CytomX delivers a pancreatic surprise

But the group’s attempt to join Janux at the high altar of masking technology falls flat.

But the group’s attempt to join Janux at the high altar of masking technology falls flat.

Last week’s 215% surge in CytomX stock on the mere promise of preliminary data for CX-904 showed the huge amount of faith investors had in this Amgen-partnered anti-EGFR T-cell engaging probody. However, it’s probably fair to say that seeing activity in pancreatic cancer wasn’t a realistic hope.

Yet this is what CytomX delivered after market close yesterday, hinting that, after many setbacks, its masked antibodies might have a viable path forward. But today the group's stock sold off heavily, showing just how far CytomX still has to go before it’s seen in a similar light to its peer Janux, whose own masking technology impressed in January.

Cross-trial and cross-company comparisons are seldom precise, but the market’s views are unequivocal. Janux is sitting on a valuation of nearly $3bn, while CytomX opened this morning off 40%, taking its market cap back below $200m, and near its March 2024 cash balance.

Nevertheless, what’s fuelling enthusiasm behind Janux is the PSMA-directed T-cell engager JANX007, which analysts have called best in class. The relevant comparator for CX-904 is the EGFR-targeting JANX008, and based on the early data revealed yesterday the CytomX project appears at least as good.

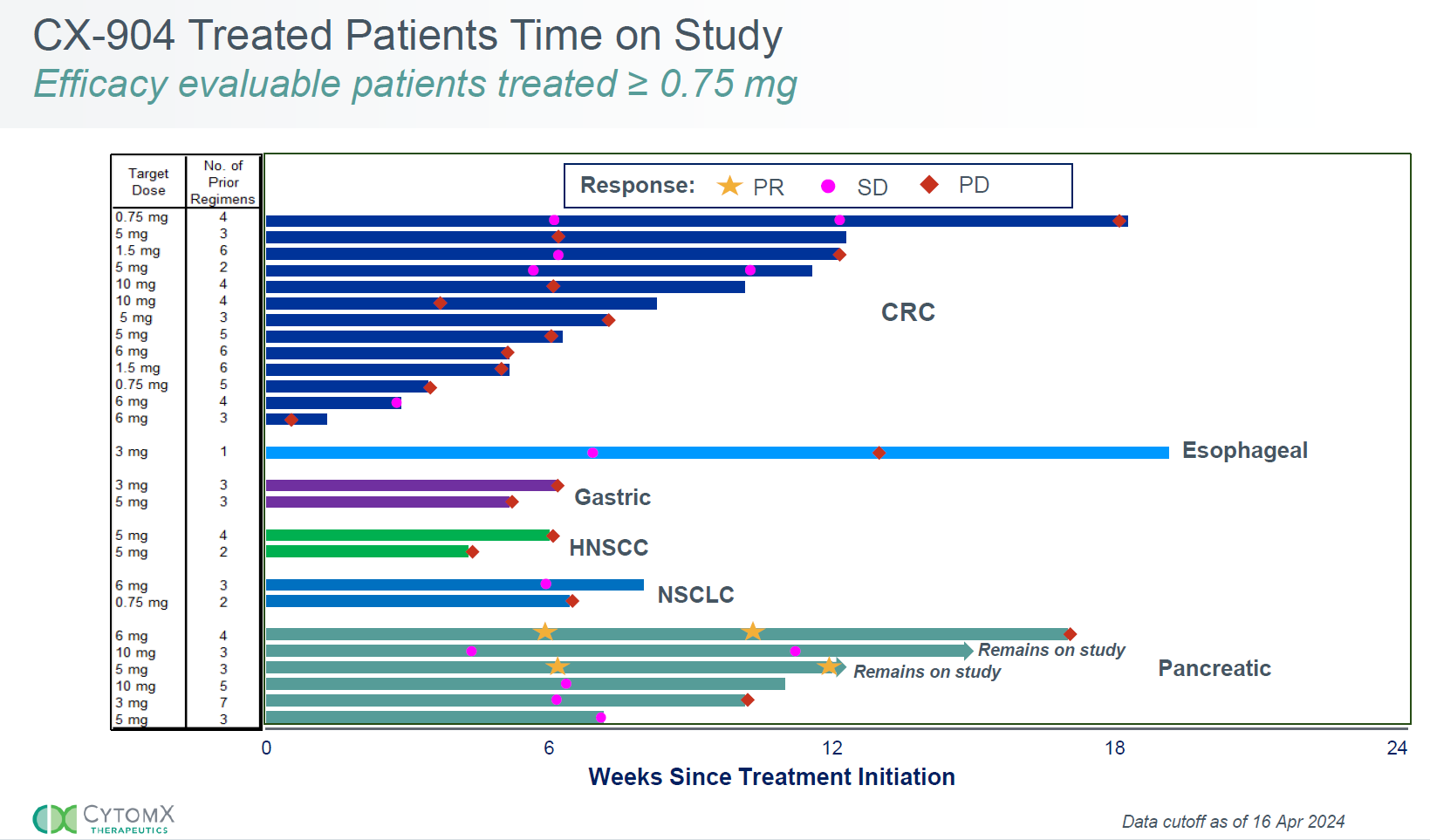

CytomX's results came from a phase 1 basket study in tumours thought to express EGFR, but which weren’t selected specifically for this, and the most striking takeaway was two partial remissions (one confirmed) among six pancreatic cancer patients. There was no activity in other cancer types, of which microsatellite-stable colorectal cancer was the biggest cohort (13 subjects).

Unsurprisingly CytomX zeroed in on the pancreatic cancer cohort, whose other four patients all reported stable disease, two of these with some tumour shrinkage.

For its part Janux has been able to show just one partial response in its multi-tumour phase 1 trial of JANX008, and that was in NSCLC, a much more tractable cancer than pancreatic. The JANX008 trial isn’t seeking to recruit pancreatic cancer subjects, according to inclusion criteria on clinicaltrials.gov.

Amgen kudos

In any early-stage, open-label study the sponsor has the luxury of picking the best moment to announce data, for instance once a certain number of responses have been seen. This likely holds true for Janux and CytomX alike, though the latter has the added kudos of Amgen as a partner that will likely have signed off on the CX-904 release.

Under the deal Amgen has rights to opt in to clinical development, and the big question now is whether, on the strength of the data CytomX presented yesterday, it will do so. For now CX-904 remains listed in Amgen’s pipeline under the code AMG 651. CytomX’s focus is on determining a phase 2 dose, and with relatively clean safety so far there appears to be scope to dose CX-904 higher.

While there is clearly promise in the CX-904 data, CytomX carries much baggage, and the failures of praluzatamab ravtansine and pacmilimab weigh heavy – the company’s big pharma partnerships notwithstanding.

This, combined with pancreatic cancer’s intractability and the lack of responses in other cancers, make the CX-904 pancreatic result look like a fluke, and likely explains this morning’s market reaction.

2829