ASCO-GU – Corbus throws its hat into the Nectin-4 ring

The biotech surges on data with its new oncology lead, so could it have a new Padcev on its hands?

The biotech surges on data with its new oncology lead, so could it have a new Padcev on its hands?

ASCO’s Genitourinary Cancers Symposium this weekend was largely about pivotal datasets and established big pharma drugs. But there was at least one small biotech beneficiary too: Corbus rocketed 250% on Friday after it threw its hat into the ring as a challenger in Nectin-4 targeting.

A first-in-human basket trial of Corbus’s CRB-701, an anti-Nectin-4 antibody-drug conjugate, featured in an ASCO-GU poster claiming a 43% response rate among seven patients given “predicted therapeutically relevant doses”. The data are important for Corbus, whose earlier pipeline lead, lenabasum, failed in lupus in 2021, after which the group pivoted to oncology and CRB-701.

True, even after the stock’s surge Corbus is worth only $130m, but the company bought western rights to CRB-701 a year ago for just $7.5m – the asset was originated by the Chinese company CSPC Pharmaceutical, which is developing it under the code SYS6002. The 250% climb amounts to some $90m of market cap, so in the immediate sense the deal looks like $7.5m well spent.

How good?

But are the data all they’re cracked up to be? The main problem is that they come from a subset of seven patients, from only 18 who are said to be efficacy evaluable at the 10 January 2024 cutoff presented in the ASCO-GU poster. The dose-escalation study in question is the phase 1 that CSPC is running, at 19 solely Chinese hospitals.

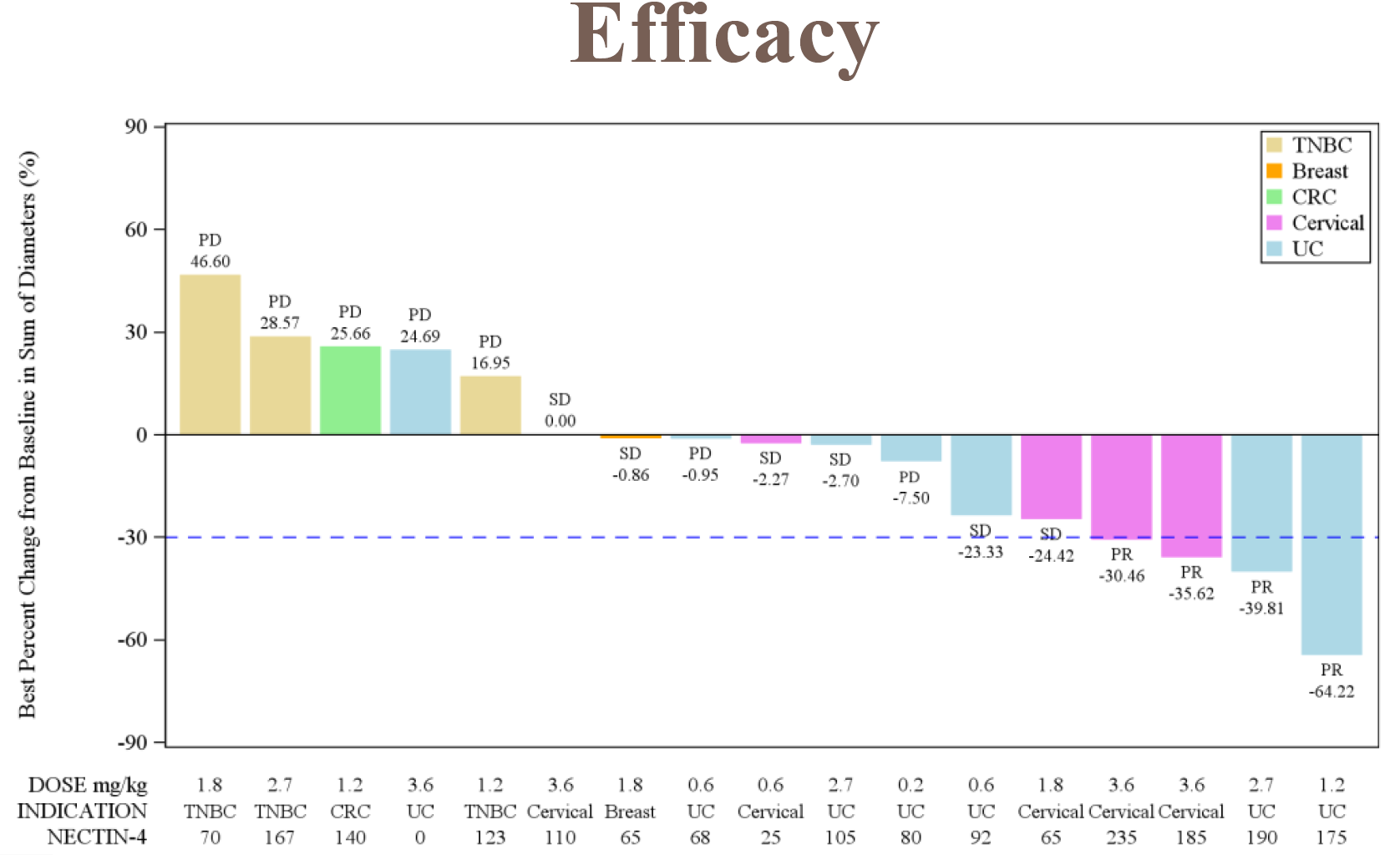

So far six CRB-701 dose levels have been tested, from 0.2mg/kg to 3.6mg/kg, and Corbus is zeroing in on 2.7mg/kg or above. There was a fourth partial response in the 1.2mg/kg cohort, and Corbus says escalation up to 4.5mg/kg is under way. Its own US trial of CRB-701, under an already open IND, is due to start in the current quarter.

Looking at the waterfall plot presented, it’s clear that one of the PRs is borderline, falling right on the 30% tumour reduction line. A further two are slightly more convincing, but ironically the biggest reduction comes from a bladder cancer patient dosed at the non “therapeutically relevant” 1.2mg/kg; two of four PRs have yet to be confirmed, moreover.

Nectin-4 is in focus because it’s the target of Pfizer’s Seagen-originated ADC Padcev, which scored a knockout result in the first-line bladder cancer trial EV-302. Competition here includes Bicycle Therapeutics, Mabwell and others.

Corbus's chief executive, Yuval Cohen, told ApexOnco that CRB-701 used the same technology as Elevation Oncology's anti-Claudin18.2 ADC SYSA1801, also licensed from CSPC. The tech involves site-specific conjugation with stable linker and a drug-to-antibody ratio of 2.

The ASCO-GU poster makes the point that CRB-701 is designed to be more tolerable than Padcev, citing non-clinical data demonstrating preferential internalisation-mediated payload release, and a longer half-life and reduced circulating concentration of this payload, monomethyl auristatin E.

The phase 1 trial includes bladder cancer, and various Nectin-4-positive tumours, and the four responses claimed came in bladder and cervical cancers. An early Padcev trial in the relapsed bladder cancer setting showed a 41% ORR, but that involved 301 patients; CRB-701’s two responses among seven bladder cancer subjects treated across all doses aren’t realistically comparable.

Corbus might want to take advantage of its increased valuation to raise funds for its own trial, but as for whether it now has another Padcev in its pipeline it’s far too early to judge.

This story has been updated to add comment from Corbus.

1707