EHA 2024 – J&J bows out as Roche looks to confirm

Starglo reveals a surprisingly strong survival benefit in an EHA late-breaker.

Starglo reveals a surprisingly strong survival benefit in an EHA late-breaker.

The landscape for CD20 T-cell engaging bispecifics has shifted again. One day after Johnson & Johnson pulled out of a deal covering Xencor’s clinically disappointing contender plamotamab, Roche revealed data from the confirmatory phase 3 Starglo trial suggesting that its marketed drug Columvi could be headed for full US approval.

The Starglo data, concerning a Columvi plus chemo combo in second-line diffuse large B-cell lymphoma, look surprisingly positive; Starglo’s delay, and Roche’s restrained wording when toplining a positive result in April, suggested an underwhelming outcome. The result will be of vital importance to the other CD20 bispecific players jostling for position here.

Among these perhaps Regeneron is the most closely watched. The FDA has knocked back with a complete response letter a DLBCL filing for its contender odronextamab; the possibility of a fully approved Columvi on the US market calls into question the availability of an accelerated pathway for odronextamab by the time Regeneron resubmits.

EHA late-breaker

That pathway seemed still to be open in April when Roche announced that Starglo, the first randomised Columvi trial, testing the drug plus chemo versus Rituxan plus chemo, had met its primary OS endpoint – but omitted to say whether the result had clinical relevance.

