ASCO-GU – some backing for Pfizer's EZH2 plan

Phase 1 data give investors a benchmark for mevrometostat's pivotal Mevpro-1 trial.

Phase 1 data give investors a benchmark for mevrometostat's pivotal Mevpro-1 trial.

Pfizer is notable for having fast-tracked its EZH2 inhibitor mevrometostat from phase 1 straight into phase 3 in prostate cancer. Now updated results from that phase 1 study, presented in a late-breaker at the ASCO Genitourinary Cancers Symposium and for the first time showing an active comparator, have provided some support for the pivotal move, albeit at a higher dose.

The data appear to back the company's earlier claim, that in post-Zytiga patients mevrometostat plus Xtandi improves progression-free survival compared with Xtandi monotherapy – but now against an actual study cohort, rather than historical Xtandi data. That said, the company can still be criticised for switching patients from Zytiga to another androgen therapy.

So far the only results from the phase 1 study in heavily pretreated metastatic CRPC patients came from disclosures at Pfizer's innovation day a year ago. These amounted to median radiographic PFS of 17.1 months among 12 post-Zytiga patients, while in 35 post-Xtandi subjects the number was 11.7 months.

Prospective support

This was said to be promising given separate data suggesting rPFS of around four months for hormone-switch therapy, and now Pfizer has backed this up prospectively.

