Candel will need more than a Christmas miracle

The company impresses investors, but money’s running short.

The company impresses investors, but money’s running short.

A year after halving its workforce Candel has had some good news, with an apparent phase 3 win with its lead project, the viral immunotherapy CAN-2409 (aglatimagene besadenovec) in localised prostate cancer.

The group’s stock rocketed as much as 180% on Wednesday morning, but closed the day up 68%. All is not completely rosy: Candel also disclosed the failure of a phase 2 trial of CAN-2409 in a different prostate cancer population, and it only has enough cash to get it to the end of the first quarter of 2025.

In addition to this funding gap, there could also be questions about how the FDA might receive the data package. The phase 3 trial was being conducted under a special protocol assessment which, during a conference call to discuss the data on Wednesday, Candel’s chief executive, Paul Peter Tak, said was “unchanged”.

However, in its third-quarter SEC filing Candel disclosed that it had made "minor amendments" to the trial protocol, and hadn’t obtained an SPA amendment in connection with this new design. Candel has said it doesn’t expect to file CAN-2409 for US approval until the fourth quarter of 2026 but, when asked by ApexOnco, didn't give a reason for the delay.

CAN do?

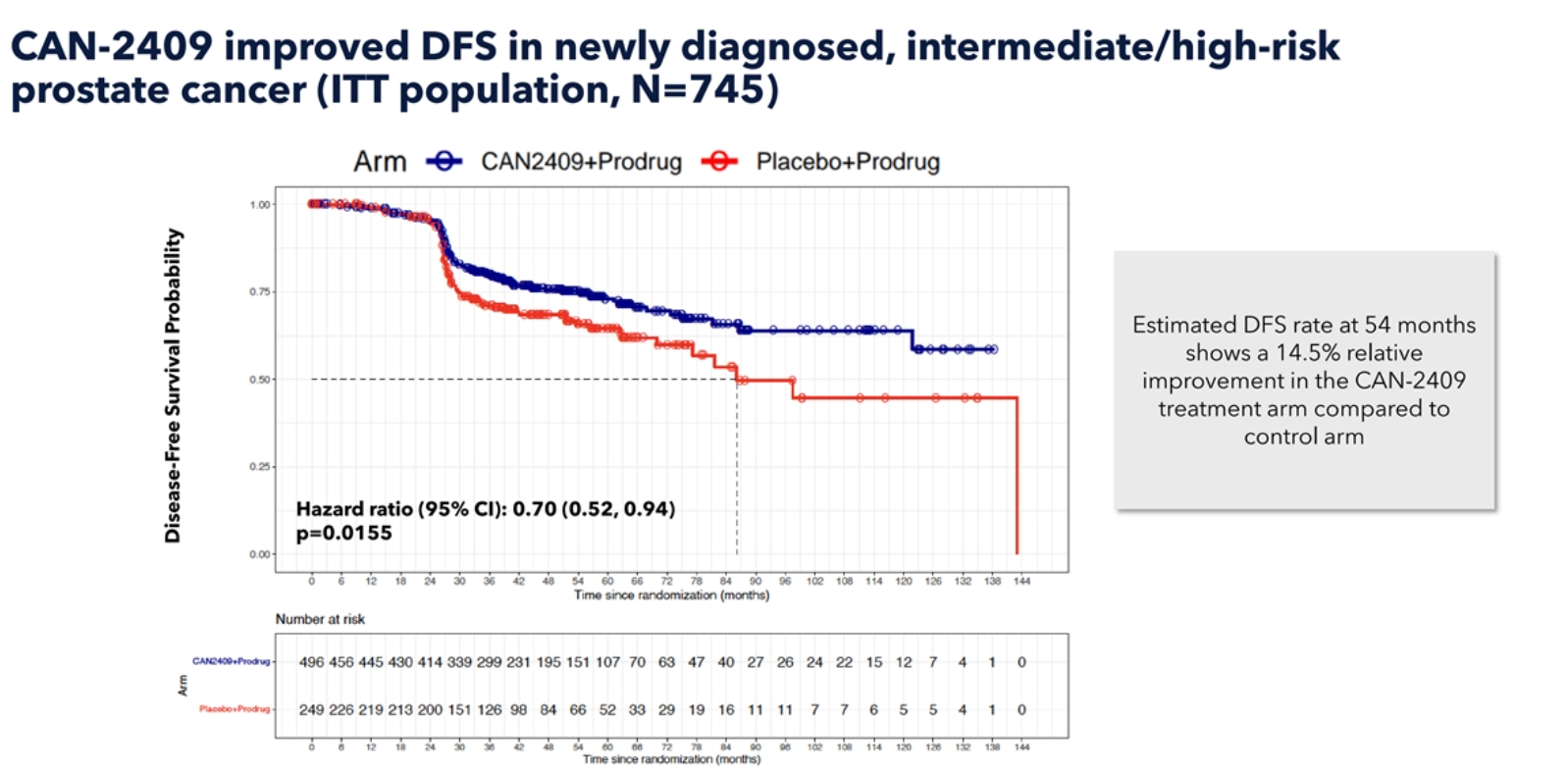

The phase 3 study enrolled 745 patients with newly diagnosed, intermediate to high-risk localised prostate cancer, who were randomised to receive CAN-2409 plus valacyclovir and radiotherapy, or placebo plus valacyclovir and radiotherapy – both with and without short-course androgen deprivation therapy.

CAN-2409 is an off-the-shelf adenovirus designed to deliver the herpes simplex virus thymidine kinase (HSV-tk) gene to a patient’s tumour and spur an individualised, systemic immune response. HSV-tk is said to convert orally administered valacyclovir into a toxic metabolite that kills nearby cancer cells.

The primary endpoint of the study was disease-free survival, and the trial had 90% power to detect a 15% difference between arms.

Candel said this was achieved, with a 14.5% relative improvement in DFS seen at 54 months for the treatment versus control arm. The company added that 54 months was a prespecified timepoint, and noted that DFS curves separated further after this time.

Source: Company presentation.

Overall, the addition of CAN-2409 decreased the risk of an event or death by 30%, with a p value of 0.0155, the company said.

Candel described its therapy as generally well tolerated, although chills, fever and influenza-like illness were more common in the treatment versus placebo arms. It said these were to be expected given CAN-2409’s mechanism of action, and added that the events were generally mild to moderate.

Investors seem to be impressed, but Wednesday’s win was marred by failure of a phase 2 trial in 190 low to intermediate-risk localised prostate cancer patients who were undergoing active surveillance.

That study tested CAN-2409 plus valacyclovir versus placebo plus valacyclovir, but didn’t show a benefit on its primary endpoint, progression-free survival.

This, and questions about how Candel might keep going past the start of next year, could be red flags, but for now the company is riding high.

861