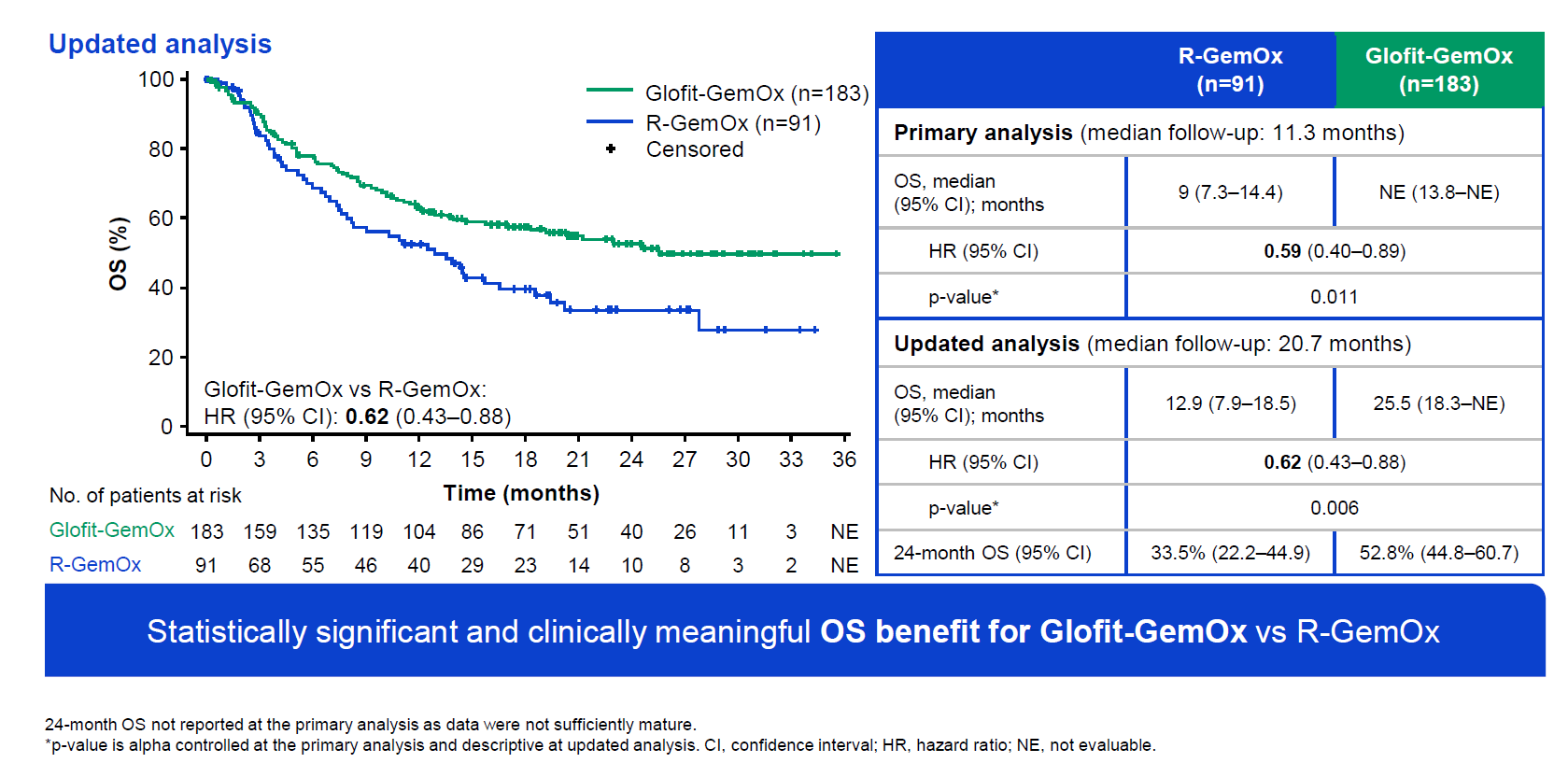

The numbers were revealed on Friday in a late-breaking abstract ahead of Saturday’s plenary session at the European Hematology Association conference. They showed a 41% reduction in risk of death at any point (p=0.011), at the time of the primary analysis of Starglo, relating to data cutoff on 29 March 2023.

A fuller analysis, carried out once all patients had completed therapy on 16 February 2024, revealed median OS of 25.5 months for the Columvi regimen, versus 12.9 months for Rituxan, and a hazard ratio of 0.62. Survival curves published in Friday’s abstract show nothing untoward, with early and consistently improving separation.

Overall survival in Starglo

The control arm appears consistent with a retrospective analysis of Rituxan plus chemo in second-line DLBCL, which showed median OS of about 10 months. 37% of Starglo patients had received two or more earlier therapies, and a split by second and third-line patients, provided on Saturday, showed OS hazard ratios of 0.68 and 0.55 respectively.

What about the west?

Some alarming signs might be seen in the fact that the OS benefit was apparently driven by patients enrolled outside the US and Europe; these rest-of-world subjects made up 59% of Starglo's 274-strong population.

The OS outcome was strongly positive in rest-of-world patients, but when cut by Europe or North America there was no apparent benefit, according to a forest plot presented on Saturday. Perhaps it was this finding that led to Roche being so cautious about its wording in April.

Still, in reality the patient numbers for geographical splits are small and confidence intervals wide. In a statement Roche said these factors, plus the exploratory nature of this analysis, limited the interpretation that could be made of such "regional inconsistencies".

What is closely watched is adverse events. The EHA presentation revealed serious AEs, primarily cytokine release, to be higher for Columvi than for Rituxan (54% versus 17%); fatal AEs related to Columvi occurred in 3% of patients, while those related to Rituxan were seen in 1%.

In addition there were seven Covid-related deaths in the Columvi cohort (4% rate), against none with Rituxan. Overall 27% of patients on Columvi discontinued owing to an AE, a rate more than double that seen for those on Rituxan.

Plamotamab dumped

If Regeneron is now looking anxiously at the Starglo dataset at least its odronextamab still technically remains in this race. The same can’t be said for Xencor’s plamotamab, which has now been dumped by not one but two big pharma partners.

On Thursday Xencor said J&J was terminating a 2021 collaboration covering this CD20 T-cell engager. This probably doesn’t come as a huge surprise, as plamotamab had long underwhelmed versus the data competitors were putting up, and Xencor already scrapped a phase 2 Monjuvi plus Revlimid combo study in relapsed/refractory DLBCL, citing problems accruing lymphoma patients.

The MAb had earlier been licensed to Novartis, which under a 2016 deal gained ex-US commercialisation rights. Novartis ended that tie-up in 2019, a move Xencor put down to the Swiss firm’s “strategic pipeline reprioritisation”.

Columvi got accelerated US approval for third-line or later DLBCL a year ago, one month after Genmab/AbbVie’s similarly acting Epkinly secured a similar green light. The potentially confirmatory phase 3 Epcore DLBCL-1 study, testing Epkinly monotherapy versus chemo in second-line DLBCL, could read out by the end of this year.

This is an updated version of a story published earlier.

2629