ELCC 2025 – J&J takes it to Tagrisso

The company talks up Rybrevant plus Lazcluze’s disease-modifying potential, but still has much to prove.

The company talks up Rybrevant plus Lazcluze’s disease-modifying potential, but still has much to prove.

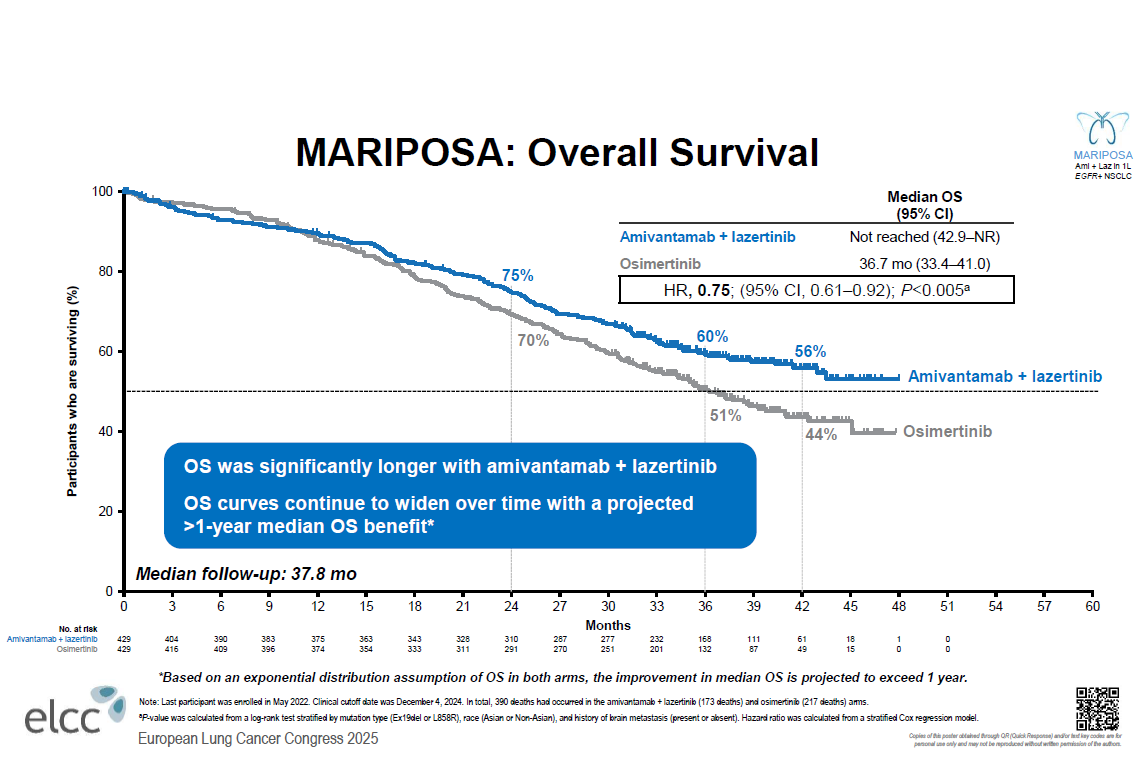

With Rybrevant, Johnson & Johnson hopes to challenge AstraZeneca’s multiblockbuster EGFR inhibitor Tagrisso, and at the European Lung Cancer Congress on Wednesday the company revealed overall survival data that it hopes will help it do just that.

J&J already said in January that, in the Mariposa first-line NSCLC trial, Rybrevant plus Lazcluze had beaten Tagrisso monotherapy on overall survival, and now it has presented the numbers, showing a convincing benefit with the combo. While AstraZeneca has already moved on to Tagrisso plus chemo, J&J still reckons it has an edge with Rybrevant plus Lazcluze, despite worries over skin toxicity and venous thromboembolism.

Tagrisso monotherapy has been approved in the US since 2018 for first-line EGFR-mutated NSCLC; the chemo combo got the FDA go-ahead in February 2024, based on a progression-free survival benefit versus Tagrisso in the Flaura2 trial. Rybrevant plus Lazcluze followed suit with its first-line approval in August, based on PFS in Mariposa.

