ASH 2024 – Merck treads a fine line in ROR1

Phase 2 data show why Merck took the lowest dose of zilo-V into phase 3.

Phase 2 data show why Merck took the lowest dose of zilo-V into phase 3.

Results of a phase 2 study of zilovertamab vedotin, the anti-ROR1 ADC Merck & Co got from VelosBio, back the company's recent decision to start a pivotal trial in first-line lymphoma, but the data, just released at the ASH conference, show that adverse events will loom large over this project.

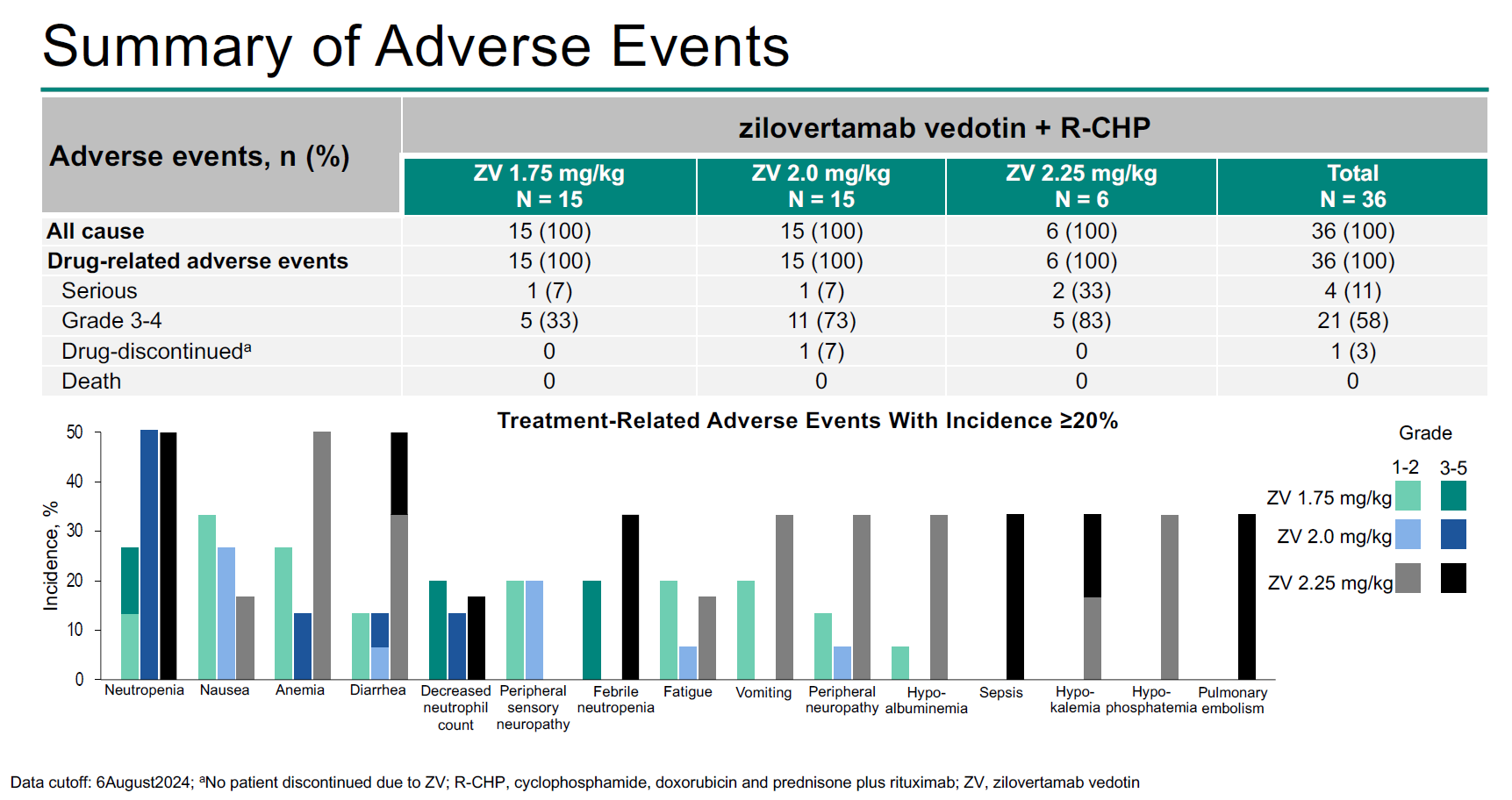

The phase 2 trial, Waveline-007, tested three doses of zilo-V, 1.75mg/kg, 2mg/kg and 2.25mg/kg, but the highest two were associated with dose-limiting toxicities, and it's 1.75mg/kg that has just gone into the phase 3 Waveline-010 trial. On the plus side, 1.75mg/kg yielded a 100% complete response rate in 15 patients in Waveline-007, so if tox can be avoided Merck has the basis for an approvable drug.

That's not to say that 1.75mg/kg of zilo-V had a clean safety profile. Among the 15 Waveline-007 patients given this dose one suffered a serious drug-related adverse event, and five had events graded 3 to 4 (all involving neutropenia), according to the ASH presentation. Meanwhile, the two higher doses resulted in four dose-limiting toxicities: diarrhoea, pneumonia, and two cases of febrile neutropenia.

Waveline-007 and 010 both concern first-line DLBCL, where zilo-V is being combined with R-CHP, and the latter study uses R-CHOP as control.

Interestingly, neither mandates that patients express ROR1, a fact explained by the ASH presentation, which stated that lymphoid cancers expressed near-ubiquitous levels of ROR1. No data were presented as to the extent to which Waveline-007 patients actually expressed ROR1, or whether this might have correlated with depth of response.

Another interesting claim in the presentation was that lymphoid cancers are responsive to "ADCs that deliver monomethyl auristatin E (MMAE)". MMAE is the payload used in zilo-V, but it's not the one used by BI 3702025, the anti-ROR1 ADC Boehringer scrapped after enrolling just 12 patients, or STRO-003/IPN60290, the preclinical competitor Ipsen recently picked up from Sutro.

This is all food for thought for companies that still see promise in targeting ROR1, a strategy that, with the exception so far of zilo-V, has disappointed. Merck acquired zilo-V through the $2.8bn buyout of VelosBio four years ago.

R-CHOP is estimated to put up to 80% of front-line DLBCL patients into complete remission, so as long as zilo-V's efficacy is maintained, and this translates into a statistically significant benefit on PFS (Waveline-010's primary endpoint), Merck seems to have a decent shot at approval.

1815