ASH 2024 – Astra sets the bar for Merck's Curon buy

AZD0486 seems highly active, including in patients relapsed on Car-T therapy.

AZD0486 seems highly active, including in patients relapsed on Car-T therapy.

Through the acquisition of Curon's anti-CD19 T-cell engager CN201/MK-1045 Merck & Co put this mechanism back on the industry's agenda, but it's AstraZeneca that has just set the benchmark for Merck to hit.

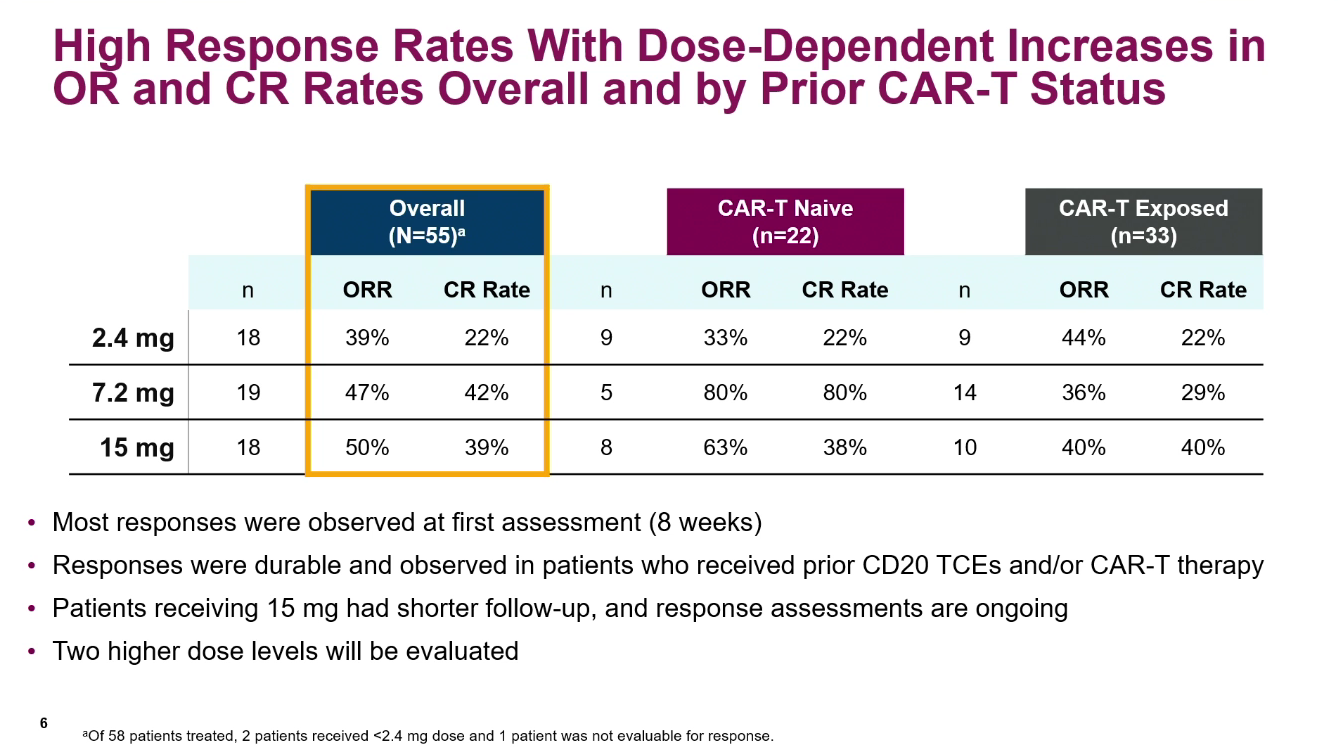

Data on AstraZeneca's similarly acting rival AZD0486 have just been presented at ASH, showing a 45% response rate in 55 diffuse large B-cell lymphoma patients. This is an important benchmark as no data have yet been published on MK-1045 in DLBCL; the only comparison for the two projects has been in indolent lymphomas, where both are showing near-100% response rates.

While Merck became the focus of much attention courtesy of Curon, Astra is making it clear who the leading player is. Just days after the Curon deal was struck AZD0486 went into a phase 3 trial.

Complete remissions

Not only does a 45% ORR seem impressive in the cohort presented at ASH, where patients had failed a median of four prior therapy lines, a 35% rate of complete remissions is no less notable.

Perhaps especially head-turning was AZD0486's activity in the 33 patients who had failed on CD19-directed Car-T therapy. Here an ORR of 39% was seen, with 30% of patients going into complete remission, Dr Sameh Gaballa of the Lee Moffitt Cancer Center told the conference.

That said, patients had to have documented CD19 expression before entering this trial, a precondition that will clearly have aided response rates, especially in the post-Car-T setting. Clearly, for AZD0486 to work after Car-T patients must have relapsed while still retaining CD19 expression, for instance by dint of waning or suboptimal Car-T cells.

There was also something of a toxicity price to be paid for AZD0486's efficacy. Neutropenia was especially notable in the study, seen at grade 4 in over 20% of patients; there was also a relatively high 19% rate of all-grade ICANS, including 5% at grade 3.

Merck paid $700m up front for rights to Curon's MK-1045 in August, largely on the basis of a 100% response rate among 19 patients with follicular/mantle cell/marginal zone lymphomas given doses above 5mg, low 7% rate of any-grade cytokine release syndrome, and complete absence of neurotoxicity in a 74-patient safety dataset.

However, the Curon trial actually included 18 patients with more aggressive lymphomas, but nothing has been disclosed about MK-1045's activity in these subjects.

As far as indolent lymphoma goes, at ASH on Saturday Astra reported an update on AZD0486's trial in the follicular setting, claiming a 95% ORR among 41 patients given doses of 2.4mg or higher.

Astra gained AZD0486 in its 2022 acquisition of Teneotwo for $100m up front, and like a separate Teneo-derived molecule, AbbVie's etentamig, ASH was told that a key feature of the design of these bispecifics was a low-affinity CD3 binder, to reduce cytokine release. Until now the focus seemed to be on Teneo's use of heavy chain-only binders for the CD19 or BCMA antigen.

The extent to which the CD3 binder aids AZD0486 is an open question. Clearly this property wasn't enough for Amgen, which scrapped a separate Teneo-originated asset, the anti-PSMA T-cell engager AMG 340 that at ASCO was revealed to have yielded an ORR of 0%.

1301