ASCO-GI – no masking Xilio's disappointment

Poor efficacy clouds prospects for the company's "improved" Yervoy.

Poor efficacy clouds prospects for the company's "improved" Yervoy.

Conditionally acting molecules might recently have had a resurgence, but one biotech that remains decidedly out of favour is Xilio Therapeutics. Vilastobart, a masked, "tumour-activated" anti-CTLA-4 MAb, has managed a confirmed response rate of just 11% in combination with Tecentriq in colorectal cancer, the company revealed on Tuesday after market.

This in itself might not be disastrous: there is arguably scope for further responses in what is a tough population of patients with microsatellite-stable disease. But Xilio is already homing in on a subgroup, and vilastobart has shown some toxicities that could undermine the logic behind a conditionally acting therapy; the group's stock was off 30% in early trade.

Though the data, from a first-in-human phase 1/2 trial, are to be presented at this week's ASCO Gastrointestinal Cancers symposium, Xilio has unveiled them early by press release and investor presentation. The results comprise the first significant human dataset for vilastobart, which until now had yielded little more than case reports detailed at last year's SITC meeting.

Limited efficacy

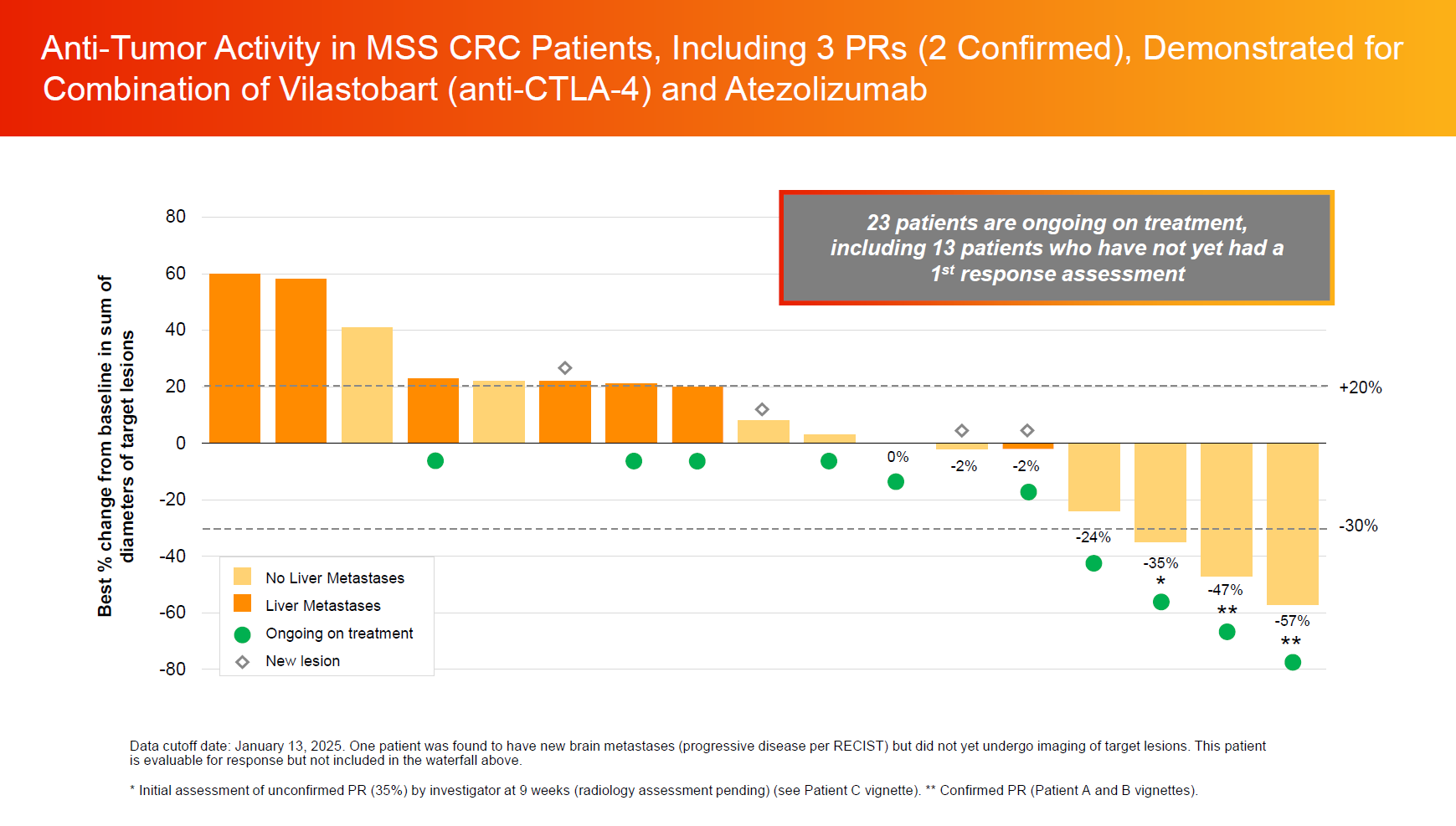

As of 13 January 2025, the trial has treated 40 MSS colorectal cancer patients, 70% of whom had received three or more prior therapy lines.

Four of these experienced treatment-related ALT and four AST rises, with one case of the latter liver enzyme increase being graded 3. There were also two grade 4 events (laboratory abnormalities), and two cases of grade 3 colitis.

Bristol Myers Squibb's Yervoy is the most prominent approved anti-CTLA-4 MAb, and is associated with significant toxicity. Using an approach like vilastobart, which becomes activated only once a masking domain is cleaved off, is meant to alleviate the problems, so the extent to which Xilio's molecule actually achieves this could be an open question.

18 patients were evaluable for efficacy, with at least one imaging scan, and Xilio reported three partial responses, one of which was unconfirmed. On the plus side the unconfirmed patient is still on treatment, so this has a chance to become a confirmed PR on second scan; and a fourth patient has a 24% tumour reduction, not far off the 30% PR boundary.

However, more worrying is that all four patients with such apparently meaningful lesion reductions had no liver metastases. Liver involvement is a common problem in colorectal cancer, but in the seven efficacy-evaluable patients with liver metastases in this trial the ORR is zero, with the best response being one case of stable disease.

This left the company claiming a 27% unconfirmed ORR in patients without liver metastases.

The standard bearer for conditionally acting therapeutics is Janux, sitting on a $2.3bn valuation on the back of a heavily curated dataset.

Xilio's attempt to get in on the party has fallen flat, as has that of another player, CytomX. Xilio is sitting 94% below its IPO price, with a valuation of $42m, a remarkably similar performance to CytomX, whose float is now under water to the tune of 93%, and which carries a $66m market cap.

Xilio's future already looked uncertain a year ago, and it was only a surprise deal with Gilead, covering a tumour-activated IL-12 project, that provided a lifeline. However, the reprieve won't last long: Xilio's current cash runs out in mid-2025.

135