hepatotoxicity. There is no sign of Astra taking volrustomig pivotal in kidney cancer, and instead its focus here is a first-line phase 1 combo with either Lenvima or Inlyta.

Agenus reality check

While volrustomig is a bispecific that only binds CTLA-4 in the presence of PD-1, Agenus is pinning its hopes on a combo of two separate MAbs, balstilimab (targeting PD-1) and botensilimab (CTLA-4, with an enhanced Fc region); this is to be filed in the US next year for colorectal cancer.

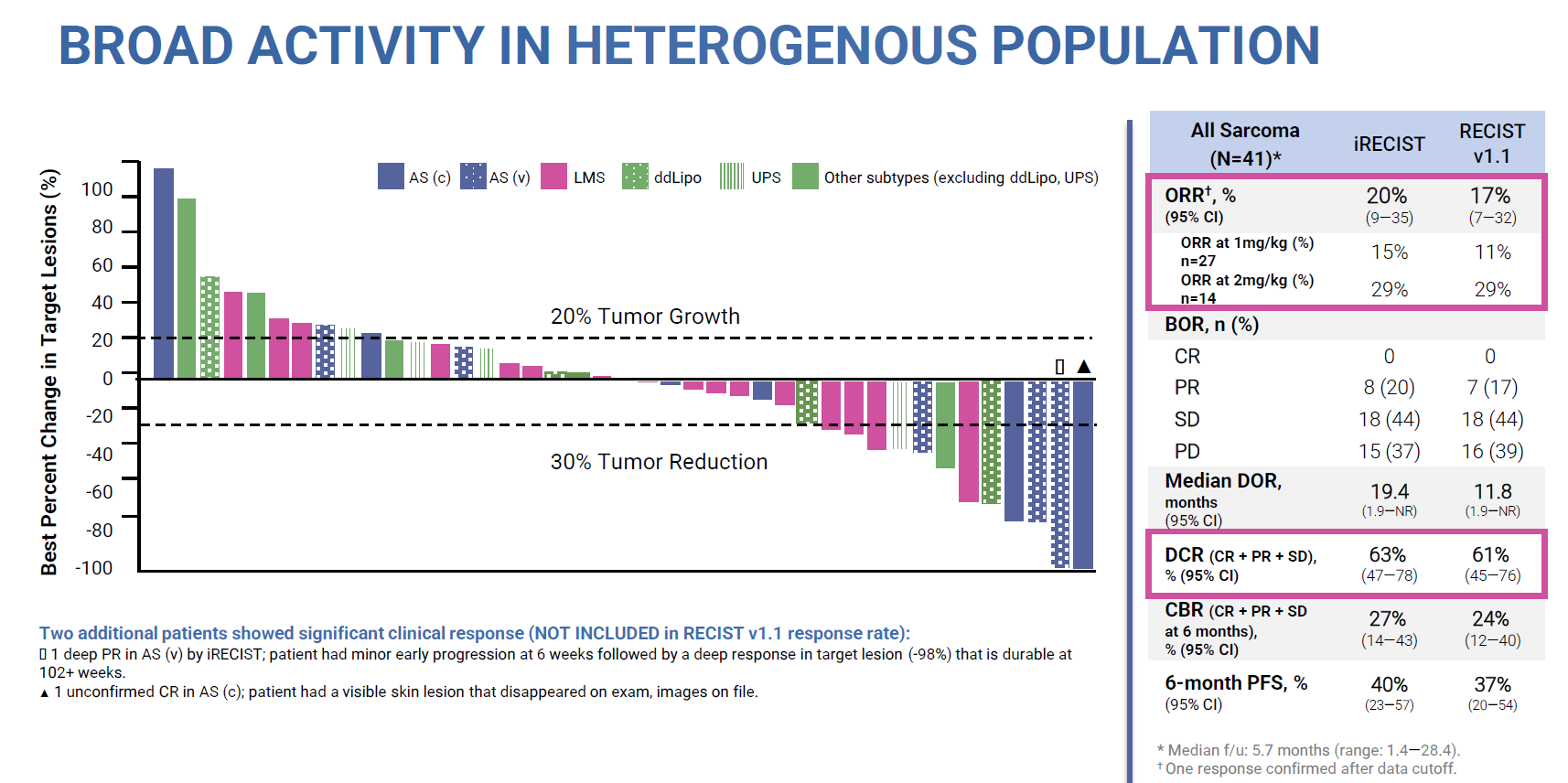

At ESMO this combo featured yesterday in the sarcoma cohort of a phase 1 basket trial. This now boasts 41 patients, in whom a 20% ORR was reported according to iRecist criteria in various sarcoma types, in addition to an unconfirmed complete remission. Agenus had earlier boasted a 46% ORR in 13 sarcoma patients, so the update represents a reality check.

Of course, it would have been unrealistic to expect a similarly high efficacy rate with many more patients enrolled, but 20% is approaching the 16% ORR that Opdivo plus Yervoy has managed. Agenus argues that the highest balstilimab/botensilimab doses scored 29%, still a respectable ORR result.

However, the phase 1 study also includes botensilimab monotherapy, and as nothing has been said about this it can be assumed that it isn’t sufficiently potent on its own to back an approval. This goes to the heart of Agenus’s possible regulatory problem in filing the combo for colorectal cancer, because neither of its two molecules has been approved as monotherapy.

It’s usual practice to get an anti-PD-1 approved first to act as a backbone for future combo therapy – see GSK’s Jemperli or Incyte’s Zynyz, for instance. But for Agenus this strategy backfired in 2021, when the group had to pull a US filing for balstilimab monotherapy in second-line cervical cancer.

China

Imjudo and Yervoy remain the west’s only approved anti-CTLA-4 drugs. China, however, has a third: Akeso’s Kettany, a PD-1 x CTLA-4 bispecific, is approved for second-line cervical cancer.

Another Chinese company, Qilu, today presented ESMO data on a separate asset that hits PD-1 and CTLA-4, coded QL1706. This is described as a “bifunctional Mabpair” product, but still comprises two antibodies called iparomlimab and tuvonralimab.

A first-line cervical cancer trial showed confirmed ORRs of 75% and 77% for QL1706 alone or combined with Avastin respectively. One treatment-related death was deemed due to Avastin. This compared favourably against Keytruda with or without Avastin, which in Keynote-826 scored a 68% ORR – a result that excluded PD-L1 non-expressers, who made up 28% of the Qilu trial.

However, Qilu has shown few signs of developing QL1706 beyond China, and in any case the ESMO data were old, dating from an April 2023 cutoff.

2086