This is the first time either combo regimen has shown median overall survival numbers.

When asked ahead of ELCC if Rybrevant plus Lazcluze could prove better than the more relevant comparator of Tagrisso plus chemo, Mark Wildgust, vice-president of global medical affairs for J&J oncology, replied. “Right now, we know that Rybrevant plus Lazcluze provides a survival benefit; who knows whether Flaura2 will or will not.”

Median OS data from Flaura2 are expected this year.

No underperformance?

Meanwhile, it seems clear that Rybrevant plus Lazcluze is more effective than Tagrisso monotherapy. In Mariposa median overall survival wasn’t reached for J&J’s combo, while it was 36.7 months for Tagrisso.

The Tagrisso monotherapy number fell short of the 38.6 months seen in the earlier Flaura trial, however, coming on top of questions about Tagrisso’s underperformance on PFS in Mariposa.

Wildgust was adamant that Tagrisso hadn’t underperformed, pointing to similar OS confidence intervals with the AstraZeneca drug across Flaura and Mariposa. “You typically expect to see OS with Tagrisso of about three years. That’s exactly where it came in.”

Rybrevant vs Tagrisso in first-line EGFRm NSCLC

Mariposa | Flaura | Flaura2 | ||||

|---|---|---|---|---|---|---|

| Regimen | Rybrevant + Lazcluze | Tagrisso | Tagrisso | Iressa/Tarceva | Tagrisso + chemo | Tagrisso |

| mPFS (months) | 23.7 | 16.6 | 18.9 | 10.2 | 25.5 | 16.7 |

| Stats | HR=0.70; p=0.0002 | HR=0.46; p<0.0001 | HR=0.62, p<0.0001 | |||

| mOS (months) | Not reached | 36.7 | 38.6 | 31.8 | N/A | N/A |

| Stats | HR=0.75; p<0.005 | HR=0.80; p=0.0462 | HR=0.75 at 41% maturity | |||

Source: ELCC 2025, OncologyPipeline & product labels.

As doctors make their choice about what to prescribe for first-line EGFRm patients, J&J hopes to sway them with the intriguing possibility that Rybrevant plus Lazcluze could prevent resistance, if used early.

“We fundamentally change the disease biology. We’re stopping and preventing the development of resistance, and it’s showcased here in our OS curve – that’s why you see plateauing,” Wildgust told ApexOnco. However, how long the plateau remains, and whether this will be enough to tempt physicians away from an established therapy like Tagrisso, remain to be seen.

He reckons this is down to a triple effect of Rybrevant, a bispecific antibody that blocks EGFR and Met extracellularly, and also incorporates an engineered Fc domain designed to recruit NK cells and macrophages. Meanwhile, Lazcluze, an oral EGFR-TKI, targets intracellular EGFR.

“Think about being in a house,” Wildgust said. “EGFR is the front door for escape – I can lock that in two ways. And Met is the back door. If I close the back door and front door I’ve nowhere else to get out.”

Toxicity

However, another factor that will be weighed up by prescribers is toxicity. Tagrisso’s label features warnings of interstitial lung disease, QTc prolongation and cardiomyopathy, but J&J’s combo has its own issues, including severe rash and venous thromboembolic events.

J&J reckons it’s found a way to address these: rash with prophylactic antibiotics, and VTE with prophylactic anticoagulants, given for three to four months.

In the ongoing phase 2 Copernicus trial the company is testing what Wildgust terms its “optimised regimen”, including these prophylactic measures, and a once-monthly subcutaneous version of Rybrevant (Mariposa used an IV form given every two weeks).

Mariposa also saw a higher incidence of liver enzyme elevations with Rybrevant plus Lazcluze than with Tagrisso, although Wildgust brushed these off as “early and transient”.

J&J hasn’t yet broken out sales numbers for Rybrevant, but has said it will start doing so in its first-quarter 2025 results, due in mid-April. This will give investors an idea of just how far the drug will need to go to catch Tagrisso, which brought in $6.6bn in 2024.

1597