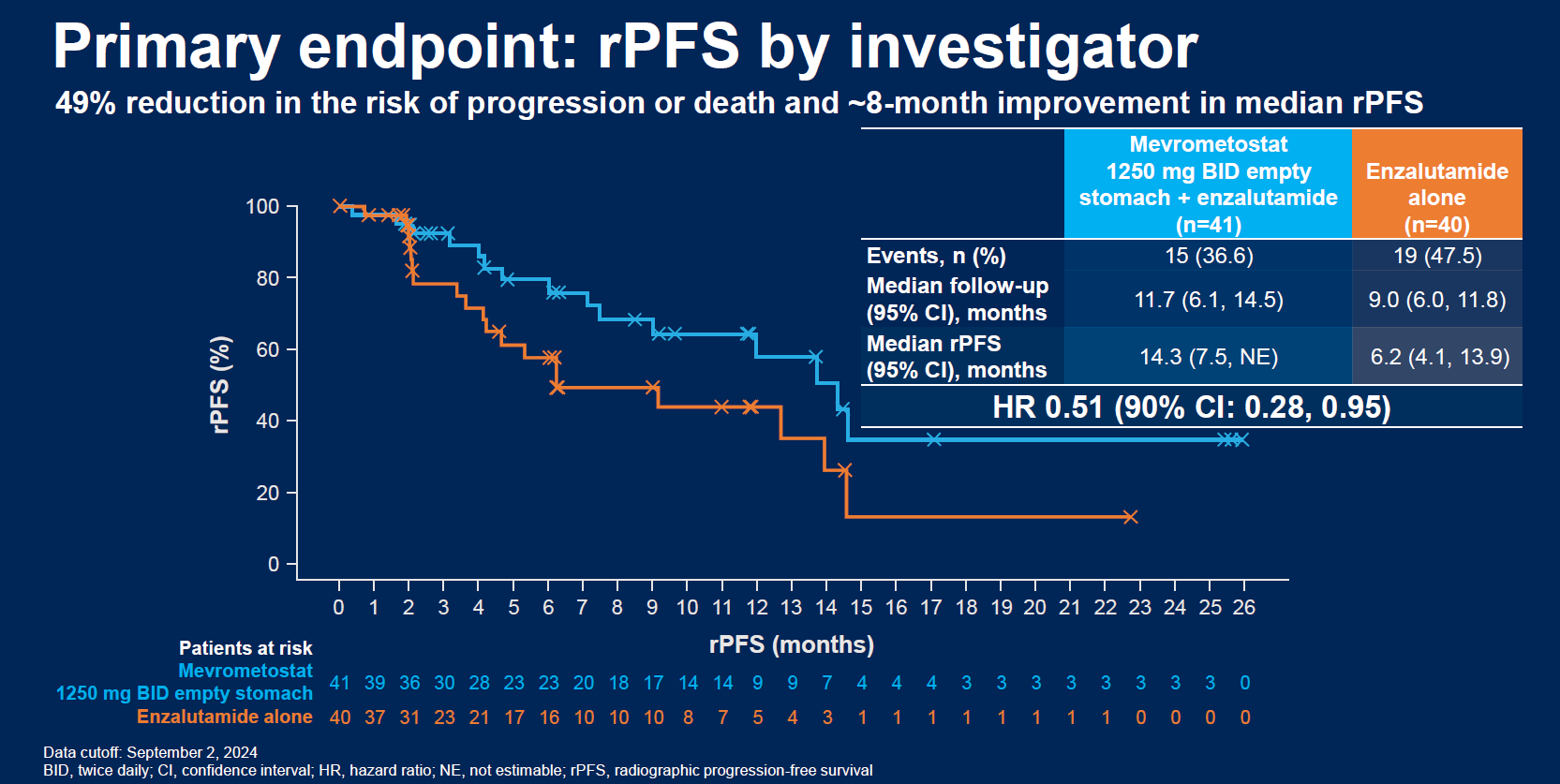

The ASCO-GU late-breaker concerns the trial's dose-expansion phase, and zeroes in on 41 post-Zytiga patients given mevrometostat plus Xtandi, as well as a control arm of 40 given Xtandi alone. The headline number is an eight-month improvement in median rPFS, from 6.2 to 14.3 months, yielding a hazard ratio of 0.51.

Other measures are also supportive, including ORRs of 27% for the combo versus 14% for Xtandi alone, and confirmed PSA50 responses of 34% versus 15%. On the safety side grade 3 or higher serious treatment-related adverse events rose from 3% to 24%, and there were more dose reductions on the combo, but there were no treatment-related deaths.

The rPFS numbers suggest what Pfizer might be shooting for in the phase 3 Mevpro-1 study, which began last year and aims to enrol 600 post-Zytiga patients, comparing mevrometostat plus Xtandi versus physician's choice of hormone-switch Xtandi alone, or docetaxel.

One notable difference, however, is that the phase 1 update concerned mevrometostat dosing of 1.25g bid on an empty stomach, whereas Mevpro-1 tests 875mg with food. These are said to yield similar plasma exposures, with the latter having improved safety.

And the issue of hormone-switch therapy could vex too. This has been called a weak control, given that once a patient progresses after an androgen therapy like Zytiga they might naturally be unlikely to respond to another one like Xtandi. Moreover, chemo is moving into early lines of therapy, and is thought by some to provide a better option.

It's perhaps a nod to this that Mevpro-1 includes the possibility of chemo as control, and this fact as well as the different dosing will have to be borne in mind by anyone using the latest phase 1 data to handicap Mevpro-1's rPFS primary endpoint.

Tazverik's Cello-1 puzzle

Another factor that might cast doubt on Pfizer's pivotal plan is the fact that several other EZH2 players have turned away from prostate cancer. One company, Ipsen, recently reported a dismal result in the phase 1/2 Cello-1 study of its EZH2 inhibitor Tazverik, in the same prostate cancer setting and in a similar combination with Xtandi.

However, it won't go unnoticed that the Xtandi control in Cello-1 yielded median rPFS of 13.8 months, vastly outperforming that in Pfizer's phase 1. ECOG performance status zero (meaning relatively good) patients made up 55% of Cello-1's control arm, versus only 38% of Pfizer's, and the two trials used different rPFS metrics (blinded central review for Ipsen, and investigator assessment for Pfizer).

Another key competitor is Oric Pharmaceuticals, whose ORIC-944 has a related mechanism of action. On Tuesday, after ASCO-GU unveiled Pfizer's late-breaker early, Oric stock fell 12%.

A separate Pfizer phase 3 trial, Mevpro-2, is testing mevrometostat plus Xtandi versus Xtandi in first-line mCRPC, and Pfizer disclosed in its its fourth-quarter earnings presentation that it also plans to start Mevpro-3, in first-line castration-sensitive prostate cancer, this half.

1953